5 Ways to Finance Your Car Loan Easily

The process of securing a car loan can be one of the most daunting steps in purchasing a new or used vehicle. However, with the right approach, financing your car loan can be more straightforward than you might expect. Here, we'll delve into five effective strategies to simplify the financing of your car loan, ensuring you drive off with not only a car but also peace of mind.

1. Understand Your Financial Position

Before you start the car loan application process, a thorough assessment of your financial health is crucial:

- Calculate Your Budget: Determine how much you can afford for monthly payments without straining other expenses.

- Check Your Credit Score: A higher credit score can unlock better interest rates, thereby reducing the total cost of your loan.

- Financial Stability: Lenders look for steady employment or reliable income sources. Ensure your financial situation is stable or improving.

2. Research Loan Options

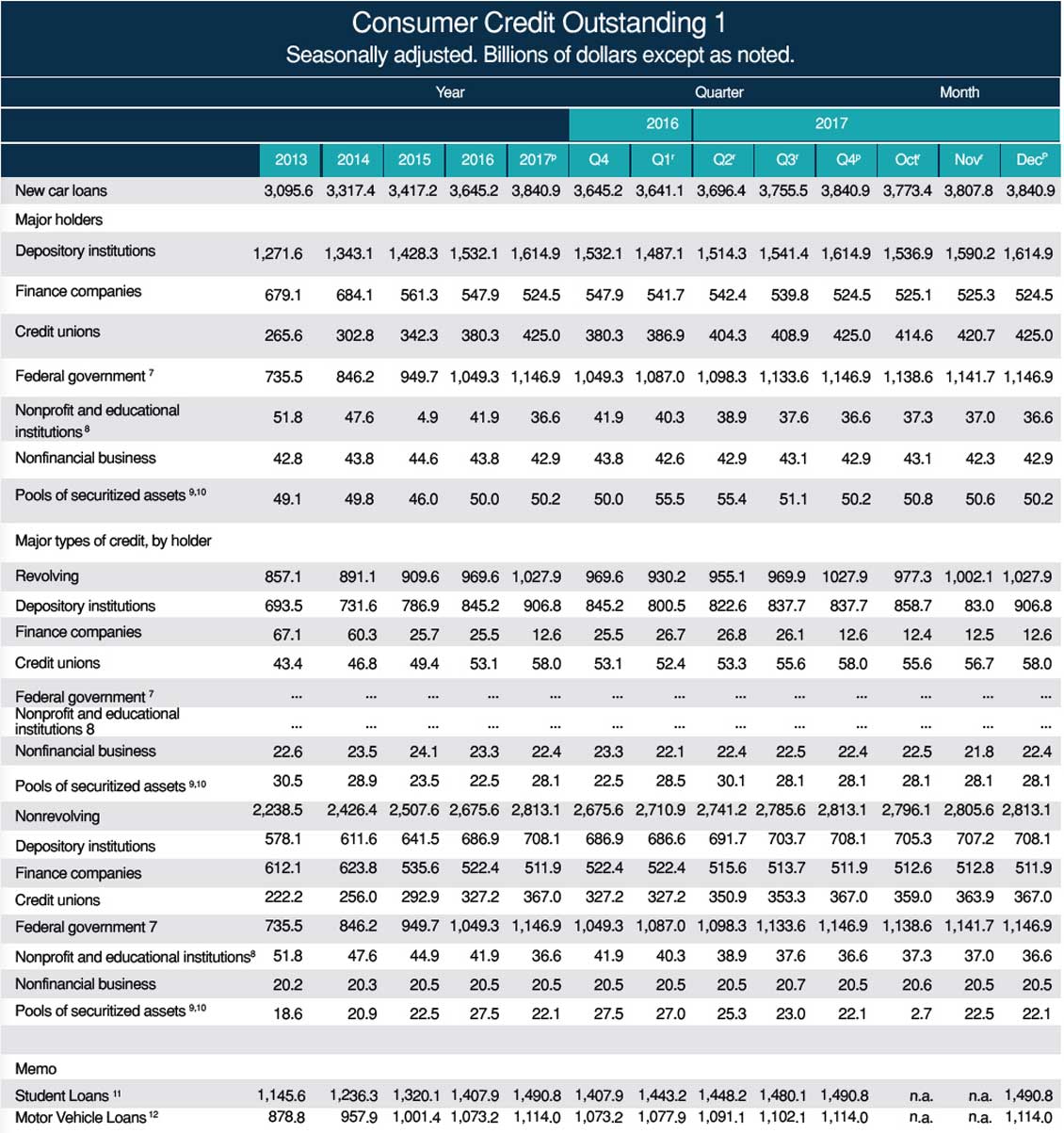

Not all car loans are created equal. Here are some avenues to consider:

- Dealer Financing: Often convenient as it's available directly from the car dealer, but comparing rates is beneficial.

- Banks and Credit Unions: These can offer competitive rates, especially if you have a pre-existing relationship with them.

- Online Lenders: Providing potentially lower rates and quicker approval, but ensure you're dealing with reputable entities.

3. Pre-approval for Car Loans

Getting pre-approved for a car loan has several advantages:

- Budgeting: Knowing your loan amount helps in setting a realistic budget for your car search.

