Guaranteed Van Finance: Get Approved Fast!

Securing van finance can be a crucial step in expanding or starting a business, especially for those in sectors like courier services, construction, or mobile services where a vehicle is an essential tool for trade. However, getting approved for van finance isn't always straightforward. Many potential borrowers are concerned about their creditworthiness or the perceived complexity of the finance application process. This post will guide you through understanding van finance, particularly focusing on guaranteed approval solutions, the requirements, and how to get approved fast.

Understanding Van Finance

Van finance can come in various forms, each tailored to different needs and circumstances:

- Hire Purchase (HP): Here, you’ll pay an initial deposit followed by fixed monthly payments. At the end of the term, the van becomes yours upon completion of payments.

- Leasing: With leasing, you use the van for a set period without owning it at the end of the term. Leases typically require lower monthly payments but will never give you ownership.

- Contract Hire (CH): Similar to leasing but includes maintenance packages, making it ideal for businesses looking to manage their vehicle fleet with ease.

- Personal Contract Purchase (PCP): This gives you the option to either return the van or make a final balloon payment to own it outright after a series of monthly payments.

Guaranteed Van Finance Approval

While no financier can absolutely guarantee approval, there are strategies and finance options designed to increase your chances of getting approved:

Soft Search Options

Before diving into a full application, consider using soft search options:

- Soft Credit Checks: These checks don’t impact your credit score, giving you an idea of your chances without leaving a mark on your credit report.

Lender Specializations

Some lenders specialize in:

- Financing for new businesses or those with poor credit

- Alternative data lenders using income verification instead of credit history

- Second chance finance programs aimed at those with previous credit issues

Guarantor Van Finance

Having a guarantor with good credit can:

- Increase approval rates by backing up your application with their financial stability

Steps to Get Approved Fast for Van Finance

Here’s how you can streamline the process and increase your approval chances:

1. Check Your Credit Score

Start by:

- Checking your credit score for any discrepancies or issues

- Addressing any negative marks or errors on your credit report

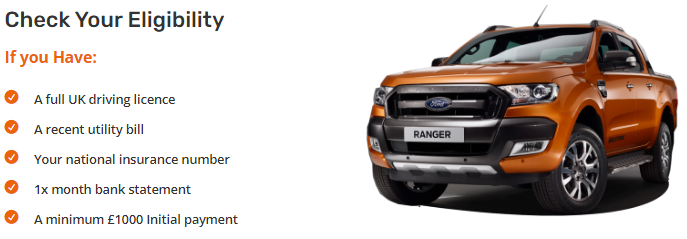

2. Prepare Your Documents

Having all documents ready will speed up the process:

- Proof of identity (passport, driving license)

- Address verification

- Bank statements, payslips, or tax returns to verify income

- Business plan or trading history (for business owners)

3. Choose the Right Lender

Selecting a lender:

- Look for lenders that cater to your profile (poor credit, new business, etc.)

- Compare rates, terms, and APRs online

- Read reviews and feedback from other users

4. Make a Larger Down Payment

If possible:

- A larger deposit reduces the lender’s risk, thereby increasing approval chances

- It might also lower your monthly payments

5. Apply with Confidence

Once prepared:

- Submit your application with all the required documents

- Follow up promptly with any additional information requested by the lender

💡 Note: Always be truthful in your application. Inaccurate information can lead to immediate denial or legal repercussions.

Navigating the Application Process

The application process can sometimes feel daunting, but here are tips to navigate it:

- Understand the Terms: Make sure you comprehend all terms, including the interest rate, total amount repayable, and any additional fees.

- Use Brokers: Van finance brokers might help find the best deal for your situation.

- Read the Fine Print: Look out for early repayment fees or penalties for missed payments.

🌟 Note: Remember, the faster you provide requested information, the quicker you can get a decision.

Getting finance for your van doesn't have to be a lengthy ordeal. With the right preparation, understanding of your financial position, and selection of the appropriate finance options, you can significantly enhance your chances of securing guaranteed van finance approval. Whether you're a sole trader or managing a fleet for your business, efficient financing will keep your operations running smoothly. Remember, preparation is key; so equip yourself with the right documents, creditworthiness knowledge, and a clear understanding of what lenders look for in an application. By taking these steps, you set yourself up for a swift, successful finance application process.

How does my credit score affect van finance approval?

+

Your credit score is a key factor in determining your approval for van finance. A higher score generally increases your chances of approval, often at a better interest rate. Lenders see a good credit score as an indicator of responsible financial behavior. If your score is low, you might still be eligible for finance but could face higher interest rates or need a guarantor or larger deposit.

Can I still get van finance if I’m self-employed?

+

Absolutely, many finance companies cater specifically to self-employed individuals. You’ll need to provide evidence of income through bank statements or tax returns, often for at least the last three months or a year. Some lenders may require additional documentation like contracts or a business plan.

What are the advantages of getting a larger deposit?

+A larger deposit reduces the total loan amount, which can mean lower monthly repayments and potentially better interest rates. It also lowers the risk for the lender, increasing the likelihood of approval, especially if you have a less-than-ideal credit history.

What if my van finance application is rejected?

+If your application is rejected, first find out why. It could be due to your credit history, income, or another reason. Address the issues, possibly by improving your credit score, providing more documentation, or considering a guarantor. Also, explore alternative lenders who might be more lenient with their criteria.

How long does the van finance approval process typically take?

+The duration varies depending on several factors including the lender’s criteria, your preparation, and the complexity of your application. With all documents in order and a straightforward financial situation, you might get a decision within hours or a few days. For more complex cases, it can take longer, up to several weeks.