Car Insurance Guide: Save Money on Coverage in 2023

If you're navigating the process of obtaining or updating your car insurance, then this Car Insurance Guide: Save Money on Coverage in 2023 will equip you with the essential strategies to save on premiums without sacrificing coverage. Car insurance isn't just a legal necessity; it's a financial safeguard against potential accidents, theft, or damage. However, with costs rising and policy options becoming increasingly complex, understanding how to manage your insurance can seem daunting.

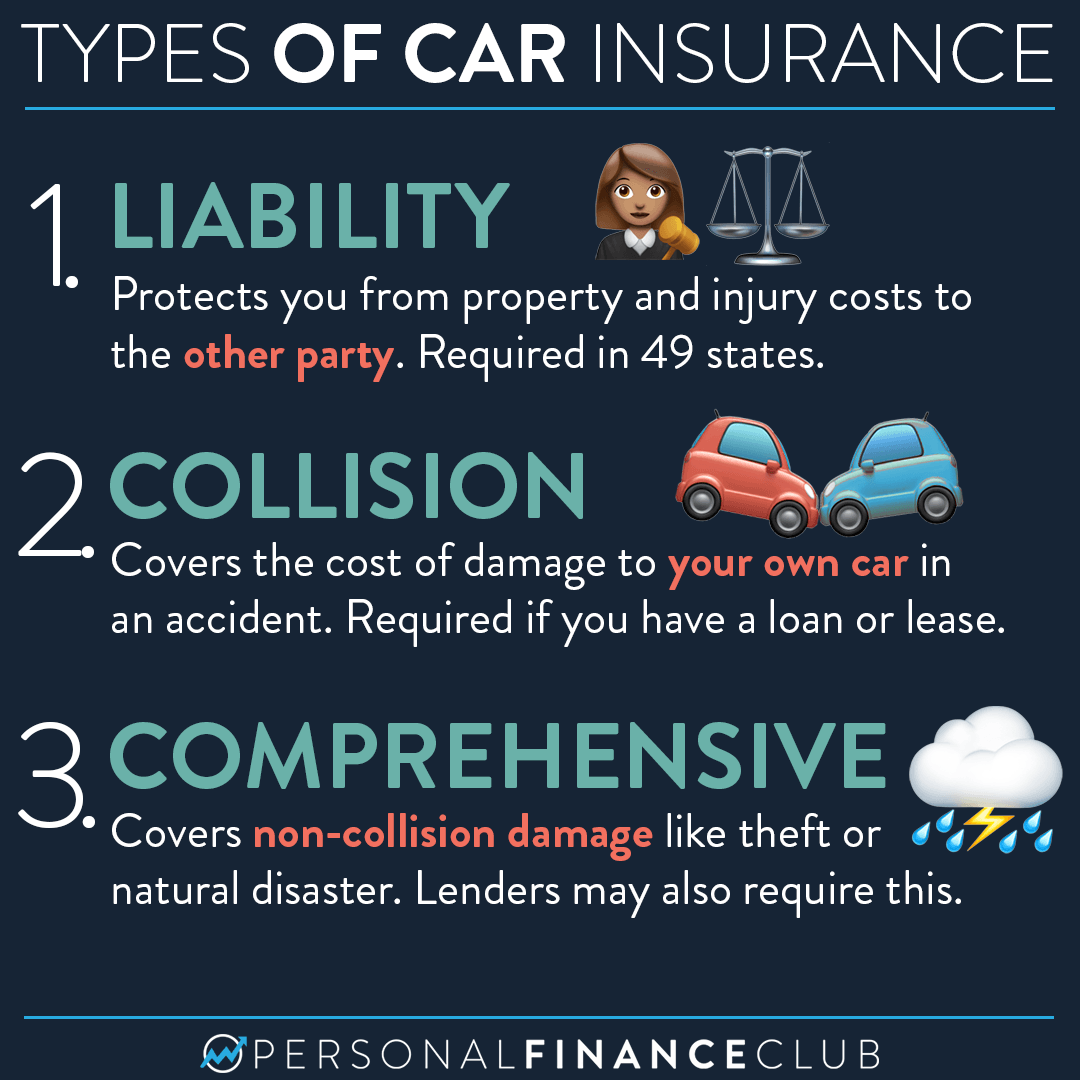

Understanding Car Insurance Basics

Before diving into savings strategies, it’s crucial to grasp what car insurance covers. Here’s a quick rundown:

- Liability Coverage: Protects you if you’re responsible for injury or property damage to others.

- Collision Coverage: Covers damages to your car resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Provides for non-collision-related damages like theft, natural disasters, or vandalism.

