Today's Market Insights: Trending Now

In today's dynamic world, staying on top of market trends can provide an edge in both personal finance and professional investments. Whether you're a seasoned investor, a budding entrepreneur, or someone who wants to make smart personal financial decisions, understanding market dynamics is invaluable.

Economic Indicators Shaping Today's Trends

The first step in analyzing market trends is understanding the key economic indicators:

- Inflation Rates: Currently, inflation is hovering around 2.5% in many developed countries, affecting both consumer spending power and investment returns.

- Unemployment Figures: Lower unemployment generally signals a healthy economy, though it might also indicate potential future inflation.

- Interest Rates: Central banks use interest rates as a tool to manage inflation and economic growth, influencing investment in bonds and stock market behavior.

Technology and Innovation

The tech sector continues to influence market trends significantly:

- Blockchain and Cryptocurrency: With Bitcoin's stabilization and Ethereum's Ethereum 2.0, blockchain technologies are not just for speculators anymore but are becoming part of mainstream financial transactions.

- Artificial Intelligence: AI companies like NVIDIA, Google, and Microsoft are driving growth, particularly in sectors like healthcare, automotive, and finance.

- Cloud Computing: As businesses continue their digital transformation, the demand for cloud services from Amazon Web Services, Microsoft Azure, and Google Cloud is escalating.

Sector-Specific Market Trends

| Sector | Trends |

|---|---|

| Energy | Shift towards sustainable energy solutions like solar, wind, and hydrogen. Traditional oil and gas companies are investing in renewables to pivot their business models. |

| Healthcare | Demand for telemedicine, personalized medicine, and AI-driven diagnostics. The sector is also seeing a surge in investments in biotech and pharmaceuticals post-COVID. |

| Real Estate | Smart homes, co-living spaces, and the rise of REITs (Real Estate Investment Trusts) are driving growth. Proptech innovations are also changing how real estate transactions are handled. |

Global Economic Climate

Global economic conditions play a crucial role in shaping market trends:

- Trade Wars and Tariffs: The ongoing trade disputes, particularly between the US and China, have ripple effects across various sectors.

- Geopolitical Tensions: Political stability or instability impacts investor confidence and market performance.

- Pandemics: After the experience with COVID-19, there's increased focus on resilience, supply chain diversification, and health infrastructure investments.

💡 Note: Keep an eye on macroeconomic trends but remember microeconomic activities can significantly affect specific market sectors or stocks.

Consumer Trends

What consumers are doing, buying, or avoiding is a direct indicator of market health:

- Sustainability: There is a growing demand for eco-friendly products, influencing various sectors from fashion to food.

- Remote Work: This trend has not only changed the workplace but also impacts real estate, technology sales, and consumer electronics.

- Digital Consumption: Increased digital consumption, particularly in entertainment, gaming, and streaming services, has reshaped the media and tech industries.

🔍 Note: Analyzing consumer behavior patterns can provide insights into future market opportunities or potential declines in specific sectors.

The Role of Big Data and Analytics

The use of big data and advanced analytics is transforming market analysis:

- Data-driven decision making is becoming the norm, enhancing predictive capabilities in investment strategies.

- Sentiment analysis helps in understanding consumer trends and investor sentiment, which can be pivotal in trading and long-term investment planning.

🔬 Note: Data science and machine learning are key competencies in today's financial sector, providing a competitive edge in market analysis.

In summary, navigating today's market trends requires a multifaceted approach, incorporating economic indicators, technological advancements, sector-specific insights, global economic climates, consumer behavior, and data analytics. Keeping abreast of these elements not only enriches your understanding but also empowers you to make informed decisions, whether you're investing, running a business, or simply making personal financial choices. Adapting to these trends swiftly and strategically can lead to opportunities for growth and stability in an ever-evolving marketplace.

What are the economic indicators I should follow for market trends?

+

Key economic indicators include inflation rates, unemployment figures, GDP growth, and central bank interest rate decisions.

How does technology drive market trends?

+

Technology drives market trends by creating new industries, enabling innovation, and disrupting traditional business models through advancements in AI, blockchain, and cloud computing.

Can consumer behavior predict market trends?

+

Yes, consumer behavior trends, especially in sectors like sustainability, remote work, and digital consumption, can predict shifts in market dynamics and investment opportunities.

How do global events impact market trends?

+

Global events like trade wars, geopolitical tensions, and pandemics can significantly affect market trends by influencing economic stability, trade relationships, and investor confidence.

What role does big data play in market analysis?

+

Big data plays a crucial role in market analysis by providing predictive insights, enabling data-driven decisions, and enhancing sentiment analysis for better investment strategies.

Related Terms:

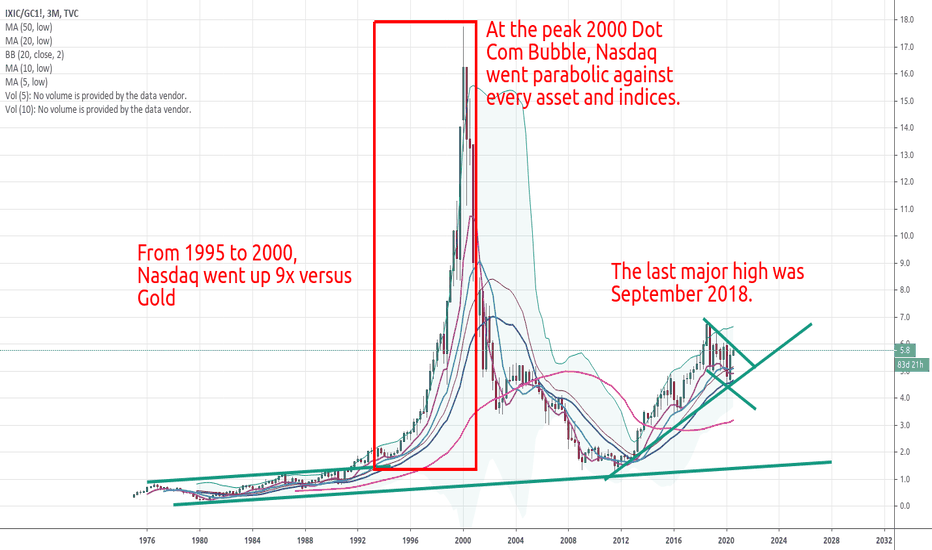

- Nasdaq IXIC