Apply for Car Finance Online: Simple Steps

Applying for car finance online has never been easier. With the advancements in digital banking and finance, you can now secure a car loan from the comfort of your home or office. This blog post will guide you through the simple steps to apply for car finance online, ensuring you get behind the wheel of your dream car with minimal hassle.

Preparing for Your Application

Before you start filling out online applications, here are some key preparations:

- Check Your Credit Score: Knowing your credit score can give you an edge. Lenders typically favor applicants with higher scores.

- Calculate Your Budget: Use an online car loan calculator to determine how much you can afford to pay monthly.

- Gather Necessary Documents: Most applications will require:

- Proof of income (payslips or tax returns)

- Proof of identity (driver’s license, passport, etc.)

- Address proof (utility bills or rental agreements)

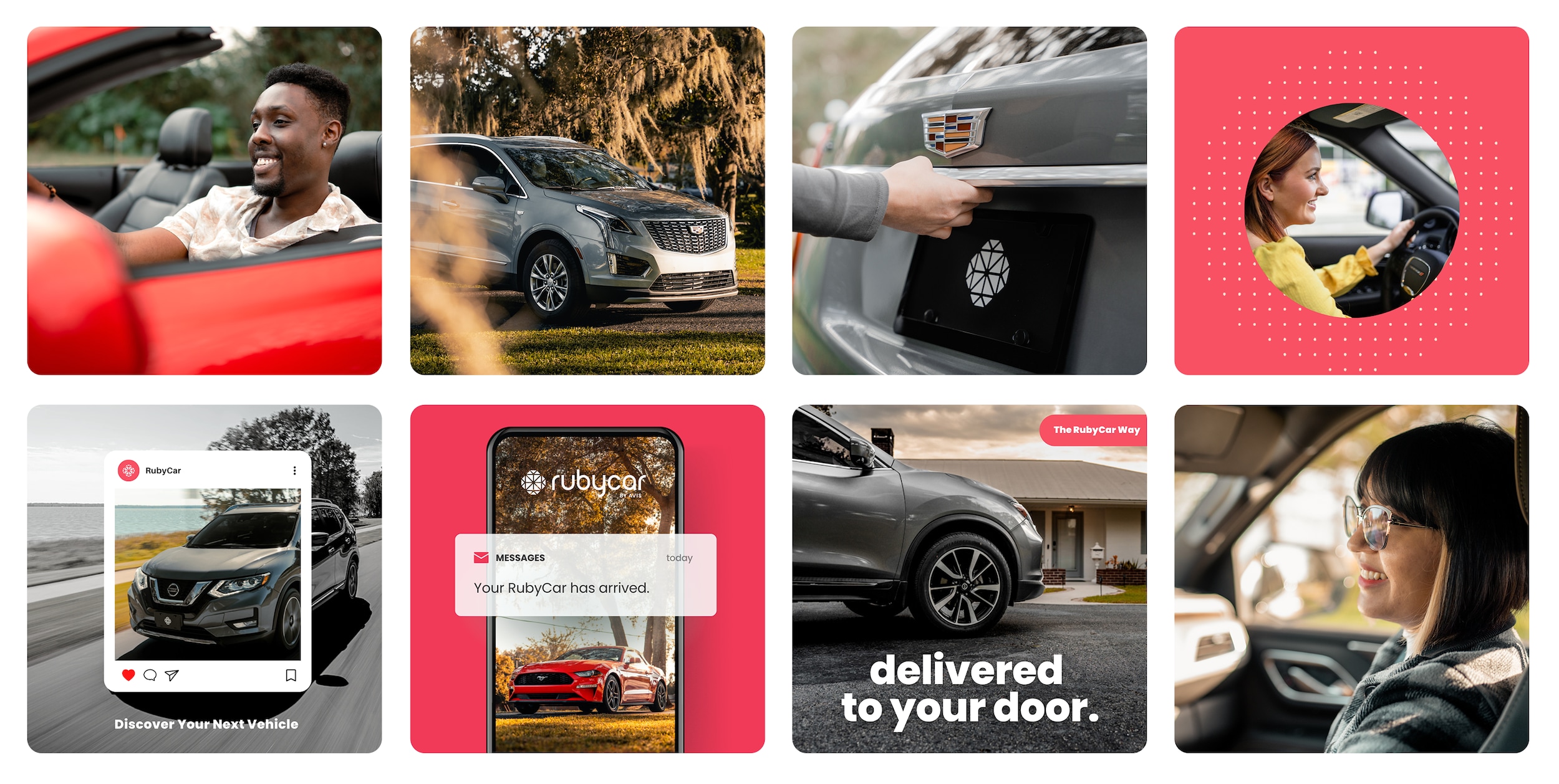

Choosing the Right Lender

With numerous options available, selecting the right lender is crucial:

- Compare Interest Rates: Look for competitive rates but be wary of hidden fees.

- Read Reviews: Check customer feedback for insights into the lender’s reliability and customer service.

- Understand Loan Terms: Pay attention to:

- Loan duration

- Down payment requirements

- Repayment schedules

- Prepayment penalties

🔍 Note: Remember, the best lender for one might not be the best for all. Tailor your choice to your specific needs and circumstances.

