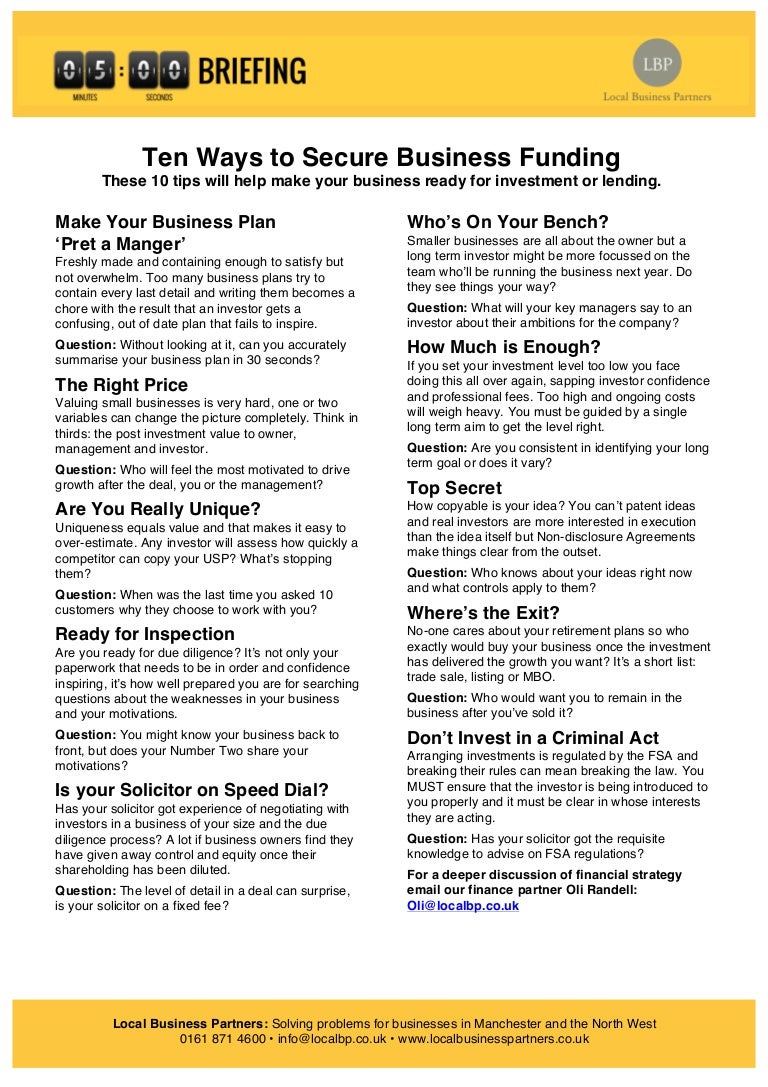

10 Innovative Ways to Secure Startup Funding in 2023

As startups navigate the competitive landscape of 2023, securing adequate funding remains a pivotal challenge and opportunity. Whether you're in the ideation stage or looking to scale, understanding and exploring innovative financing methods can significantly impact your venture's trajectory. Here's an in-depth look at ten groundbreaking approaches to securing startup funding this year, tailored for founders and entrepreneurs aiming to accelerate growth and innovate.

