How to Easily Get Car Finance Today

Are you in the market for a new car but finding the finance aspect daunting? Worry not, as getting car finance today is more straightforward than you might think. This comprehensive guide will walk you through the process, highlight the best options available, and ensure you are equipped to make an informed decision that fits your financial situation.

Understanding Car Finance

Car finance is not a one-size-fits-all solution. Here’s what you need to know:

- Personal Contract Purchase (PCP): PCP allows you to drive a car for a set period by paying an initial deposit, followed by monthly payments. At the end of the agreement, you can return the vehicle, pay the balloon payment to keep it, or trade it in.

- Hire Purchase (HP): With HP, you pay an initial deposit and then monthly payments until the car is fully paid off. Once completed, the vehicle is yours.

- Personal Loan: Loans for car finance are straightforward. You borrow the money to buy the car outright and then pay back the lender in instalments, with interest.

Steps to Secure Car Finance

Here’s how you can secure car finance with ease:

-

Check Your Credit Score

Your credit score significantly impacts the terms of your finance. A higher score can get you better interest rates and loan terms. Always start by:

- Obtaining a free credit report from a recognized credit bureau.

- Reviewing your credit history for any errors or negative items.

- Working on improving your score if necessary, perhaps by paying down existing debt or correcting errors on your credit report.

-

Set Your Budget

Before you dive into the car buying process, determine:

- How much can you afford for a deposit?

- What monthly payments fit within your budget?

- Consider all ongoing car ownership costs, including insurance, maintenance, and fuel.

-

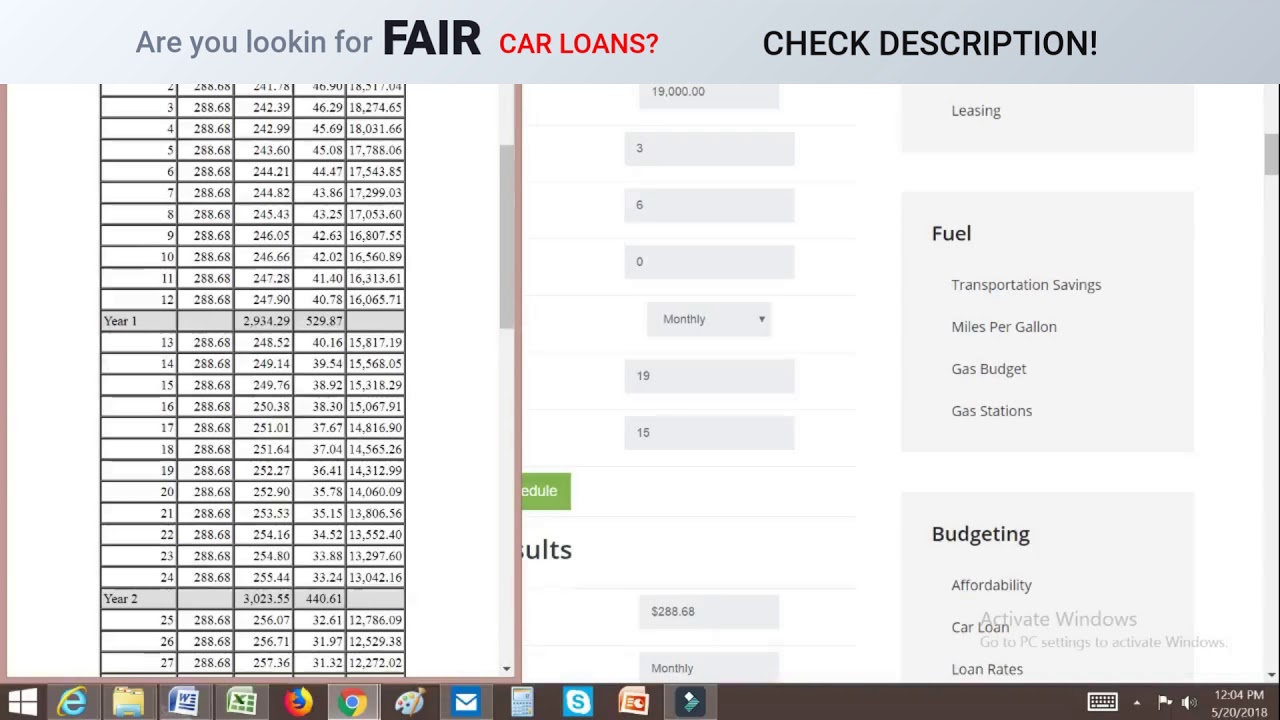

Research Car Finance Options

Not all finance options are equal. Here’s what you need to consider:

- Interest Rates: Look for the best rates by comparing offers from various lenders.

- Fees: Watch out for hidden fees like setup fees, early repayment charges, or balloon payments.

- Terms: Decide whether you need a short-term deal or if a long-term arrangement fits better.

-

Choose the Right Car

Your choice of vehicle will affect your finance terms. Consider:

- The make and model of the car.

- Its condition, especially if it’s used.

- How the car’s value depreciates over time, influencing your PCP balloon payment.

-

Apply for Finance

Once you’ve done your homework, apply with:

- Personal information like income and employment details.

- Details of the car you wish to finance.

- Prepare to negotiate or consider pre-approval from lenders for better bargaining power.

🚗 Note: Always read the fine print, especially regarding early repayment penalties, as this can have significant financial implications if you decide to settle your loan or PCP early.

Comparison of Car Finance Options

| Finance Option | Deposit Requirement | Interest Rates | Flexibility | Ownership at End |

|---|---|---|---|---|

| PCP | 10-20% of car value | Variable | High (end of term options) | No unless you pay the balloon |

| HP | 10-30% of car value | Fixed or Variable | Medium | Yes, after final payment |

| Personal Loan | Not required | Fixed | Low | Yes, after loan is paid off |

Based on your financial situation and car needs, selecting the right finance type can save you money over the vehicle's lifetime.

🌟 Note: Remember, interest rates can be influenced by your credit score, loan term, and current economic conditions. Always compare personalized offers from multiple lenders.

Financial Considerations

Financing a car involves more than just the cost of the vehicle:

- Insurance: Ensure your car insurance covers the financed amount if the car is stolen or written off.

- Taxes and Registration: Account for road tax, vehicle registration, and potential changes in tax laws.

- Depreciation: Understand how quickly your car loses value, particularly important for PCP.

- Total Cost of Ownership: Beyond finance, consider fuel, maintenance, and potential repairs.

In summing up, getting car finance today involves understanding different options, preparing your financial documents, and applying wisely. With the right approach, you can drive your dream car without the financial strain. Remember, your situation is unique, so tailor your finance choice to what benefits you the most over time.

What’s the difference between PCP and HP?

+

With PCP, you have flexibility at the end of your contract, whereas HP requires you to pay off the car in full to own it.

Do I need a deposit for car finance?

+

While not always necessary, a deposit can reduce your monthly payments and improve your loan terms.

Can I finance a used car?

+

Absolutely. Many finance options exist for used cars, although terms might differ from new car finance.

What happens if my financial situation changes?

+

Discuss your options with your finance provider. They might offer solutions like extending the term or refinancing.

Is it better to use cash or car finance?

+

It depends on your financial strategy. Finance can help preserve cash for other investments or emergencies, but ensure the total cost is worth it.