Linked Finance Ireland: Your Guide to Smart Funding Solutions

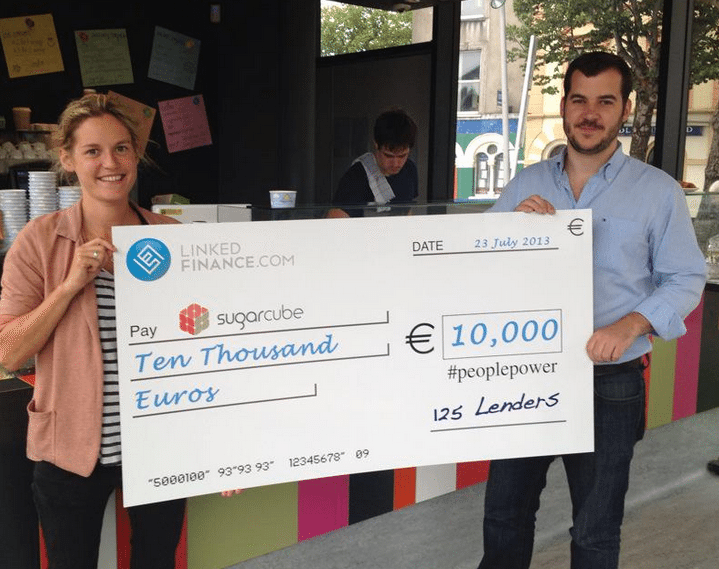

Linked Finance offers an innovative platform for both businesses seeking funding and investors looking to finance them in Ireland. For Irish entrepreneurs, securing financial resources is often the first hurdle in transforming ideas into reality. Traditional banking might be slow or unattainable, making alternative finance solutions like Linked Finance an attractive option. Here's how you can leverage Linked Finance for your business:

What is Linked Finance?

Linked Finance Ireland is a peer-to-peer lending platform where businesses can borrow money directly from investors, bypassing traditional banking channels. This model provides a faster, more flexible alternative to bank loans. Here’s what you need to know:

- Loan Types: Offers business loans, property finance, and invoice financing.

- Interest Rates: Often more competitive than those of banks.

- Loan Sizes: Can fund from a few thousand Euros to several million Euros.

- Speed: The application process can be completed, and funds can be received within a few days.

Linked Finance facilitates this process by connecting borrowers with lenders, ensuring transparency and security in transactions.

How to Apply for a Loan

The process of getting a loan from Linked Finance is streamlined but here are the steps you should follow:

- Account Creation: Register on the Linked Finance website.

- Loan Application: Fill out the loan application with details about your business, the purpose of the loan, and amount needed.

- Documentation: Provide necessary documents like financial statements, tax returns, and business plans.

- Review Process: Linked Finance evaluates your application, performs credit checks, and assesses your business’s viability.

- Listing: If approved, your loan is listed on the platform for investors to fund.

- Investment Period: Investors have a set time to invest in your loan.

- Funds Disbursement: Once the loan is fully funded, the money is disbursed to your business account.

💡 Note: The review process can vary in duration depending on the completeness of the application and verification needs.

Investing Through Linked Finance

On the other side of the platform, individuals or businesses can invest in Irish companies through Linked Finance. Here’s how you can get started:

- Create an Investment Account: Register as an investor on the platform.

- Explore Opportunities: Browse or filter through loan listings for potential investments.

- Invest: Choose how much to invest in each loan, spreading risk with diversification.

- Monitor: Keep track of your investments, get notifications, and manage your portfolio.

- Returns: Receive interest payments monthly or at the end of the loan term, depending on the terms.

Linked Finance ensures that all investments are spread across multiple loans, reducing the risk for the investor.

Benefits of Using Linked Finance

Here are several advantages of choosing Linked Finance for business funding:

- Quick Access to Funds: Applications can be processed and funded in days, not weeks.

- Competitive Rates: Often lower than traditional bank loans due to direct lending models.

- Flexibility: Customize loan terms to fit your business needs.

- Support Local Economy: Investing in local businesses helps the community grow.

- No Hidden Fees: Transparent fee structure with no prepayment penalties.

These benefits make Linked Finance Ireland an appealing choice for both borrowers and investors.

In closing, Linked Finance offers a dynamic alternative to traditional lending, providing Irish businesses with the financial agility to grow or stabilize their operations. For investors, it presents an opportunity to support local ventures while earning returns. The platform's transparent and efficient system ensures that both parties can engage in a mutually beneficial financial relationship, fostering economic growth within Ireland.

How secure is my investment on Linked Finance?

+

Linked Finance employs strict security measures, including identity verification, credit checks, and loan defaults are managed through a recovery process. However, like any investment, there’s an inherent risk, but the platform works to mitigate this risk.

Can I apply for a loan if my business is brand new?

+

Yes, new businesses can apply, but they might need to provide more comprehensive business plans or projections to secure funding. Early-stage businesses might face higher interest rates due to the increased risk.

What are the requirements to invest in loans?

+

To invest, you must be 18+, have a valid ID, and go through an investor verification process. You’ll need to deposit funds into your Linked Finance account to make investments.

How does Linked Finance compare to crowdfunding?

+

While crowdfunding platforms typically raise funds through donations or pre-selling products, Linked Finance deals in loans. Borrowers repay the loan with interest, and investors earn returns on their investment, offering a more structured financial engagement.