High Paying Finance Jobs: Your Path to Wealth

If you're looking to fast-track your way into the world of wealth, high-paying finance jobs offer a promising path. Finance is a dynamic field, intersecting business, economics, investments, and personal management. Whether your interests lie in managing corporate funds, guiding investments, or steering financial strategy, there are various lucrative roles you can aspire to. Here's your guide to understanding some of the top finance positions and how you can navigate your way into them.

Why Finance?

The finance sector is renowned for its potential for high earnings, but it's not just the income that attracts talent:

- Job Security: Financial services will always be in demand as long as businesses exist.

- Growth Opportunities: With financial regulations evolving and markets expanding globally, there are endless avenues for career progression.

- Influence: Finance professionals often have a direct impact on a company's or individual's financial health.

- Variety: From banking to insurance, hedge funds to private equity, the sector offers a broad spectrum of roles.

The Top Finance Jobs

1. Investment Banker

Investment bankers are the financial powerhouses that facilitate large and complex financial transactions. They:

- Help companies raise capital through IPOs, bonds, and other means.

- Advise on mergers and acquisitions (M&A).

- Manage wealth for high net worth individuals and institutions.

Typical earnings can reach into the high six figures or even seven figures, with bonuses based on performance and the deals closed.

2. Financial Analyst

Financial analysts study market trends, perform quantitative analysis, and provide investment recommendations:

- Buy-side analysts work for investment firms.

- Sell-side analysts work for brokerages or investment banks, supporting sales teams.

- Work with large datasets to predict financial outcomes.

Salaries can start at around 50,000 for beginners, but with experience and expertise, earnings can soar well past 100,000 annually.

3. Portfolio Manager

Portfolio managers are responsible for the growth and preservation of investment portfolios:

- They construct and manage investment portfolios to meet client goals.

- Monitor market movements and adjust investments accordingly.

- Engage in research and asset allocation strategies.

With significant responsibility comes significant compensation, often in the range of 100,000 to over 500,000, depending on the assets managed and performance.

4. Hedge Fund Manager

Hedge fund managers aim for high returns through various investment strategies, including speculative investments:

- Develop unique trading strategies that can outperform the market.

- Manage significant risk through diversification or hedging techniques.

Due to their potential for outsized returns, these managers can command bonuses, fund shares, or carried interest, which can push their earnings into the multimillion-dollar range.

5. Financial Advisor

Financial advisors help clients reach their financial goals through personalized planning and investment advice:

- Assist with retirement planning, estate planning, and wealth management.

- Advise on tax strategies and insurance needs.

Compensation can be through fees for service or commissions, with top advisors earning upwards of $150,000 a year.

6. Chief Financial Officer (CFO)

As a company’s top financial executive, a CFO’s role includes:

- Overseeing financial operations and strategy.

- Providing strategic direction and financial analysis.

- Managing financial risk.

Total compensation for CFOs at large companies can include base salaries in the high six figures, stock options, bonuses, and other perks, making the position highly lucrative.

7. Trader

Traders are the engine room of financial markets, executing buy and sell orders:

- Stock traders buy and sell stocks.

- Bond traders deal in fixed income securities.

- Forex traders manage currency exchanges.

- They operate within specific risk parameters set by firms.

Their income is often directly tied to their trading success, with top traders potentially earning millions.

Your Path to Wealth in Finance

Navigating into these high-paying roles typically requires:

Education

Most finance professionals have at least a bachelor’s degree in finance, economics, accounting, or a related field. Advanced degrees like MBAs or relevant certifications (CFA, CPA, CIMA, etc.) can be highly advantageous.