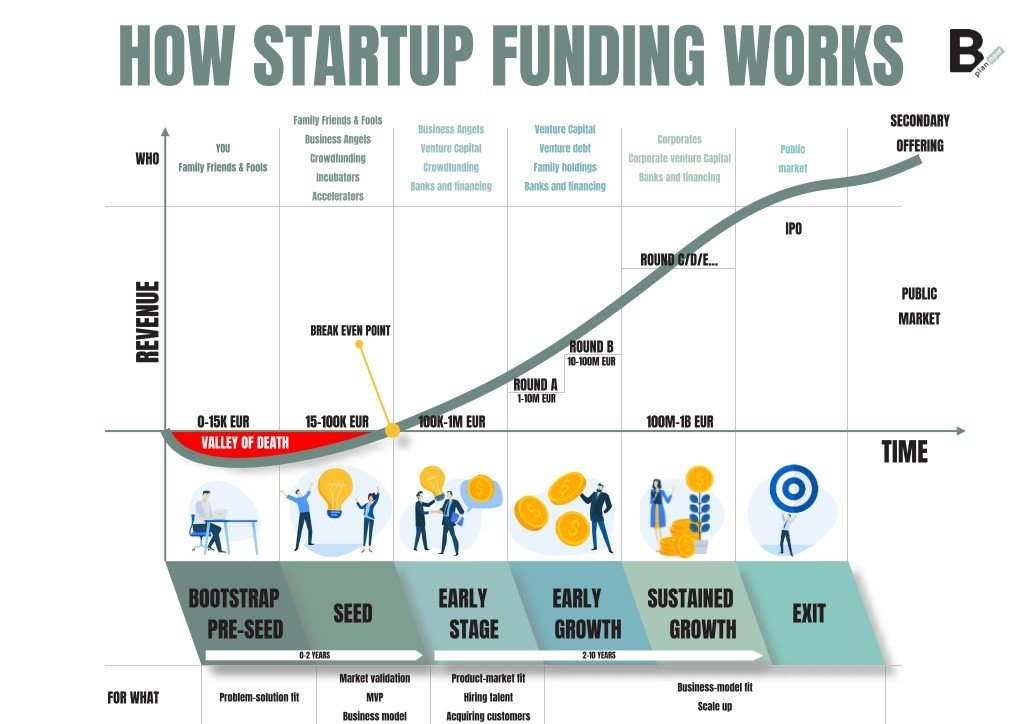

Bootstrapping: Leveraging Personal Resources

Bootstrapping, the practice of funding your startup through personal savings, revenue, or family and friends, might seem traditional but holds new ground in 2023:

- Crowdfunding Pre-Sales: Use platforms like Kickstarter or Indiegogo to pre-sell products, generating initial capital.

- Leverage Skills: Offer your professional services or consultancy on the side, using the earnings to fund your startup.

💡 Note: Bootstrapping not only conserves equity but also forces lean operations, potentially fostering innovative problem-solving and business model refinement.

Crowdfunding Campaigns

The evolution of crowdfunding platforms has introduced:

- Equity Crowdfunding: Investors fund startups in exchange for equity, broadening your investor base significantly.

- Donation-Based Crowdfunding: Ideal for socially impactful startups where supporters contribute for moral or emotional reasons.

Angel Investors: The Strategic Approach

In 2023, finding the right angel investors can:

- Offer More Than Just Capital: Investors can provide mentorship, networking, and industry-specific guidance.

- Angel Syndicates: Join or form groups of angel investors to pool resources and expertise for larger investments.

