MSE Car Finance: Top Tips for Smart Buyers

Purchasing a car is a significant decision, often accompanied by the need for financing. While car finance can open the door to owning the vehicle you need or desire, navigating the complex landscape of auto loans and leasing options requires careful planning and informed decision-making. Whether you're a first-time buyer or looking to upgrade, these top tips will guide you in making smart choices when it comes to MSE car finance.

Understand Your Financing Options

Before you step into a dealership or engage with a finance broker, it’s essential to understand the various car finance options available:

- Personal Contract Purchase (PCP): This option provides lower monthly payments, with the option to buy the car at the end of the term by paying a balloon payment or to return the vehicle.

- Higher Purchase (HP): Also known as traditional hire purchase, you pay a deposit, followed by monthly payments until the car is fully paid off.

- Leasing: Essentially renting the car for a set period, with no option to own it at the end, but maintenance and breakdown cover are often included.

- Personal Loans: An alternative to dealer financing, you could take out a loan from a bank or credit union to purchase a vehicle outright.

🚗 Note: Each option has its benefits and potential downsides, depending on your financial situation, driving habits, and future plans regarding the vehicle.

Check Your Credit Score

Your credit score plays a pivotal role in the type of finance deal you can secure. Here’s what you should do:

- Obtain a free credit report from one of the credit agencies.

- Review it for inaccuracies and dispute any errors.

- If your score needs improvement, take steps to boost it by paying bills on time, reducing debt, or avoiding new credit applications.

📝 Note: A higher credit score can not only unlock lower interest rates but might also make lenders more willing to offer attractive deals.

Get Your Finances in Order

Before diving into car finance:

- Establish a budget for how much you can afford monthly.

- Consider all costs involved: insurance, fuel, maintenance, tax, and finance charges.

- Save for a significant down payment to reduce the amount you need to finance.

