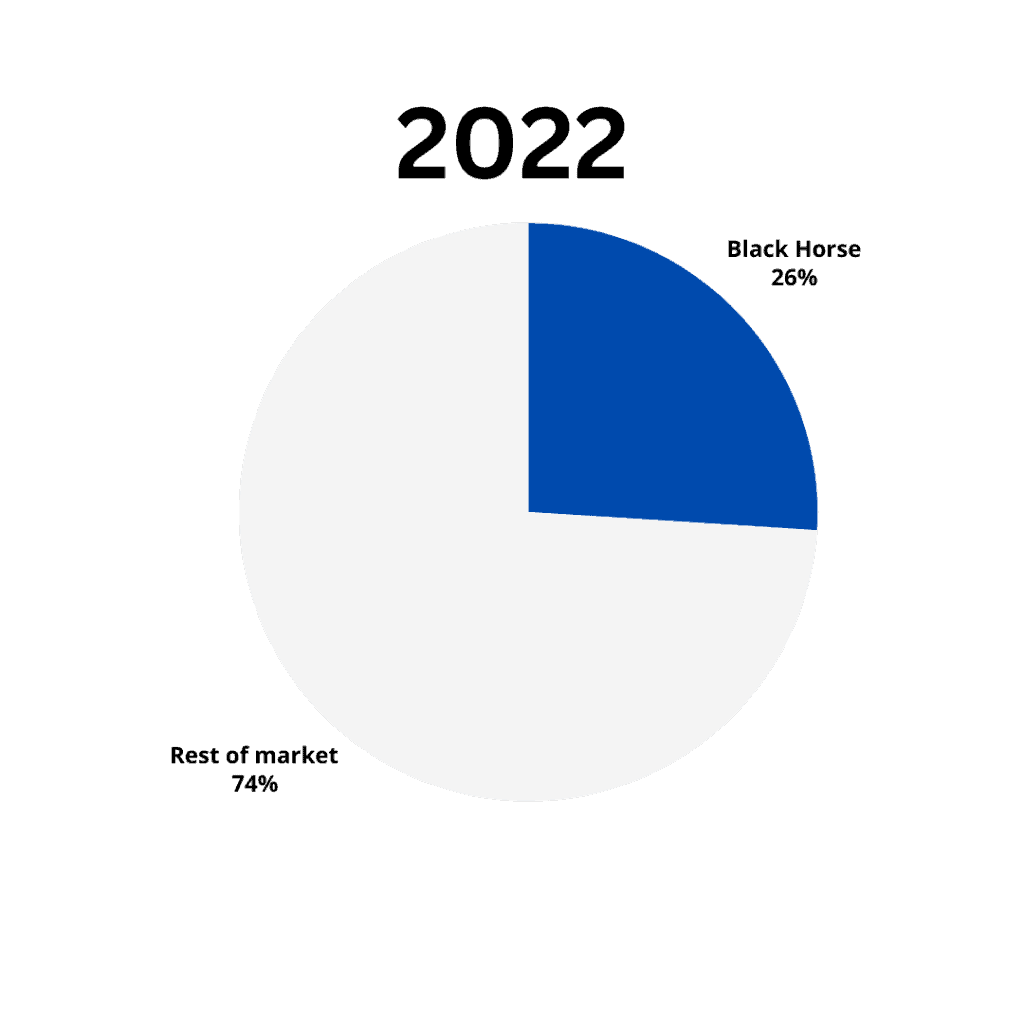

Black Horse Car Finance: Have You Been Mis-Sold?

Introduction

The auto finance industry can be a labyrinthine maze where the layman can easily get lost. One company that has garnered significant attention in recent years due to allegations of mis-selling practices is Black Horse Car Finance. For many vehicle owners and buyers, obtaining finance is a necessary part of the car purchasing journey. However, what happens when the finance agreement you entered into isn't exactly what you signed up for?

Understanding Car Finance Mis-selling

Car finance mis-selling refers to situations where consumers are sold finance products or agreements that were not suitable for their circumstances, often due to misleading or incomplete information. Here are common signs of potential mis-selling:

- Hidden Fees: You were unaware of additional costs like commission charges.

- Misleading Information: You were provided with inaccurate or incomplete details about the finance product.

- Pressure Selling: You felt pressured into a finance deal without adequate time to review or consider alternatives.

- Unsuitable Agreements: The finance agreement didn't match your financial situation or needs.

