Navigating Private Equity: Your Financing Guide

Introduction to Private Equity

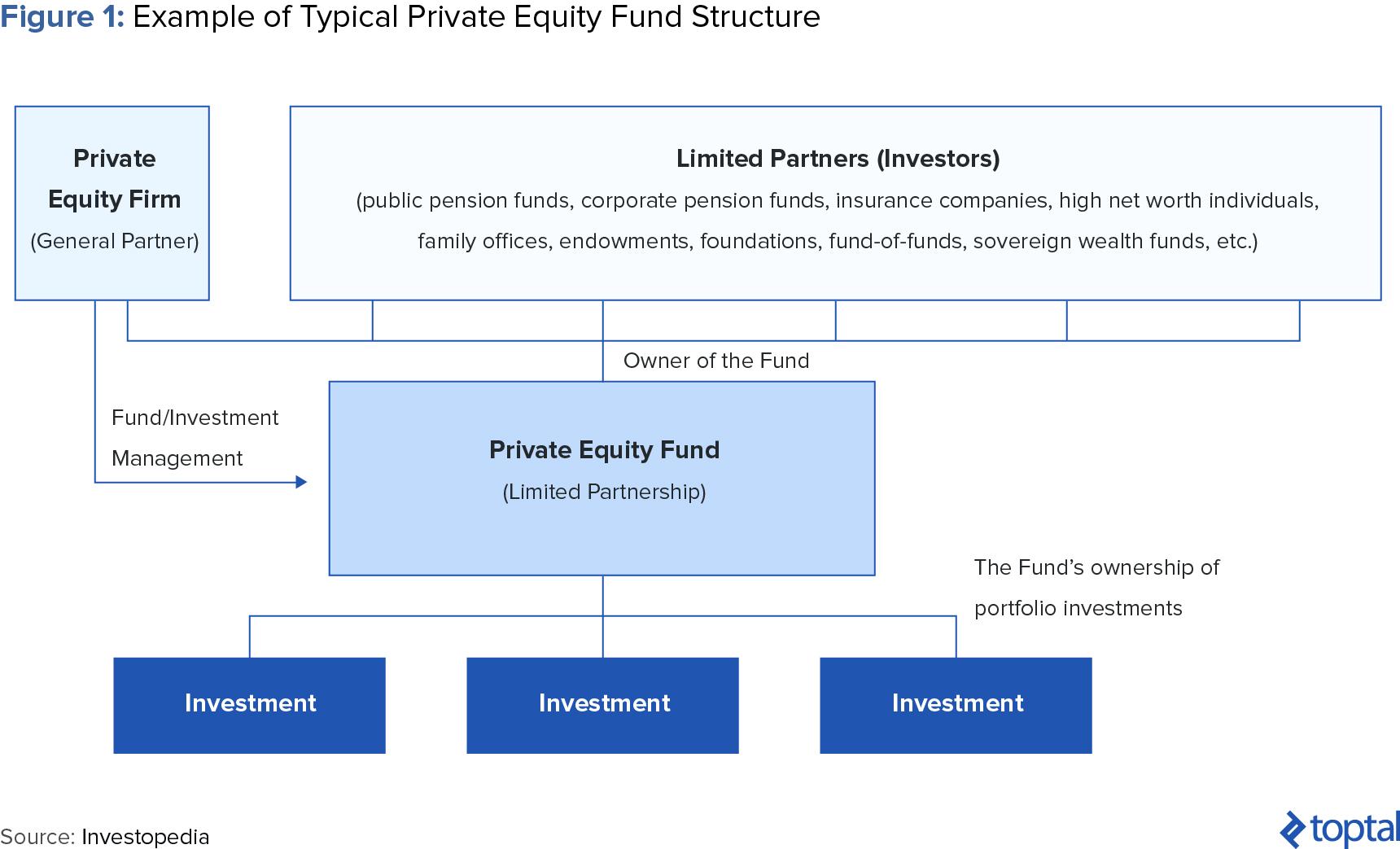

Private equity is a significant part of the financial ecosystem, offering an alternative avenue for companies to secure capital outside of public markets. Unlike public stocks, which are traded on open exchanges, private equity involves investments in companies that are not publicly listed. This guide will walk you through the intricacies of private equity financing, explaining what it entails, the benefits and risks, how to engage with private equity firms, and much more.