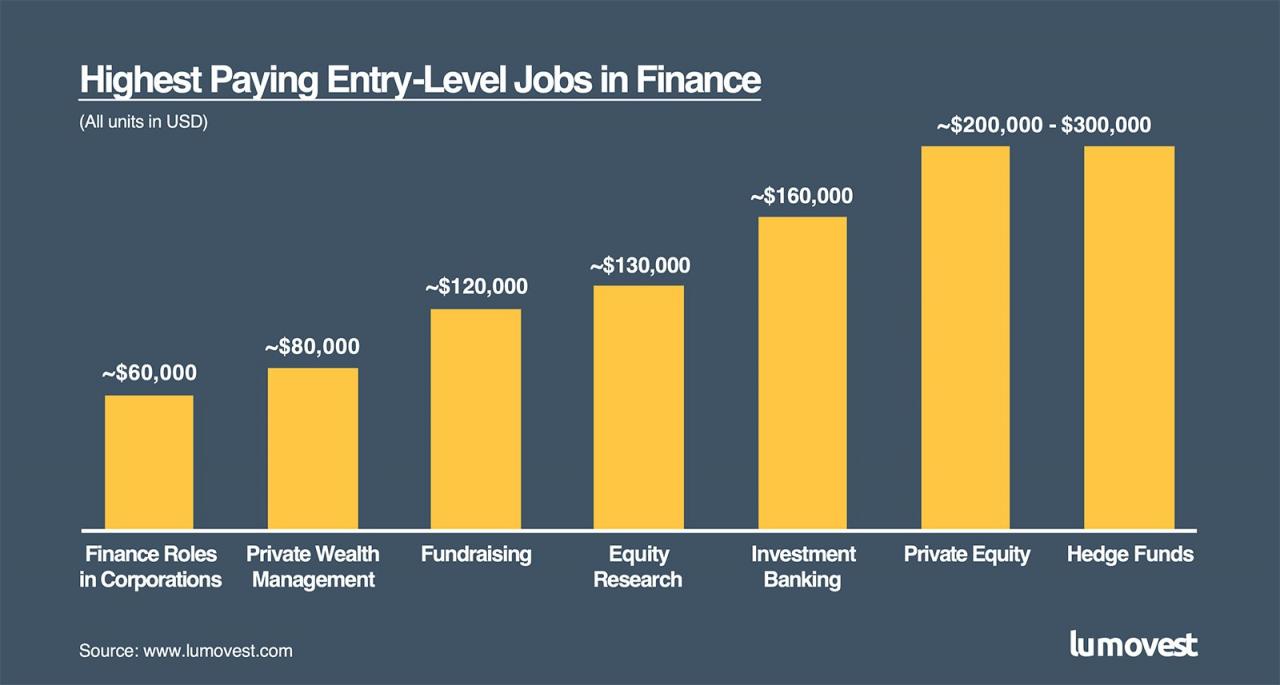

Internships and Entry-Level Roles

- Starting with internships at banks, investment firms, or financial institutions provides invaluable experience.

- Entry-level positions like analyst or associate roles are stepping stones.

Networking

The finance world thrives on connections. Attending industry events, joining finance-related organizations, and leveraging LinkedIn can open doors.

Skill Development

- Quantitative analysis for roles like Financial Analyst or Portfolio Manager.

- Soft skills like negotiation, communication, and sales for client-facing positions.

- Compliance knowledge for regulatory-focused roles.

Continuous Learning

The finance landscape changes with technology, regulations, and market conditions. Continuous learning through courses, workshops, and staying abreast of industry news is crucial.

💡 Note: Keeping abreast of financial news and trends through outlets like The Financial Times or Bloomberg can offer insights into market movements and strategic considerations for finance professionals.

Mentorship

Finding a mentor in finance can provide guidance, insider knowledge, and career development opportunities.

Risk and Reward

High finance is often associated with high stakes, where success comes with significant personal and professional challenges. Understanding risk management is critical in finance.

🧐 Note: Pursuing a finance career requires resilience, as you will face intense competition, high stress, and long hours, especially in initial years.

Having traversed the various high-paying finance roles and discussed the paths to obtain them, it's clear that the journey to wealth in finance demands not only educational and professional prowess but also personal tenacity and strategic networking. Each role offers unique challenges and rewards, with the potential for substantial financial gains. Through perseverance, continuous learning, and networking, you can carve out a prosperous career in the dynamic finance sector.

Do you need an MBA to get a high-paying finance job?

+

While an MBA can be advantageous for career advancement and higher pay, it’s not strictly necessary. Many finance professionals have succeeded with just a bachelor’s degree combined with experience, certifications, and skill development.

How can one break into finance without industry experience?

+

Start with internships, volunteer work, or entry-level positions in related fields like accounting or business analysis. Networking, gaining relevant certifications (like CFA), and showcasing your passion for finance through personal investments or online engagement can also help.

What are the typical career progression paths in finance?

+

The progression often starts from Analyst or Associate, moving to Vice President or Senior Associate, then Director or Managing Director, and potentially to CFO or similar executive roles. However, paths vary significantly between different segments of finance.