5 Best Car Finance Options in Pakistan Banks

In the ever-evolving landscape of automotive financing in Pakistan, selecting the most suitable car finance plan can greatly affect your overall car ownership experience. Whether you're buying your first vehicle or upgrading to a new model, understanding the various options available can help you make a well-informed decision. Here, we delve into the 5 best car finance options provided by major banks in Pakistan, shedding light on what they offer and how they can cater to your unique needs.

1. Bank Alfalah Car Financing

Bank Alfalah offers a car financing scheme that’s designed to make car ownership a reality with competitive interest rates:

- Maximum Financing Amount: Up to 85% of the car’s value

- Tenure: Up to 5 years

- Processing Fee: From 1.5% to 2.5% of the loan amount

- Benefits: Quick approval, flexible repayment options, comprehensive insurance, and the possibility for early settlement without penalties.

🚗 Note: Always ensure to have all your documents ready, as delays in document submission can prolong the approval process.

2. MCB Bank Car Financing

MCB Bank provides financing options aimed at making vehicle acquisition straightforward and beneficial:

- Car Value: Financing up to PKR 3.5 million

- Down Payment: Starting at 15%

- Interest Rate: Competitive rates with adjustable terms

- Additional Perks: Coverage for life and asset insurance, no balloon payments, and tailored payment plans.

3. Askari Bank Limited (AKBL) Car Loan

AKBL offers a car financing package tailored to fit varying customer needs:

- Loan Amount: Up to 80% of the car’s price

- Maximum Loan Term: Up to 6 years

- Features: Easy documentation, hassle-free application process, and flexible repayment schedules.

- Loan Insurance: Customers can opt for comprehensive or basic coverage.

🚦 Note: Check the current rates and insurance options as they can change periodically.

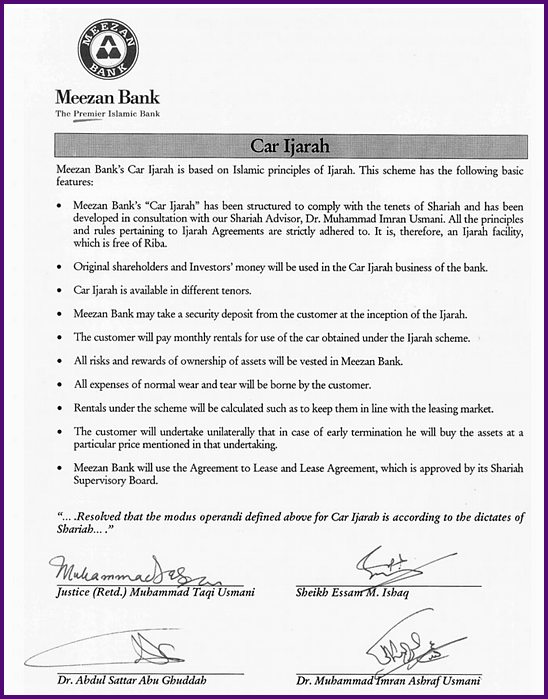

4. Dubai Islamic Bank Car Ijarah

Embracing Islamic financing, Dubai Islamic Bank provides a Sharia-compliant vehicle financing solution through its Car Ijarah product:

- Leasing Term: Up to 7 years

- Rental Downpayment: From 15% to 50%

- Rentals: Monthly, starting from a minimum amount

- End of Term: Option to own the vehicle or return it

🔍 Note: The rental payment is based on the car’s value and depreciates over time, unlike traditional interest-based loans.

5. United Bank Limited (UBL) CarLoan

UBL’s CarLoan plan is crafted to ease the process of car purchasing with benefits like:

- Loan to Value: Up to 85% of the car’s value

- Repayment Period: Flexible up to 5 years

- Additional Benefits: A rebate for timely payments, insurance options, and no prepayment penalty.

How to Choose the Right Car Finance Option?

Choosing the right car finance option requires careful consideration:

- Interest Rates: Compare the effective interest rates, as they directly impact your monthly payments.

- Down Payment Requirements: Higher down payments can lead to lower monthly installments but might limit your purchasing power.

- Loan Term: Opt for a term that balances monthly affordability with total interest paid.

- Flexibility: Look for options with flexible repayment schedules, early settlement, and no penalties for prepayments.

- Insurance and Service: Understand the insurance requirements, coverage, and any additional services offered by the bank.

To summarize, when seeking car finance in Pakistan, you have numerous attractive options from leading banks. Each offers unique benefits tailored to various customer needs, from competitive interest rates to Sharia-compliant solutions. By understanding what each bank provides, you can choose a finance option that not only fits your budget but also aligns with your long-term financial and ownership goals. Remember to do your due diligence, assess your needs, and perhaps even consult with financial advisors to make an informed choice.

What is the minimum down payment for car financing in Pakistan?

+

Down payment requirements can vary from 15% to 50% of the car’s price, depending on the bank’s policy and the financing option you choose.

Can I finance a used car in Pakistan?

+

Yes, several banks offer financing for used cars, often with a cap on the car’s age and condition.

Is there an option for car lease instead of buying in Pakistan?

+

Yes, leasing options like Dubai Islamic Bank’s Car Ijarah provide an alternative to traditional car loans, aligning with Sharia principles.