What is Private Equity?

Private equity (PE) represents investments in companies through various mechanisms, usually involving:

- Acquiring or investing in private companies.

- Buying out public companies, making them private again (LBO - leveraged buyouts).

- Investing in distressed assets or restructuring them.

The core of private equity revolves around:

- Acquisitions: Often, private equity firms acquire a controlling interest or complete ownership of a target company.

- Management: PE firms may also engage in active management to enhance performance and profitability, which might include operational improvements, strategic shifts, or cost reductions.

- Exits: Eventually, PE investors aim to sell their investment for a profit, either through an initial public offering (IPO), a trade sale, or a secondary buyout.

🌟 Note: While private equity can be transformative, it's not a one-size-fits-all solution; the industry's success hinges on strategic fit, execution, and market timing.

Benefits of Private Equity Financing

Private equity offers several compelling benefits:

- Capital Infusion: PE provides substantial capital, often used for growth, acquisitions, or restructuring.

- Expertise: Many PE firms bring industry-specific knowledge and operational expertise to improve the company's performance.

- Long-term Investment Horizon: PE firms typically hold investments for several years, allowing for longer-term planning and execution.

- Financial Engineering: Through debt and equity structuring, PE can optimize the company's capital structure for growth or efficiency.

- Network and Connections: Access to a broader network of contacts can open doors for business development.

Risks and Drawbacks

While the allure of private equity is strong, it comes with risks:

- High Debt Levels: Leveraged buyouts might saddle a company with significant debt, potentially hampering cash flow.

- Loss of Control: Selling a significant stake often means the company's founders or owners lose operational control.

- Short-term Focus: Despite the long-term investment horizon, PE firms might push for short-term results to prepare for exit.

- Fees and Expenses: Management fees, carried interest, and other expenses can be high, affecting net returns.

- Regulatory Oversight: Less than public companies, PE transactions still face scrutiny from regulators.

Engaging with Private Equity Firms

Here's how to approach private equity financing:

- Identifying Potential PE Partners: Research firms that align with your industry, investment size, and growth stage.

- Pitching to Investors: Prepare a compelling business plan, growth strategy, and financial projections.

- Due Diligence: PE firms will perform extensive due diligence, reviewing financials, operations, legal matters, etc.

- Negotiating Terms: Deal terms, valuation, governance, and exit strategies are key points to negotiate.

- Post-Investment Relationship Management: Establish regular communication to align on goals and strategies.