- Personal Injury Protection (PIP): Pays for medical expenses for you and your passengers post-accident.

- Uninsured/Underinsured Motorist Coverage: Covers accidents caused by other drivers with insufficient insurance.

💡 Note: Ensure you understand the minimum car insurance requirements in your state or country.

Strategies to Save on Car Insurance

Evaluate and Understand Your Needs

Start by assessing your needs:

- What is the value of your car? Consider dropping comprehensive coverage if your vehicle is worth less than $3,000.

- How much liability coverage do you need? Opt for higher limits to protect your assets in case of a significant claim.

- Do you really need extras like rental reimbursement or roadside assistance?

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Here’s why:

- Insurers have different risk assessment models, which might result in varying premiums for similar coverage.

- Some insurers offer special discounts or bundle options you might not know about without comparison.

- Using online comparison tools can make this process easier.

Consider Raising Your Deductible

Choosing a higher deductible can lower your premium:

- A higher deductible means you pay more out of pocket if you file a claim.

- But it significantly reduces your monthly insurance cost, potentially saving you money over time if you rarely make claims.

⚠️ Note: Only increase your deductible if you can comfortably afford to pay it in case of an accident.

Bundling Insurance Policies

Combining auto insurance with home, renters, or life insurance often qualifies you for multi-policy discounts:

- Insurers appreciate loyalty and offer bundled discounts as an incentive.

- Bundling can simplify policy management with a single insurer.

Explore Discounts

Ask your insurer about available discounts:

| Discount Type | What It’s For |

|---|---|

| Safe Driver Discount | Reward for clean driving record. |

| Low Mileage Discount | Driving less than the average annually. |

| Good Student Discount | Students maintaining a high GPA. |

| Defensive Driving Course | Completion of recognized courses. |

| Paid in Full | Paying your premium in advance. |

| Usage-Based Insurance | Monitoring your driving habits to adjust rates. |

Maintain a Good Credit Score

In states where credit history affects car insurance rates, here’s how to keep it in check:

- Pay your bills on time to avoid negative marks on your credit report.

- Keep credit card balances low.

- Regularly check your credit report for errors and disputes if necessary.

💡 Note: Regularly reviewing your credit score can benefit various aspects of your financial life, including lower insurance rates.

Reconsider Your Coverage as Your Life Changes

As circumstances change, reassess your insurance:

- Retirement might mean less driving, allowing you to lower your coverage or switch to pay-per-mile insurance.

- Moving to an area with lower crime rates might reduce comprehensive coverage needs.

- Purchasing a new or more expensive car may require more comprehensive coverage.

Car Insurance Myths Debunked

Here are some common myths about car insurance:

- Myth: “Red cars cost more to insure” - The color of your car has no bearing on the insurance rate.

- Myth: “Insurance only protects you from other drivers” - It also covers you if you’re at fault.

- Myth: “Comprehensive coverage is the same as collision” - They cover different types of damages.

Understanding these myths helps in making informed decisions about your insurance needs.

To sum it up, navigating the complexities of car insurance can be a daunting task, but with the right strategies, you can effectively manage your coverage while saving money. By understanding the basics, evaluating your needs, comparing quotes, raising your deductible, bundling policies, exploring discounts, maintaining a good credit score, and regularly reassessing your coverage, you can ensure you're adequately protected without overpaying. Remember, the key to saving on car insurance in 2023 is not just about finding the cheapest policy but about optimizing your coverage to match your current lifestyle and financial situation. Tailor your insurance to your life, keep abreast of changes in the industry, and always look for ways to reduce your costs while keeping your protection intact.

What is the difference between comprehensive and collision coverage?

+

Comprehensive coverage covers losses from events like theft, weather damage, or vandalism, whereas collision coverage pays for damages from your vehicle colliding with another car or object.

How often should I shop for new car insurance?

+

It’s a good idea to shop for new insurance quotes annually or before your current policy renews. However, life changes like marriage, buying a new car, or moving could also warrant a review.

Can my credit score affect my insurance premium?

+

Yes, in many places, your credit score can influence your insurance rates. Insurers often view a good credit score as an indicator of responsible financial behavior, potentially leading to lower premiums.

Are there any situations where I should consider dropping certain coverages?

+Yes, if your vehicle’s value is low (under $3,000), consider dropping comprehensive or collision coverage as the cost might exceed the potential payout. Also, if you rarely drive, you might explore usage-based insurance or low-mileage discounts.

How can I ensure I’m getting all the discounts I’m eligible for?

+Ask your insurance provider for a comprehensive list of discounts or speak directly with your agent. Remember to provide information like your driving record, student status, or any safety features in your car.