Unlocking Growth: Mastering Nucleus Cash Flow Finance

Managing cash flow is a critical aspect for any business looking to thrive and expand. The very lifeblood of a company, effective Nucleus Cash Flow Finance ensures that businesses can operate smoothly, seize growth opportunities, and maintain a healthy financial position. In this post, we'll explore various strategies to master your cash flow, understand its importance, and learn how to use it as a springboard for unlocking substantial growth.

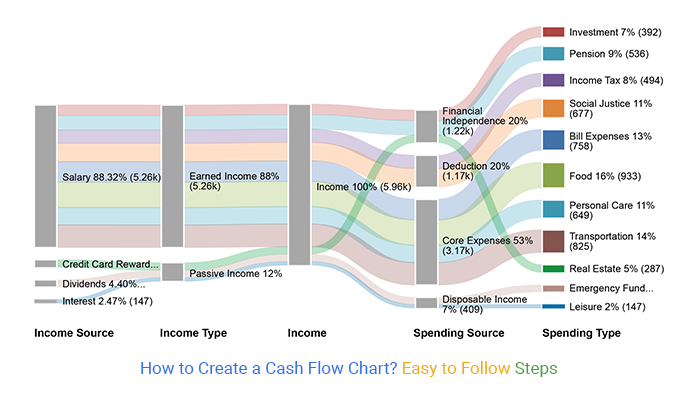

Understanding Cash Flow

Cash flow is the movement of money in and out of a business. It’s the net amount of cash being transferred into and out of a company’s accounts over a specific period. Here are the key components:

- Operating Activities: This includes the primary revenue-generating activities of the business, along with other activities that are not investing or financing activities.

- Investing Activities: Transactions involving the acquisition or disposal of long-term assets or other investments not included in cash equivalents are part of this.

- Financing Activities: These are activities that result in changes in the size and composition of the equity capital and borrowings of the entity.

The Importance of Cash Flow

Good cash flow management is essential for several reasons:

- It ensures that businesses can meet their obligations, like payroll and supplier payments, on time.

- It allows for reinvestment in the company, whether for growth, innovation, or capital improvements.

- Positive cash flow can provide a cushion against unexpected expenses or economic downturns.

Strategies for Enhancing Cash Flow

1. Accurate Forecasting

Accurate cash flow forecasting is pivotal for strategic planning:

- Historical Data Analysis: Review your past cash flow statements to identify patterns.

- Sales Projections: Estimate future sales based on market trends, seasonal cycles, and historical data.

- Contingency Plans: Develop scenarios for best, average, and worst-case forecasts.

⚠️ Note: While forecasting is crucial, remember that it's not an exact science. Regular review and adjustment are necessary for effective cash flow management.

2. Efficient Receivables Management

Receivables can make or break your cash flow. Here are strategies to manage them:

- Invoice Promptly: Send invoices as soon as goods or services are delivered.

- Offer Early Payment Discounts: Encourage clients to pay early by offering a discount.

- Enforce Late Payment Penalties: Establish clear policies regarding late payments.

3. Optimize Payables

Managing payables effectively can also improve cash flow:

- Negotiate Terms: Ask for extended payment terms from suppliers.

- Leverage Trade Credit: Use credit periods wisely to extend your cash conversion cycle.

- Prioritize Payments: Pay critical suppliers first, delay non-critical payments.

4. Cost Management

Controlling expenses is directly tied to cash flow:

- Regularly Review Expenses: Look for areas where costs can be reduced or eliminated.

- Implement Lean Practices: Reduce waste in operations to enhance efficiency.

- Outsource: Outsource non-core activities to reduce overhead.

Leveraging Technology for Better Cash Flow

Modern businesses can greatly benefit from technology:

Automated Invoicing

Automating your invoicing process can save time, reduce errors, and speed up payment cycles:

- Automated reminder systems to ensure timely payment.

- Integration with accounting software for seamless financial tracking.

Real-Time Analytics

Utilizing tools that provide real-time cash flow data can help make informed decisions:

- Real-time cash flow analytics dashboards.

- Forecasting software that can adapt to changes quickly.

Electronic Payments

Moving towards electronic payments can streamline cash flow:

- Encourage customers to pay via electronic methods.

- Use services like ACH transfers, credit card payments, or online banking to reduce time delays.

Finance and Investment

A well-managed cash flow can support strategic financial decisions:

Cash Flow Financing

Businesses can use various finance solutions tailored to cash flow:

- Factoring: Sell your accounts receivable to get immediate cash.

- Short-Term Loans: Use these to cover short-term needs.

- Lines of Credit: Provide a safety net for operational expenses.

Investment Opportunities

With positive cash flow, you can:

- Reinvest in the business for growth or innovation.

- Explore acquisition opportunities or strategic partnerships.

- Invest in marketable securities to earn a return on surplus cash.

In the world of business, managing cash flow is not just about keeping the lights on; it’s about lighting up the path to growth. A company with a strong grip on its cash flow can navigate through financial challenges, capitalize on new ventures, and create a robust foundation for future expansion. By forecasting accurately, managing receivables and payables, controlling costs, leveraging technology, and making strategic financial decisions, businesses can unlock their potential for growth. Remember that mastering cash flow finance is a continuous journey, where learning and adapting to change is just as important as having a solid strategy in place.

The key to unlocking growth through cash flow management is understanding that this process is dynamic. Businesses must be agile, responsive, and proactive in their approach to cash flow. While technology provides the tools to manage, analyze, and forecast cash flow, it’s the business’s leadership that must steer the ship. By keeping a close eye on cash flow statements, understanding the intricacies of each financial activity, and preparing for various financial scenarios, you ensure not just survival but also the ability to thrive in an ever-competitive market.

Ultimately, Nucleus Cash Flow Finance isn’t just about numbers; it’s about foresight, planning, and strategic action. When these elements come together, businesses can turn cash flow into a powerful engine for growth, resilience, and long-term success.

What are the first steps a business should take to improve its cash flow?

+The first steps include accurate cash flow forecasting, improving receivables collection, negotiating better payment terms with suppliers, and reducing operational costs where possible. Reviewing historical data and setting up real-time monitoring tools can also be crucial.

How can small businesses manage cash flow during slow periods?

+Small businesses can manage slow periods by building up a cash reserve during peak times, securing a line of credit in advance, reducing variable costs, and perhaps exploring temporary income streams or part-time work for staff to maintain cash flow.

Can technology really help with cash flow management?

+Absolutely. Tools like accounting software, automated invoicing, real-time analytics, and electronic payment systems can streamline processes, reduce errors, accelerate payment cycles, and provide actionable insights into cash flow management.