Best Low APR Car Finance Deals in the UK

When it comes to purchasing a new or used car in the UK, the financial aspect can be just as daunting as choosing the right model. Financing a car through a loan with a low Annual Percentage Rate (APR) is a smart move to reduce the total cost of your vehicle over time. This post will guide you through the best low APR car finance deals available in the UK, helping you make an informed decision that aligns with your financial situation and goals.

Understanding APR in Car Finance

Before diving into the offers, it's crucial to understand what APR means in the context of car finance:

- Annual Percentage Rate (APR) - This is the total cost of your credit as a yearly percentage, including interest, fees, and any other charges for the loan. A lower APR generally means you'll pay less over the life of the loan.

How to Find the Best Low APR Deals

To get the best possible low APR deal on car finance, consider the following:

- Shop Around: Compare rates from banks, building societies, online lenders, and car dealerships.

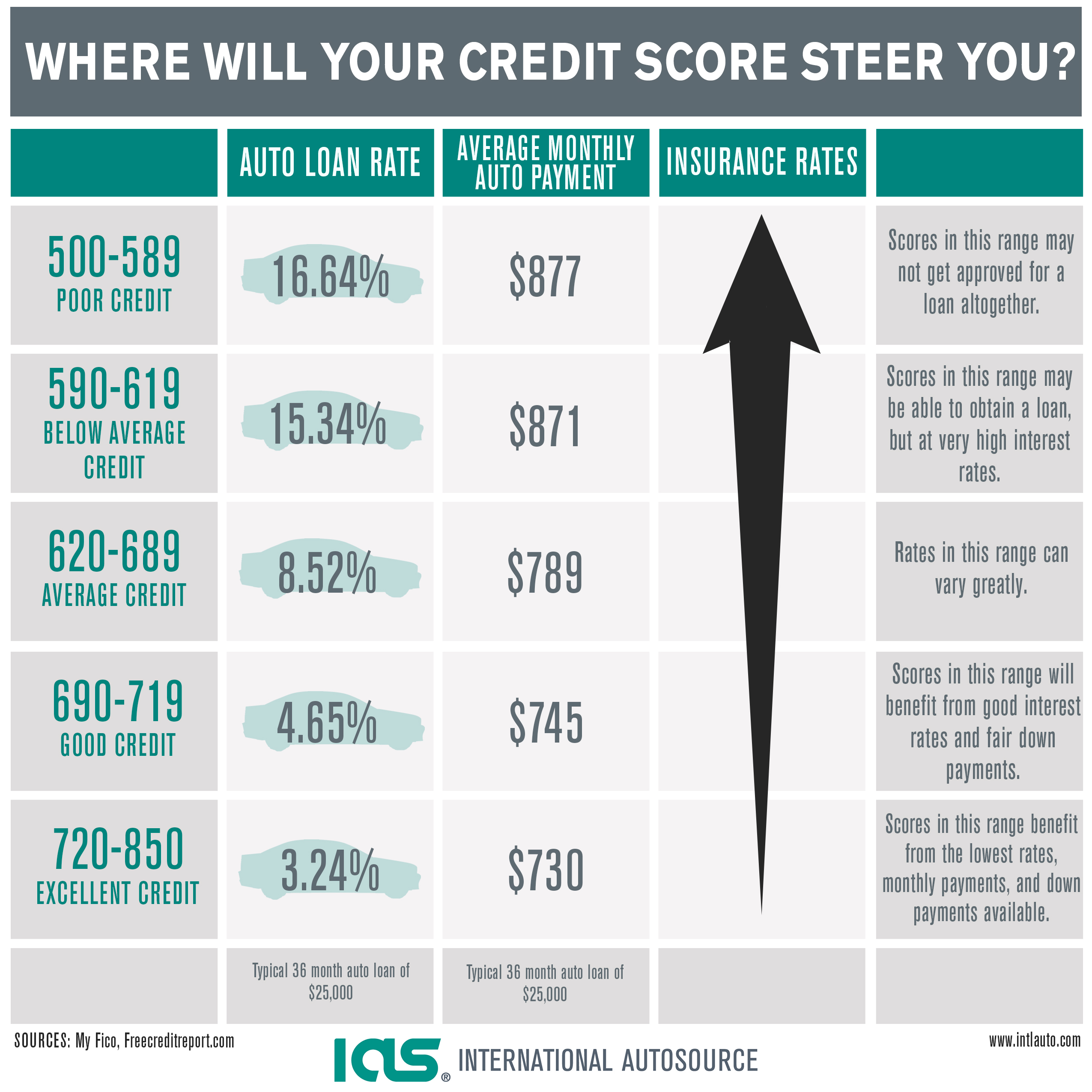

- Credit Score: Higher credit scores often qualify for lower APRs. Check your credit report to ensure there are no inaccuracies.

- Down Payment: A larger down payment can result in a lower interest rate.

- Loan Term: Shorter terms might offer lower rates but higher monthly payments.

Top Low APR Car Finance Deals in the UK

| Lender | Interest Rate (Representative APR) | Notes |

|---|---|---|

| Metro Bank | 2.9% APR | Good for new and used cars |

| Barclays | 3.5% APR | Excellent for those with higher credit scores |

| Tesco Bank | 4.7% APR | Competitive rate with potential for cashback |

| Black Horse | Variable from 4.9% | Often linked with car dealerships |

| Zopa | 4.9% APR | Online lender with competitive rates |

💡 Note: Always consider the actual rate offered to you, as it might differ from the representative APR due to individual financial circumstances.

Comparing Car Finance Options

Not all car finance deals are created equal. Here’s a quick comparison:

- Hire Purchase (HP): The car is owned by the finance company until you’ve paid off the entire loan. Once complete, ownership transfers to you.

- Personal Contract Purchase (PCP): This allows you to have lower monthly payments with an option to return the car or buy it at the end of the term. It often comes with a higher APR but can be advantageous for flexibility.