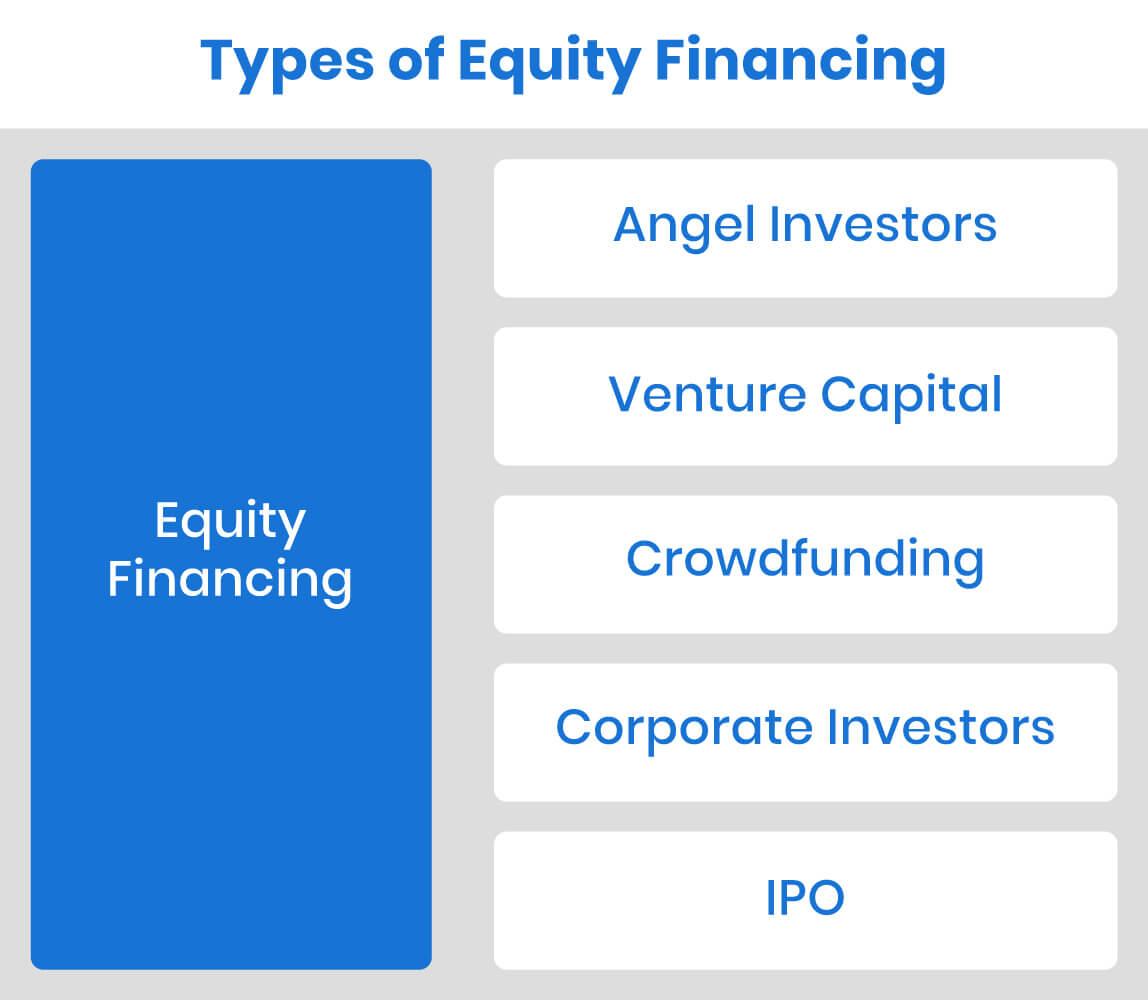

Types of Private Equity Investments

Private equity encompasses a range of investment strategies:

| Investment Type | Description |

|---|---|

| Venture Capital | Investing in startups or early-stage companies with high growth potential. |

| Growth Equity | Providing capital to mature companies seeking to expand without relinquishing control. |

| Leveraged Buyouts (LBOs) | Acquiring a company primarily with borrowed funds, often aiming for value creation through debt reduction and operational improvements. |

| Distressed Investing | Buy troubled assets with the goal of restructuring or turning them around for profit. |

| Mezzanine Financing | A hybrid of debt and equity often used for expansion or acquisitions, offering investors conversion options. |

Exiting Private Equity Investments

Exit strategies are crucial:

- IPO: Public offerings allow PE firms to sell shares to the market.

- Trade Sale: Selling the company to another business or strategic buyer.

- Secondary Buyout: Another PE firm buys the investment.

- Recapitalization: Restructuring the company's debt or equity to unlock value.

💡 Note: The choice of exit strategy largely depends on market conditions, company performance, and strategic fit.

In wrapping up this guide to navigating private equity, we've explored what private equity is, its benefits and drawbacks, how to engage with firms, the types of investments available, and the ways to exit these investments. Private equity financing is not just about raising capital but also about fostering strategic growth and creating value for all stakeholders involved. Whether you're a business seeking investment or an investor exploring opportunities, private equity offers a dynamic landscape to navigate, offering growth potential with its unique risks and rewards.

What is the difference between private equity and venture capital?

+

While both involve investing in private companies, venture capital focuses on high-risk, high-reward investments in early-stage companies, while private equity often targets more established businesses with a broader range of strategies, including buyouts.

How long does a typical private equity investment last?

+

Private equity investments typically have a holding period of 3 to 7 years, but this can vary based on investment strategy, company performance, and market conditions.

What are the fees associated with private equity investments?

+

Common fees include management fees (usually 1-2% of assets managed) and carried interest (a share of profits, often 20%). Additional fees might cover due diligence, transaction costs, and expenses related to exits.

Can small businesses benefit from private equity financing?

+

Yes, small businesses, particularly those with unique value propositions or in growing sectors, can benefit from PE. These firms can provide capital, expertise, and strategic support to scale operations or expand markets.