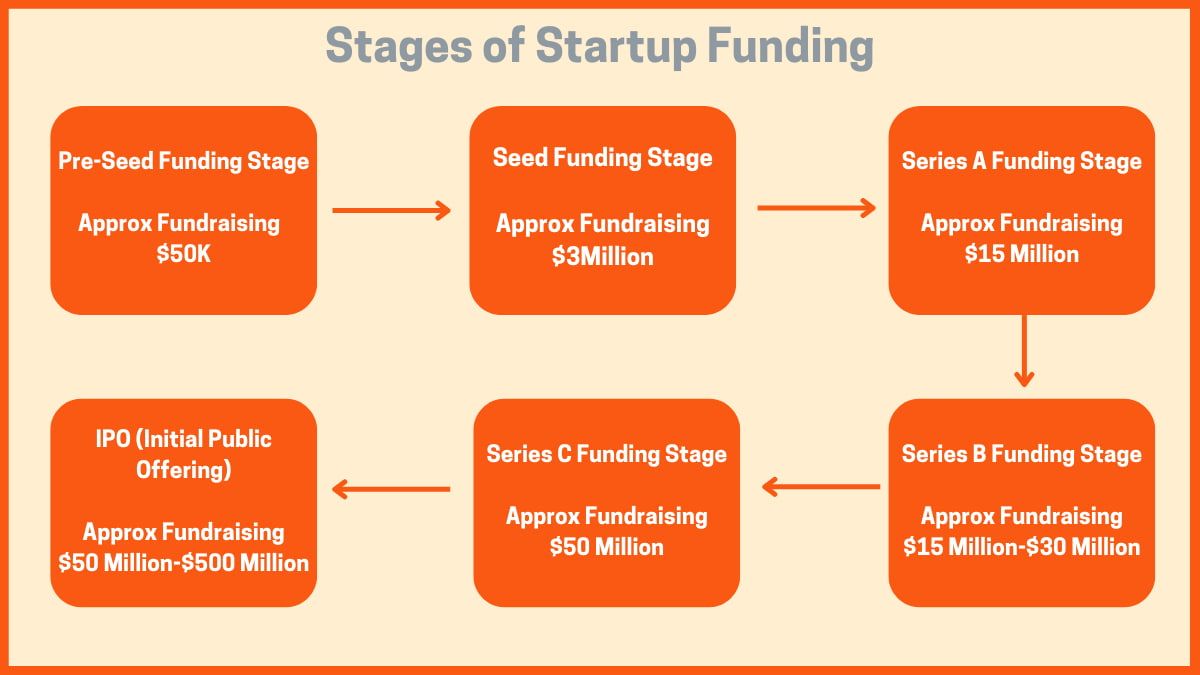

Venture Capitalists: The New Norm

Venture Capital (VC) investment strategies have evolved:

- Seed Stage Investing: VCs are increasingly interested in funding at the seed stage, fostering long-term relationships.

- Sector-Specific Funds: Specialized funds focus on high-potential sectors like AI, cleantech, or health tech, providing both capital and industry expertise.

Strategic Partnerships and Corporate Venturing

Corporations are looking for:

- Innovation through Acquisition: Large companies might invest in or acquire startups to innovate within their ecosystems.

- Joint Ventures: Partner with established businesses for mutual benefits, often involving investment or resource sharing.

Grants and Government Funding

Government and non-profit organizations offer:

- R&D Tax Credits: Grants for research and development activities can significantly reduce early-stage costs.

- Incubator Programs: Programs like Start-Up Chile or Techstars provide funding, mentorship, and resources.

Accelerators and Incubators

The incubator model has evolved:

- Vertical-Specific Programs: Specializing in specific sectors like fintech or biotech, they offer tailored mentorship and investment.

- Equity-Free Acceleration: Some accelerators are now offering their services without taking equity, reducing initial ownership dilution.

📌 Note: Accelerators not only provide capital but also significantly improve your startup’s visibility, which is crucial for further funding rounds.

Peer-to-Peer Lending and Microloans

Online lending platforms have opened up:

- Microloans: Smaller, often no-collateral-required loans perfect for bootstrapping startups or covering short-term needs.

- Revenue-Based Financing: A newer model where funding is repaid through a percentage of your future sales.

Family Offices and Private Wealth

High-net-worth individuals and families:

- Are Investing in Startups: They often seek alternative investments outside traditional markets, providing long-term capital and patience.

- Family Offices: Institutions managing wealthy families’ investments might be interested in startup equity or debt.

Competitive Pitch Events

Competing in business plan competitions or pitch events can:

- Yield Prizes and Funding: Events like TechCrunch Disrupt or local startup competitions offer cash prizes, investment opportunities, and networking.

- Visibility: These events can attract investors even if you don’t win, due to the exposure they provide.

Securing funding in 2023 requires a blend of traditional methods and innovative approaches. The landscape is dynamic, with an emphasis on strategic alignment, industry relevance, and sustainable growth. Whether through bootstrapping, leveraging new forms of venture capital, or exploring less conventional financing options like peer-to-peer lending, startups must tailor their funding strategy to their unique needs, potential, and market environment. This diverse approach not only maximizes funding options but also cultivates a versatile business model ready for the ever-changing economic terrain.

What makes equity crowdfunding different from traditional crowdfunding?

+

Equity crowdfunding allows investors to become shareholders in your company, whereas traditional crowdfunding often rewards contributors with product, perks, or recognition without providing them any ownership stake in the startup.

Why should startups consider peer-to-peer lending?

+

Peer-to-peer lending platforms offer startups a way to secure funding without giving up equity or requiring traditional collateral. It’s a flexible funding option with potentially lower interest rates and quicker approval processes.

Can government grants replace traditional venture capital?

+

While government grants provide non-dilutive funding, they typically focus on specific sectors or stages of business development. They might not provide the scale or strategic benefits that venture capital can offer, especially in terms of networking, mentorship, and scaling operations.