Unlock Savings with Lexus Auto Finance Today

The quest to unlock savings with Lexus Auto Finance is a journey many potential car owners look forward to. Financing a luxury vehicle like a Lexus should not only secure you a great car but also leave your wallet with a smile. With smart financial planning, the right knowledge, and a focus on value over luxury, it's possible to drive home in your dream Lexus while maintaining fiscal health. Here, we dive into how to make the most of Lexus Auto Finance offers, tailored to give you both the car and the savings.

Why Choose Lexus Auto Finance?

Lexus Auto Finance isn’t just another auto loan; it’s a tailored financial product for Lexus owners:

- Competitive Interest Rates: Enjoy lower rates than many traditional auto loans.

- Flexible Payment Terms: Customize your loan to fit your budget with various term options.

- Special Incentives: From loyalty programs to promotional rates, Lexus often provides exclusive offers.

Understanding Your Financing Options

Before diving into any finance option, it’s important to know what’s available:

- Standard Auto Loan: Pay for your Lexus over time with fixed monthly payments.

- Lease: Drive a new Lexus every few years with lower monthly payments, albeit with no ownership at the end.

- Lease-to-Own: Lease now, with the option to buy the vehicle at the end of your lease.

Consider your driving habits, the longevity of your vehicle preferences, and your future financial plans when choosing.

Strategies for Maximum Savings

Negotiate Your Deal

One of the most effective ways to save is to negotiate:

- Research vehicle pricing: Know the invoice price, the MSRP, and any current incentives.

- Compare dealership offers: Don’t settle for the first deal. Shop around.

- Be willing to walk away: If the numbers don’t work, be prepared to seek a better deal elsewhere.

📝 Note: Remember, negotiating isn’t just about getting the lowest price; it’s about securing the best overall value for your money.

Leverage Trade-In Value

If you have a vehicle to trade in, this can significantly lower your loan amount:

- Get a private party appraisal: This can be an honest estimate of your car’s worth.

- Use this as leverage: Present your trade-in’s value during negotiations to boost your savings.

Explore Loyalty Programs

Lexus values its customers, and loyalty can translate into savings:

- Enroll in the Lexus Owners program: Gain access to exclusive events, discounts, and offers.

- Referral bonuses: Some programs offer incentives for referring friends or family to Lexus.

- Lexus Service Advantage: Check for service or maintenance incentives for loyal customers.

Financing Your Lexus: What to Expect

When you decide to finance through Lexus Auto Finance, here’s what you can expect:

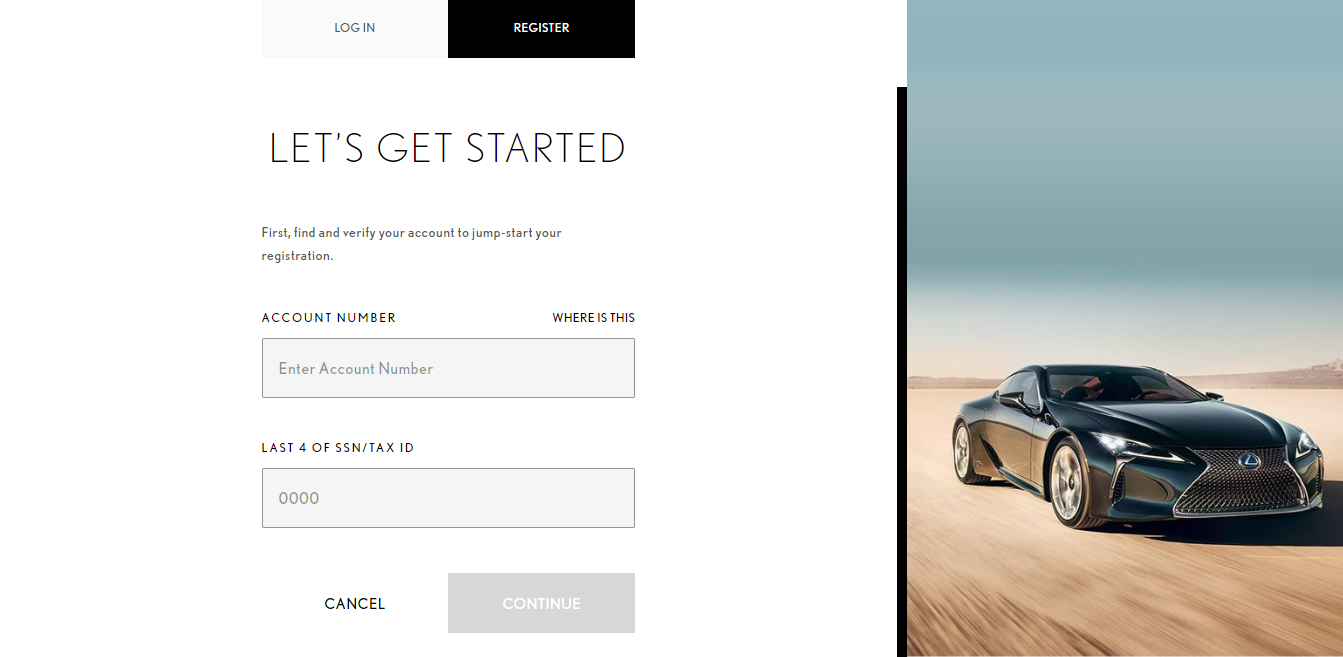

- Pre-qualification: Get a soft credit check to understand potential loan terms without affecting your credit score.

- Application and Approval: Once you’ve chosen your vehicle, apply for financing. With good credit, approval can be quick.

- Documentation: Have documents ready like ID, income proof, insurance, and proof of employment.

- Finalize the Deal: Review all terms, interest rate, and monthly payments before signing. Ensure everything is as agreed.

Wrap-up: Saving Money with Lexus Auto Finance

In conclusion, the path to unlocking savings with Lexus Auto Finance is lined with numerous strategies and options. From understanding your financing choices, negotiating like a pro, leveraging trade-ins, to taking advantage of loyalty programs, there's an avenue for every prospective Lexus owner to secure significant savings. Remember, the key lies in doing your homework, knowing your worth, and driving a hard bargain. A luxury vehicle like a Lexus can be both a rewarding and financially sound decision when approached with the right mindset and preparation.

What is the difference between a lease and a loan with Lexus Auto Finance?

+

A lease with Lexus Auto Finance involves lower monthly payments over a fixed term (typically 24 to 48 months) where you return the vehicle at the end. A loan, however, leads to ownership with payments spread over a longer term, and at the end, you own the car outright.

Can I negotiate the interest rate with Lexus Auto Finance?

+

Interest rates are based on creditworthiness and current market rates. While the rate itself might not be negotiable, you can negotiate other aspects of your deal like the vehicle price, trade-in value, or even get incentives that could reduce your interest expenses.

How does Lexus Auto Finance compare to other car financing options?

+

Lexus Auto Finance offers brand-specific benefits like loyalty programs, special promotions, and lower rates for existing customers. It’s tailored for Lexus owners, providing a streamlined experience compared to generic financing from banks or credit unions.