5 Best Honda Financing Tips for Smart Buyers

In today's market, purchasing a new car, especially a brand like Honda, known for its reliability and value, can be a significant investment. For many, financing becomes the most practical method to achieve car ownership. However, navigating the labyrinth of auto loans and financing options can be daunting. This post will explore the 5 best Honda financing tips that smart buyers should consider to make the most out of their purchase experience.

Understanding Honda Financing Options

Before diving into specific tips, it's crucial to understand the different financing options available for Honda vehicles:

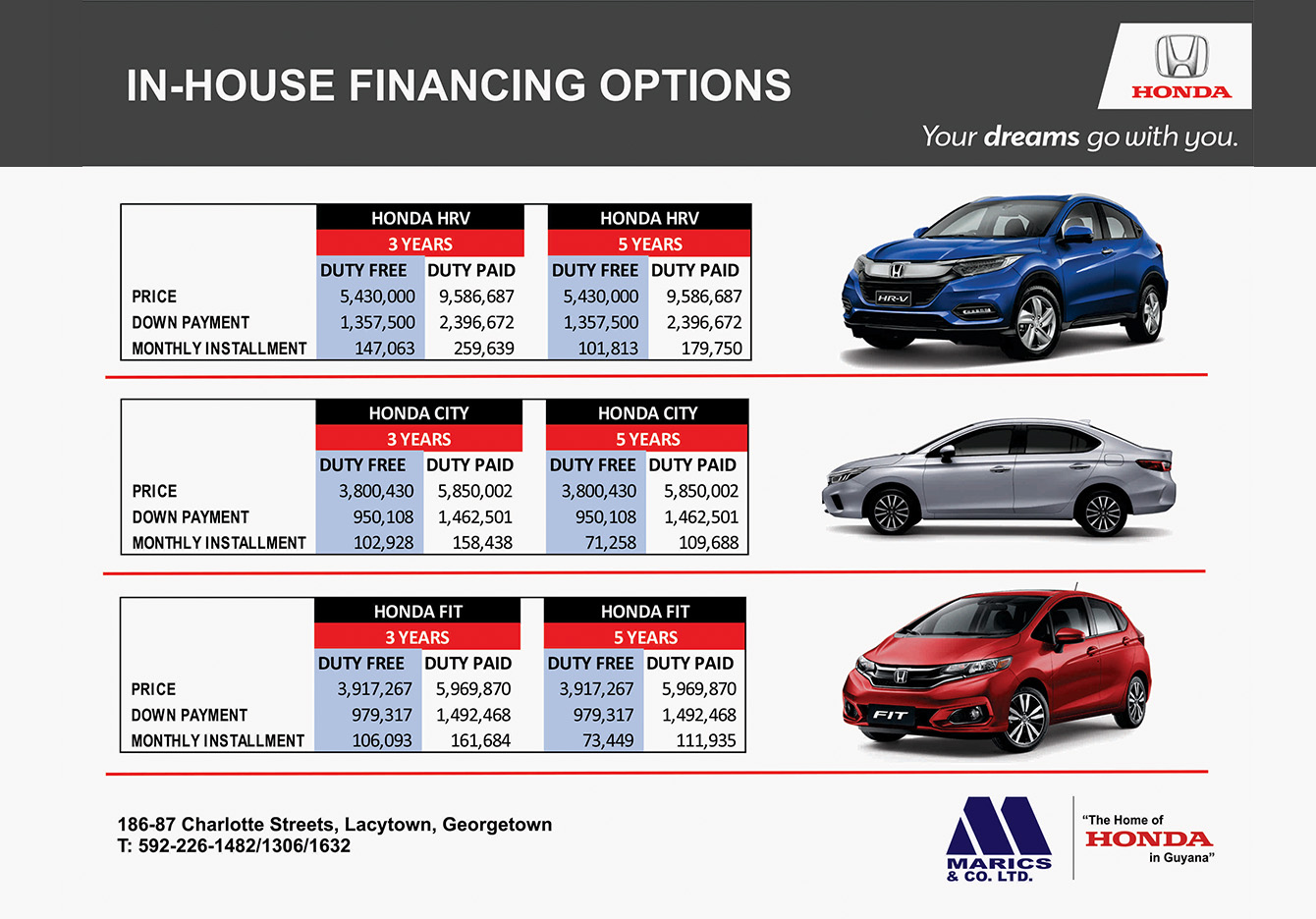

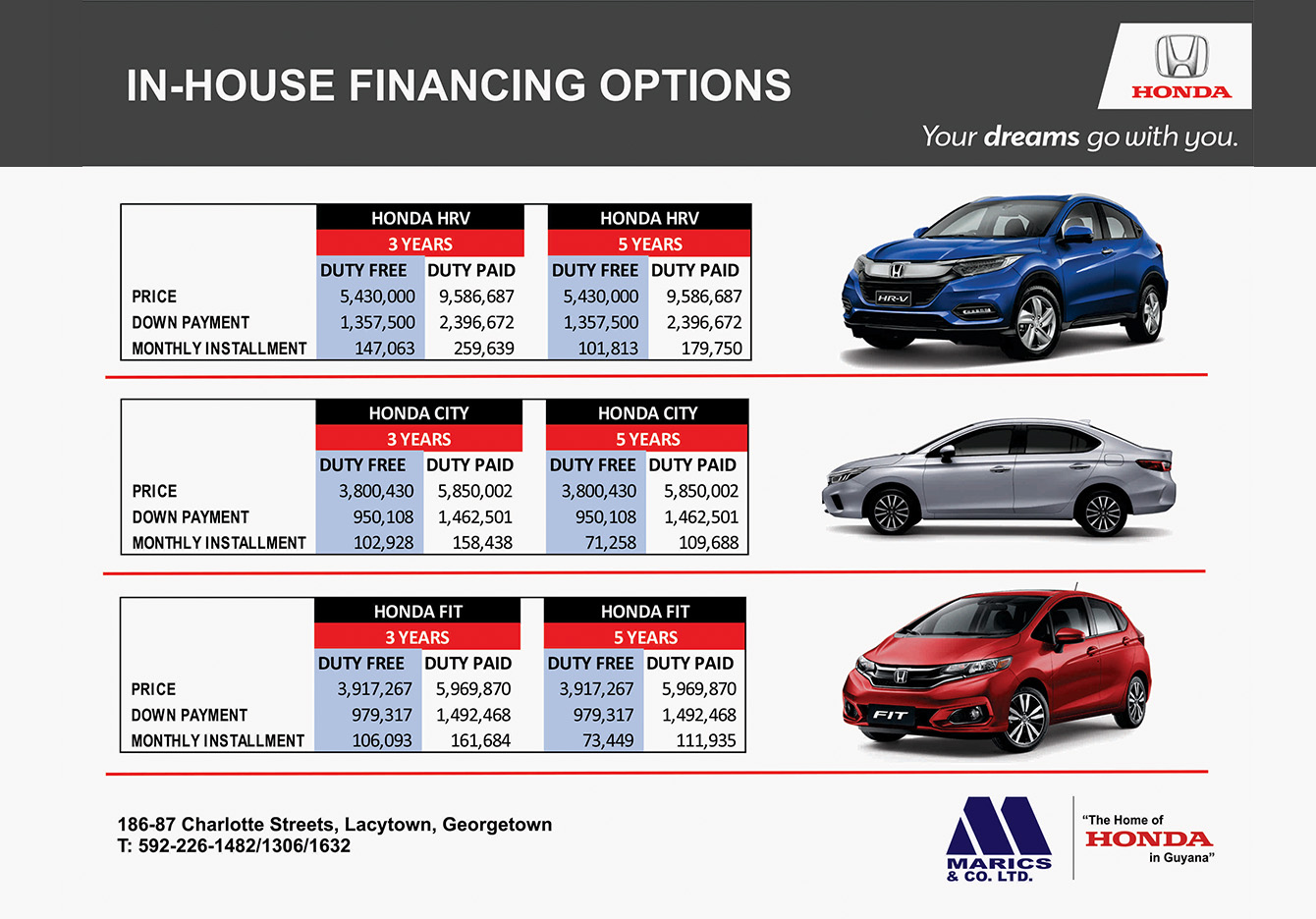

- Dealer Financing: This is when you secure a loan through Honda's dealership network.

- Bank or Credit Union Loans: Conventional loans from banks or credit unions might offer competitive rates.

- Manufacturer's Incentives: Honda often provides special financing offers like low APR rates or cash-back incentives.

Tip 1: Check Your Credit Score

Your credit score significantly impacts the interest rate you'll receive:

- A higher score means lower interest rates and better financing terms.

- Check your credit report for errors or discrepancies and correct them before applying for financing.

- Try to improve your score if possible by paying down existing debts or ensuring timely bill payments.

Tip 2: Shop Around for the Best Rates

Don’t settle for the first offer:

- Get pre-approved from multiple lenders (banks, credit unions, online financiers) to compare rates.

- Use pre-approvals as leverage during negotiations at the dealership.

🔎 Note: Pre-approval does not guarantee the final loan approval but provides a strong negotiating position.

Tip 3: Consider the Term Length of Your Loan

| Loan Term | Monthly Payment | Total Interest |

|---|---|---|

| 36 Months | Higher | Lower |

| 60 Months | Lower | Higher |

| 72 Months | Lowest | Highest |

- A shorter loan term means higher monthly payments but less interest over time.

- A longer term reduces monthly payments but increases total interest paid.

