Funding London: Unlock Your Business Potential Today

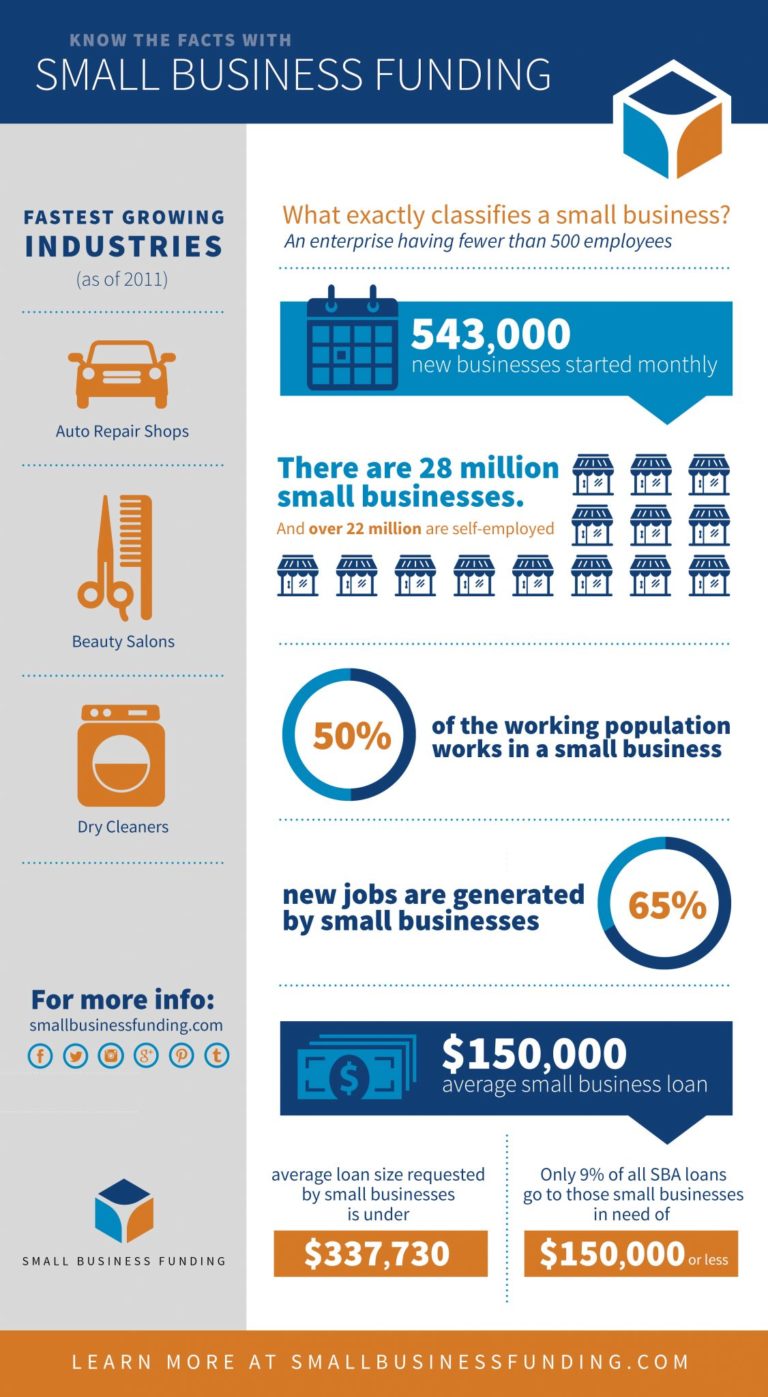

Funding is the lifeblood of any business, but securing it can be particularly challenging in a city as vibrant and competitive as London. As businesses navigate through the labyrinth of financial options, understanding the available funding avenues can significantly amplify growth potential. This guide will walk you through various funding options in London, providing insights into how to leverage these opportunities to fuel your business's growth.

The Importance of Funding for London Businesses

London's economic landscape is dynamic, characterized by a high influx of startups and scale-ups. Here's why funding is crucial:

- Capital for Growth: To expand operations, enter new markets, or invest in technology, capital is indispensable.

- Managing Cash Flow: Securing working capital can help in managing daily expenses and unexpected costs, keeping the business afloat during lean periods.

- Attracting Talent: Better funding allows businesses to offer competitive salaries, enhancing the ability to attract and retain top talent.

Types of Funding Available in London

London provides a plethora of funding options, each with its unique benefits:

Banks and Traditional Loans

Traditional bank loans are often the first port of call:

- Fixed or variable interest rates.

- Monthly repayment schedules.

- Collateral might be necessary.

Key banks include Barclays, Lloyds, and NatWest, which offer special schemes for startups and SMEs.

Alternative Finance

Beyond banks, alternative funding solutions have surged in popularity:

- Crowdfunding: Platforms like Kickstarter and Seedrs where the public can back your project in exchange for rewards or equity.

- Peer-to-Peer Lending: Get loans directly from investors through sites like Funding Circle.

- Angel Investors: High-net-worth individuals providing capital in exchange for equity, like the London Business Angels.

- Venture Capital: Institutional investors such as Octopus Ventures, which invest in high-growth companies in exchange for equity and influence.