- Lack of Transparency: The finance company didn't clearly explain the terms, conditions, or interest rates.

⚠️ Note: Mis-selling is not exclusive to Black Horse; however, this post focuses on their practices due to recent public interest.

Common Black Horse Car Finance Complaints

Many consumers have come forward with their experiences when dealing with Black Horse Car Finance:

Overcharging for Interest

There have been numerous reports of customers being charged interest rates that were not reflective of the agreement they signed or their credit profile. This might involve:

- Interest rates not aligned with market standards or creditworthiness.

- Unexpected increases in interest over time.

Failure to Disclose Commissions

Dealerships or finance companies often receive commissions for brokering car finance deals, but customers are not always informed about this:

- Lack of transparency regarding commissions received.

- Customers not knowing they could negotiate commission amounts.

Pressure Selling and Misrepresentation

Some customers reported feeling pressured into signing finance agreements without fully understanding the terms:

- Deals presented as "no alternative" options.

- Inadequate explanation of terms and conditions.

Unclear Terms and High Charges

Consumers have noted high fees for early settlement or penalties for default, which weren't explicitly outlined in the agreement:

- Excessive charges for early payoff.

- Unexpected penalties for missed payments.

📢 Note: Always read the fine print of any finance agreement, even if you feel pressured to sign quickly.

Steps to Take if You've Been Mis-sold Car Finance

Recognizing that you've potentially been mis-sold car finance by Black Horse or any other lender is just the first step. Here's what you can do next:

1. Gather Documentation

Collect all paperwork related to your finance agreement, including:

- Finance agreement

- Correspondence with the lender

- Any related emails, text messages, or recorded calls

- Your credit report

2. Contact Black Horse

Before escalating, try to resolve the issue with Black Horse directly:

- Explain your concerns clearly and request clarification.

- Ask for a written response detailing their stance.

3. Use Dispute Resolution Services

If Black Horse's response is unsatisfactory:

- Take the matter to the Financial Ombudsman Service (FOS) or similar body.

- Prepare your case with evidence.

💡 Note: Document your interactions with Black Horse, as this can be crucial for any subsequent complaints or legal actions.

4. Seek Legal Advice

If you believe you've been significantly wronged:

- Consult a solicitor specializing in consumer finance.

- Consider class action if there's a pattern of similar complaints.

📝 Note: Be aware that legal action can be time-consuming and costly; however, if you've suffered considerable financial loss, it might be worth exploring.

Protecting Yourself Against Mis-selling

While it's impossible to prevent mis-selling entirely, you can take steps to safeguard yourself:

- Read and Understand: Go through all documents thoroughly.

- Shop Around: Compare rates and terms from different lenders.

- Don't Rush: Take your time to make decisions.

- Ask Questions: If something is unclear, seek clarification.

- Stay Informed: Keep up with financial news and regulatory updates.

Looking Forward

The car finance landscape is under greater scrutiny. Regulatory bodies are examining practices like hidden commissions and mis-selling:

- Regulators are investigating discrepancies.

- New legislation is being considered to increase consumer protections.

- Innovations in finance technology are aiming for more transparency.

👀 Note: Keep an eye on financial news for updates on regulatory changes and company practices.

As the situation with Black Horse Car Finance develops, consumers remain vigilant. Many have encountered issues with mis-selling, yet the awareness has also prompted constructive action and regulatory reform. Recognizing mis-selling signs, documenting issues, engaging with lenders directly, and utilizing consumer protection services are vital steps for those who believe they've been wronged. Furthermore, taking proactive measures against mis-selling by staying informed and shopping around can significantly reduce the risk. The industry is gradually shifting towards greater transparency, heralding a potentially more just era for car finance. As developments unfold, consumers are encouraged to stay aware, advocate for change, and support each other in navigating the car finance terrain.

What qualifies as mis-selling in car finance?

+

Mis-selling in car finance can include misleading information about the finance product, undisclosed fees or commissions, unsuitable agreements for the borrower’s situation, and pressure tactics to expedite the deal.

Can I get compensation for mis-sold car finance?

+

If you can prove mis-selling, you might be eligible for compensation. This can be in the form of refunds, waived fees, or other monetary relief, depending on the specifics of your case.

What should I do if Black Horse refuses to acknowledge my complaint?

+

If the company denies your complaint, you can escalate the issue to the Financial Ombudsman Service (FOS) or seek legal counsel if the situation warrants it.