- Personal Loans: Taken out directly from a bank or lender for buying a car. Can sometimes offer lower APR than dealership finance if your credit is strong.

Navigating the Application Process

When you’ve found a lender with a desirable APR:

- Use an online loan calculator to estimate your repayments.

- Submit an application with the required documents, including proof of income and credit history.

- Read the fine print for any additional fees or conditions.

- Improve Your Credit Score: Pay bills on time, reduce your debt, and check your credit report for errors.

- Consider a Guarantor: If you have poor credit, a guarantor loan might get you a lower rate.

- Negotiate: Sometimes, especially with car dealerships, you can negotiate not just the price of the car but the finance deal itself.

- Look for Special Offers: Manufacturers often have finance offers with lower APRs for their new models.

- Reduced Total Interest: Less interest paid over the loan term means more savings.

- Lower Monthly Payments: Often, lower APRs result in smaller monthly commitments.

- Predictable Costs: Fixed APRs provide a predictable payment schedule, making budgeting easier.

⚠️ Note: Make sure to check for any balloon payments or fees for early repayment, which can significantly impact the overall cost of your car finance.

Tips for Securing Lower Rates

Benefits of Low APR Car Finance

Choosing a low APR car finance deal can offer several advantages:

Securing the right car finance deal with a low APR is not just about getting a car, it's about managing your finances wisely. By understanding the landscape of car finance in the UK, comparing offers, and making informed decisions, you can drive home in a new vehicle with confidence that you've chosen an affordable and financially prudent option.

What is a good APR for car finance?

+

A good APR for car finance in the UK is generally considered to be under 5% for new cars, but this can vary based on market conditions, your credit score, and the loan amount.

How does the loan term affect APR?

+

Loan terms can influence APR; longer terms might offer a lower APR but spread the interest over a longer period, while shorter terms might come with a slightly higher rate but significantly reduce the total interest paid.

What if I want to pay off my car finance early?

+

Check your finance agreement for any early repayment charges. If there are no fees or if the cost savings outweigh the fees, paying off your loan early can save you on interest.