Log Cabin Financing: Simple Tips for Smart Investment

Understanding Log Cabin Financing

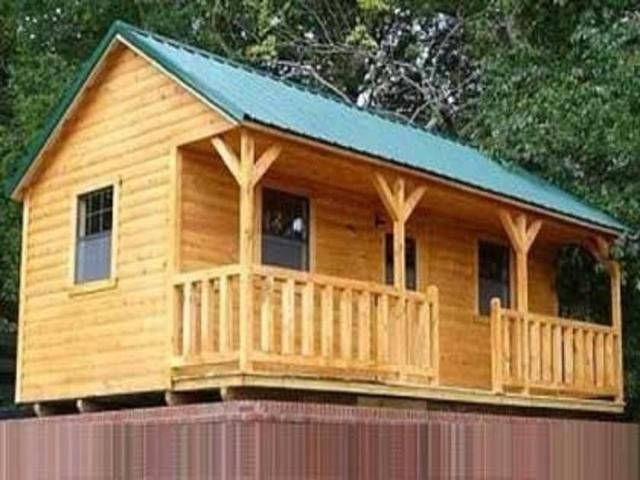

Log cabins offer a unique charm and rustic appeal, making them an attractive option for those looking to invest in secondary residences, vacation homes, or even primary residences. However, financing a log cabin can be different from traditional home financing due to several factors including location, construction materials, and potential non-traditional designs. Understanding the nuances of log cabin financing is crucial for making a smart investment decision.

Why Log Cabins are Unique Investments

Log cabins differ from conventional homes in a few key ways:

Construction Materials: Log homes are typically made from logs, which might not be as familiar to some lenders as standard materials like brick or wood framing.

Design and Layout: Log cabins can have non-standard architectural designs, which might not fit typical appraisal models.

Location: These homes are often located in rural or remote areas, potentially affecting their accessibility, value, and the ease of financing.

💡 Note: Log cabins might not increase in value as quickly as urban or suburban homes due to their less conventional appeal and location.

Log Cabin Financing Options

Here are some common financing routes for purchasing or building a log cabin:

1. Traditional Mortgages

Conventional Loans: These are loans not backed by the government. Lenders might be hesitant if the log cabin is a vacation home or if it has an unconventional design.

FHA Loans: Available for primary residences, but often have lower down payment requirements.

2. Construction Loans

- If you plan to build your log cabin from scratch, construction loans finance the building process. After construction, you might need to convert this to a traditional mortgage or refinance.

3. Home Equity Loans or HELOC

Home Equity Loans: Use the equity in your current home to finance the log cabin.

HELOC (Home Equity Line of Credit): Provides flexibility in how much you borrow and when, often used for renovations or building.

4. Personal Loans

- Suitable for smaller log cabins or additions, but typically come with higher interest rates.

5. Chattel Loans

- If your log cabin is classified as personal property (e.g., it’s on rented land or movable), you might use a chattel mortgage, which has different terms than a standard mortgage.

📌 Note: Make sure to shop around for the best rates and terms as log cabin financing can vary significantly from traditional home loans.

6. Vendor Financing

- Some log home manufacturers or sellers offer in-house financing options, sometimes with more flexible terms.

| Financing Type | Best For | Pros | Cons |

|---|---|---|---|

| Conventional Loans | Primary Residence | Competitive rates, predictable payments | May require high down payment, not suitable for vacation homes |

| FHA Loans | Primary Residence | Lower down payment, government-backed | Insurance requirements, property must meet FHA standards |

| Construction Loans | New Build | Finances entire building process | Short-term, conversion needed after completion |

| Home Equity Loans/HELOC | Existing Home Owners | Low interest rates, flexibility | Secondary to primary mortgage, variable rates for HELOC |

| Personal Loans | Small Cabin/Renovations | Faster approval, not secured against home | Higher interest rates, lower loan amounts |

| Chattel Loans | Non-Fixed Cabins | Can finance movable properties | Shorter terms, potentially higher rates |

| Vendor Financing | Log Home Purchases | Flexibility, often no down payment | Higher interest, limited options |

In the realm of log cabin financing, smart investment means understanding your options, comparing lenders, and considering the long-term implications of your loan. Whether you’re seeking solitude or a retreat for your family, proper financing can turn that dream log cabin into a reality.

Can I finance a log cabin on leased land?

+

Yes, but you might need a chattel loan, which finances personal property rather than real estate. Terms can be less favorable than traditional mortgages.

Are log cabins a good long-term investment?

+

Log cabins can be excellent investments, especially if they’re in desirable vacation spots. They offer a unique appeal, but their appreciation might not match urban homes due to market dynamics.

What should I know about insuring a log cabin?

+

Log cabins might require specialized insurance due to their construction materials and often remote locations. Ensure you’re covered for unique risks like pests, fires, or weather-related damage.