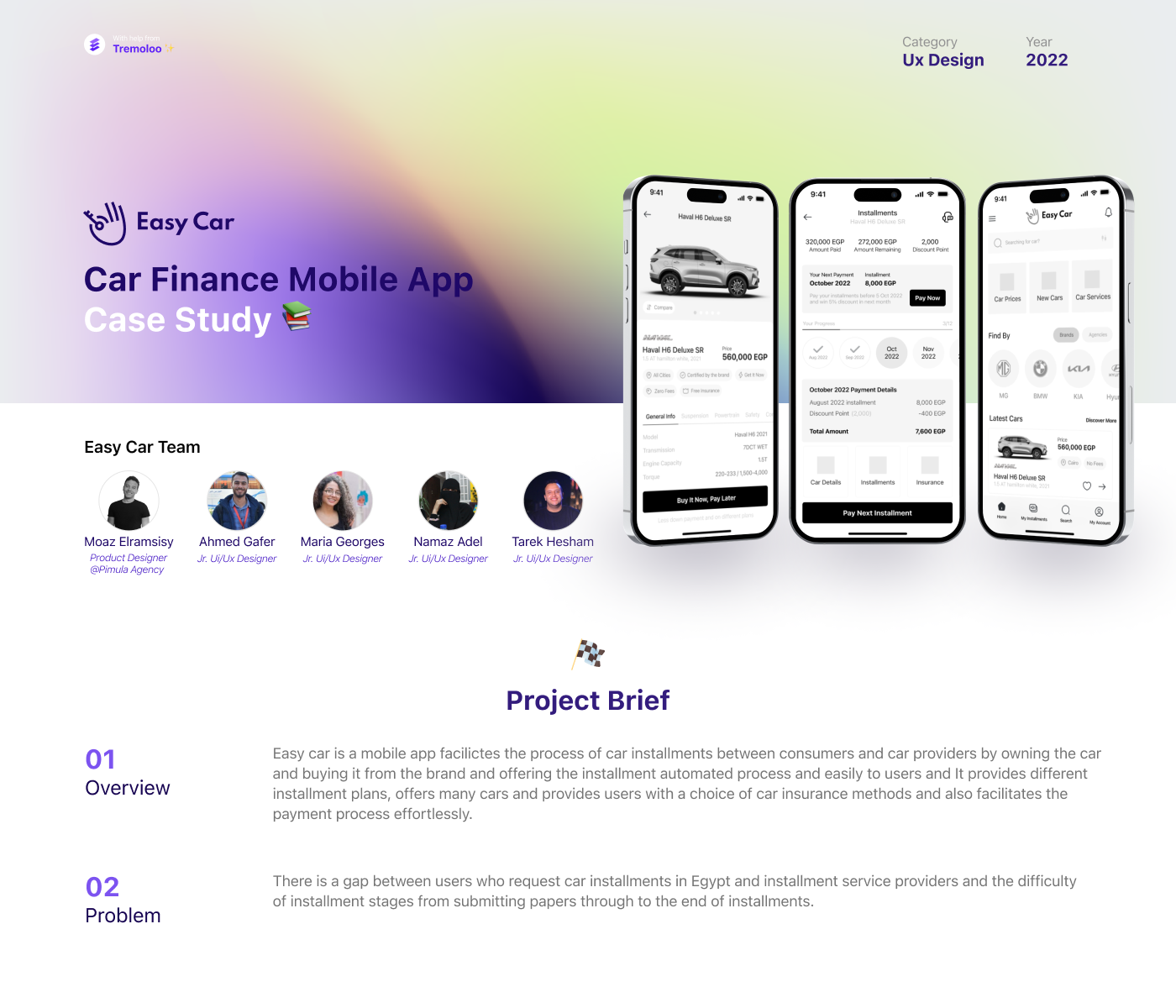

Filling Out the Online Application

The process of filling out the application varies slightly between lenders, but here are the general steps:

- Select the Car and Finance Option: Decide on the car you want and how much you need to borrow.

- Enter Personal Information: Fill in details like name, address, date of birth, etc.

- Provide Employment and Financial Information: Include details of your job, income, and expenses.

- Upload Supporting Documents: Submit the documents listed in the preparation step.

- Submit and Await Approval: After submitting, wait for a response from the lender. Some offer instant decisions.

After Your Application

Here’s what happens after you’ve applied:

- Loan Approval Notification: You’ll be notified of the decision, often via email or phone.

- Sign the Loan Agreement: If approved, review and sign the loan contract online or in person.

- Fund Release: Once all conditions are met, the funds are released to the car dealer or directly to you.

Once you've navigated through these steps, you’ll have your car finance sorted out, and you can start the process of actually getting your car. The convenience of doing it all online is a significant benefit, cutting down on the traditional legwork involved in car purchasing.

Remember, applying for car finance online streamlines the process, making it more accessible and less time-consuming. With digital tools, you can:

- Make quick comparisons between different lenders

- Apply in minutes without leaving your home

- Receive instant or near-instant decisions

What credit score do I need to get car finance?

+

While requirements vary, a good credit score generally increases your chances of approval for car finance. A score above 700 is considered good, but even with lower scores, you might still qualify with some lenders.

Can I apply for car finance if I’m self-employed?

+

Yes, self-employed individuals can apply for car finance. Lenders might require more documentation like business accounts or tax returns to verify your income.

How long does it take to get a decision on my car finance application?

+

Some lenders offer instant or near-instant decisions, especially with online applications. However, it can take up to a few days if further verification is needed.