Government and EU Grants

The UK government and EU have several programs for entrepreneurs:

| Program | Description | Eligibility |

|---|---|---|

| London Economic Action Partnership (LEAP) | Funding for projects that stimulate economic growth in London. | Small to medium enterprises with innovative projects. |

| ERDF (European Regional Development Fund) | Grants for projects contributing to economic development. | Businesses within ERDF eligible regions. |

| Small Business Research Initiative (SBRI) | Contracts for innovative solutions to public sector problems. | Companies with innovative ideas for public sector challenges. |

💡 Note: Government grants often come with strict criteria for eligibility and usage. Ensure thorough research before applying.

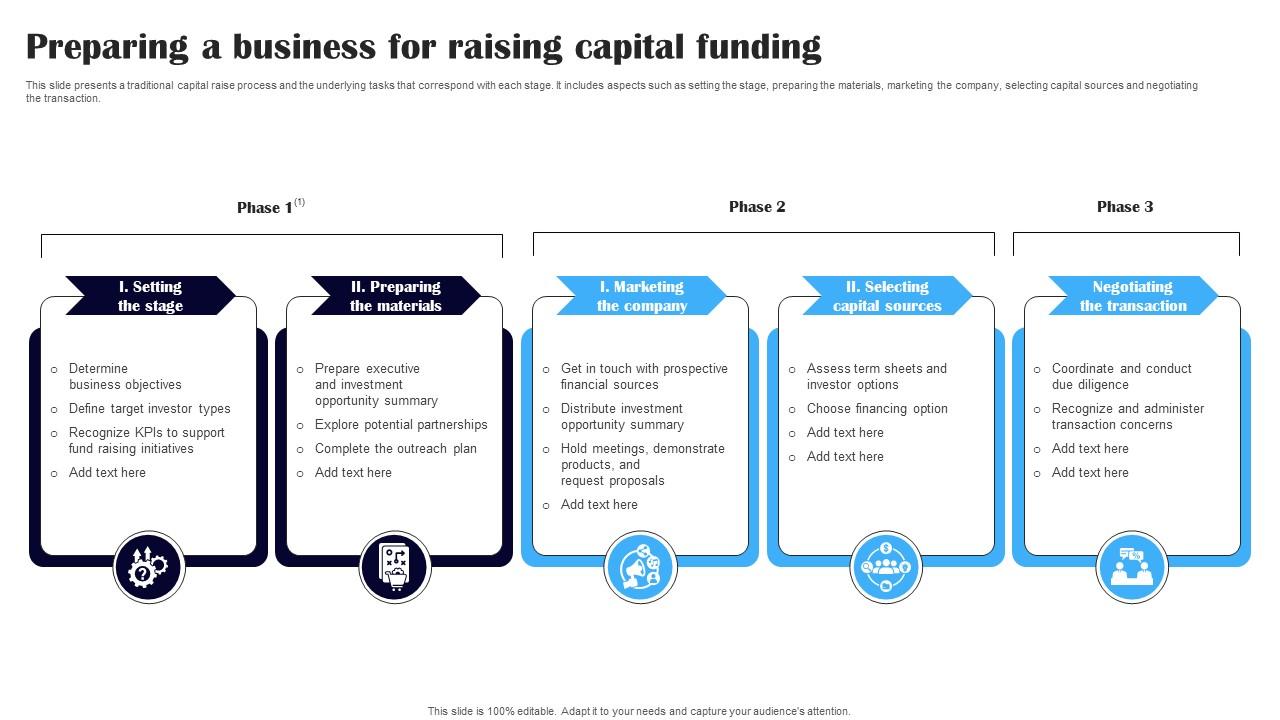

Navigating the Funding Process in London

Securing funding involves several steps:

- Prepare a Solid Business Plan: Detail your business model, market analysis, and financial projections.

- Network: Attend events, join business groups, and connect with potential investors.

- Choose the Right Funding Type: Based on your business stage, needs, and willingness to share equity.

- Pitch Perfectly: Tailor your pitch to each funding source, highlighting what they value most.

- Due Diligence: Be prepared for due diligence; provide all necessary documents and information.

- Negotiate Terms: Understand the terms offered and negotiate where possible for better deals.

Maximizing Your Funding Outcomes

To make the most of your funding:

- Use Funds Wisely: Allocate funds towards activities that directly contribute to growth and sustainability.

- Monitor and Report: Keep investors and funding bodies informed with regular updates on progress.

- Consider Additional Funding Rounds: Don’t rely on a single source; plan for multiple funding rounds.

- Build Relationships: Treat funding bodies and investors as partners in your venture.

The concluding paragraph provides a summary without heading or additional formatting:

London's business ecosystem offers a vast array of funding options tailored to different business stages and needs. Whether through traditional loans, alternative finance, or government grants, securing the right funding can propel your business to new heights. Remember, funding is not just about capital; it's about creating partnerships and leveraging networks to expand your business potential. Carefully consider your funding strategy to align with your long-term vision, ensuring that your business not only survives but thrives in the competitive landscape of London.

What are the main funding options for startups in London?

+

The primary funding options for startups in London include bank loans, crowdfunding, peer-to-peer lending, angel investments, venture capital, and various government and EU grants.

How can I prepare for securing funding in London?

+

Preparing for funding involves crafting a comprehensive business plan, networking with potential investors, researching the best funding types for your stage, perfecting your pitch, and ensuring all due diligence materials are ready.

What should I consider when choosing a funding option?

+

Consider your business’s growth stage, the amount of control you’re willing to give up, the cost of capital, the repayment structure, and the strategic benefits each funding source might bring to your business.