- Negotiation Power: With a pre-approval, dealers know you have the funds, potentially leading to better deals or trade-ins.

- Time Saving: You avoid the wait time for loan approval during the car buying process.

4. Consider Special Financing Programs

There might be opportunities for tailored financing:

- Manufacturers' Incentives: Sometimes, car manufacturers offer low or zero percent financing to boost sales.

- Government Programs: Depending on where you live, there could be programs offering loans for first-time buyers or low-income earners.

- Employee Discounts: If you or a family member work for a company that offers car discounts or special loan rates, leverage these benefits.

5. Negotiate the Best Terms

Once you've secured a loan:

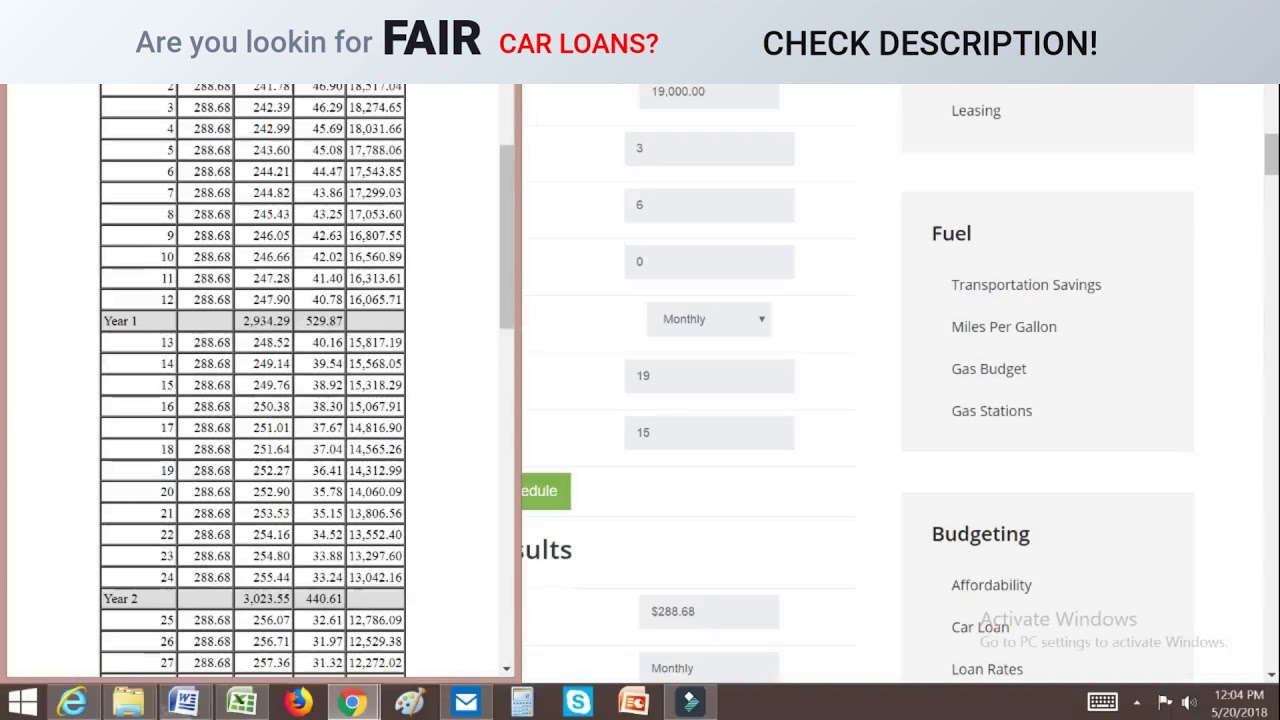

- Interest Rates: Even a small reduction can save you money over time.

- Loan Term: Longer terms mean lower monthly payments but higher total interest.

- Down Payment: A larger down payment might reduce your loan amount or interest rate.

- Fees and Charges: Negotiate or understand all associated costs before signing.

These five strategies offer you various approaches to navigating the complexities of car loan financing, allowing you to secure a loan that fits not just your financial capability but also your long-term financial health.

💡 Note: Remember, while lower monthly payments might seem attractive, they could lead to more interest paid over time. Always consider the total cost of the loan.

By understanding your financial position, researching available loan options, getting pre-approval, considering special financing programs, and negotiating the best terms, you're well on your way to securing a car loan that's both manageable and affordable. This approach not only saves you money but also ensures the car purchase process is as stress-free as possible.

What credit score do I need for a car loan?

+

While you can get a car loan with almost any credit score, a score above 660 is generally considered good, potentially qualifying you for better interest rates.

Can I finance a car with bad credit?

+

Yes, there are lenders specializing in car loans for those with poor credit. However, expect higher interest rates and possibly require a larger down payment.

What is the advantage of getting a pre-approved car loan?

+

Pre-approval gives you a clear budget to work with, making your car shopping experience more streamlined and giving you negotiation power with dealers.

How does the down payment affect a car loan?

+

A larger down payment can reduce your loan amount, which might lower monthly payments or interest rates. It can also help you secure loan approval if your credit isn’t optimal.

Are there any government programs for car loans?

+

Yes, various government programs exist to assist specific groups like first-time buyers, low-income families, or those living in certain regions. Check with local authorities or finance institutions for available programs.