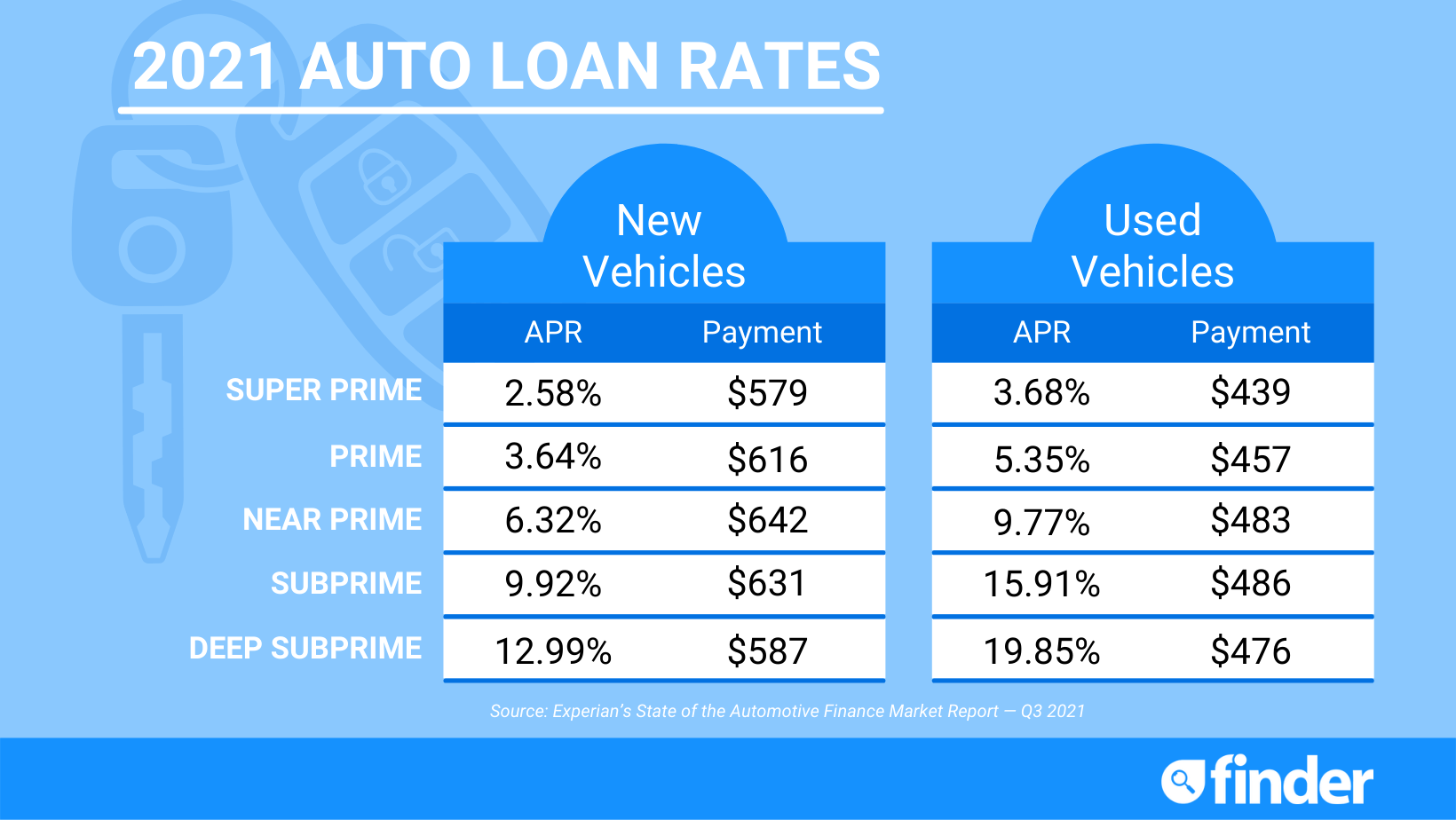

Research Interest Rates

Interest rates significantly affect the total amount you will pay over the life of the finance agreement. Here’s what to do:

- Compare rates from banks, building societies, and online lenders.

- Look into manufacturer finance deals, which might offer competitive rates or incentives.

- Negotiate with lenders; even a small reduction in the rate can save you hundreds over the term.

Read the Small Print

Don’t get blindsided by hidden terms or fees. When reviewing your finance agreement:

- Check for early repayment penalties.

- Understand the total cost of finance, including all fees.

- Know your obligations regarding mileage, maintenance, and returning the vehicle.

- Be aware of the conditions under which you can purchase the car if you’re on a lease or PCP.

Consider the Depreciation Value

Cars depreciate, but some do so faster than others:

- Research models known for holding their value well.

- Factor in the vehicle’s resale value when choosing finance options.

Negotiate the Purchase Price

Even with financing, the price you pay for the car impacts the total cost:

- Understand the market value of the car you’re interested in.

- Be ready to negotiate or look elsewhere if the price isn’t right.

💡 Note: Negotiating the purchase price can sometimes be easier than getting a better finance deal, especially with big-ticket items like cars.

Think About the Long-Term Costs

Finance deals might look appealing upfront, but consider:

- The total amount you’ll pay over the loan term.

- The potential cost of maintaining the car.

- Future-proof your choice by considering upgrades or new models in a few years.

Use Calculators and Tools

Online tools can help:

- Car finance calculators to work out what you can afford.

- MSE car finance calculators to estimate total costs.

Beware of Add-Ons

Dealers often push add-ons which can inflate your finance agreement:

- Be wary of extended warranties, gap insurance, or additional services.

- Only take what you need, and negotiate the cost of any necessary add-ons.

In Conclusion

The journey to smart car finance involves understanding your options, knowing your credit standing, and being prepared to negotiate. With careful research, a solid financial plan, and an understanding of long-term costs, you can drive away with a deal that suits both your wallet and your lifestyle. Keep these tips in mind, and you’ll be well on your way to a wise investment in your next car purchase.

How does my credit score affect car finance?

+

Your credit score impacts the interest rates you’ll be offered. A higher score can mean lower rates, reducing the total cost of your car finance.

Is a PCP or HP finance better for me?

+

It depends on your needs. PCP offers lower monthly payments but no ownership at the end unless you pay the balloon payment. HP might have higher payments but leaves you owning the car.

Should I finance through the dealership or a third-party lender?

+

Dealers might offer convenience and manufacturer-backed deals, but third-party lenders could provide better rates or more personalized loan options. Shop around for the best deal.