- Consider your financial situation: how much can you afford to pay each month without compromising your lifestyle?

Tip 4: Use Manufacturer Incentives

Honda frequently offers:

- Zero percent financing for qualified buyers.

- Discounts or rebates.

- Cash-back options that can be used as down payment or to lower the loan amount.

Tip 5: Understand the Total Cost of Ownership

Financing a car isn’t just about the loan; consider:

- Fuel efficiency.

- Insurance costs which can vary based on the model.

- Maintenance and repairs.

These factors can significantly affect the overall cost beyond the monthly car payment. By understanding these aspects, you can make a more informed decision, ensuring that your new Honda remains both an investment and an asset over its lifetime.

By applying these smart financing tips, buyers can approach their Honda purchase with confidence. Researching and understanding your options, focusing on credit health, and making informed decisions on loan terms can lead to savings, not just now but for years to come. Honda's reputation for quality and durability adds an extra layer of security when you decide on the best financing strategy for your circumstances. Remember, this is not just about securing a car; it's about managing your financial health effectively while enjoying the ride.

What is the difference between dealer and bank financing for Honda?

+

Dealer financing often comes with manufacturer incentives like lower rates or rebates, but bank or credit union loans might offer better long-term rates and allow for more flexibility in terms.

How important is a credit score when financing a Honda?

+

Your credit score is pivotal as it determines the interest rate you receive. A higher score can save you thousands in interest over the life of the loan.

What should I consider when choosing the loan term length?

+

Choosing the loan term depends on balancing monthly affordability with the total interest cost. Shorter terms mean higher payments but lower overall cost, while longer terms lower monthly payments but increase total interest.