Finance Your Dream Car with Our Easy Calculator

Acquiring a new car is one of life's major financial decisions, akin to purchasing a home or investing in education. The joy of owning a vehicle that matches your lifestyle and needs often comes with the considerable weight of financial planning. This is where our Easy Car Loan Calculator steps in, simplifying the once daunting task of understanding your automotive financial commitments. Whether you're a first-time buyer or looking to upgrade, this tool offers a seamless path to financial clarity, helping you drive away with not just a new car, but peace of mind.

Why Use Our Car Loan Calculator?

Calculating the total cost of car ownership can be intricate, with factors like interest rates, loan terms, down payments, and taxes influencing the final amount. Here’s why our calculator is an indispensable ally:

- Simplifies Complex Calculations: By inputting a few key details, you get a clear overview of your loan’s financial implications.

- Helps You Budget: Understanding your monthly payments and total interest paid can aid in budgeting more effectively for the car.

- Offers Comparison: You can tweak variables like down payments or loan terms to find a balance between immediate affordability and long-term savings.

- Transparent: The calculator provides a transparent view of how each change affects your loan, empowering you with knowledge.

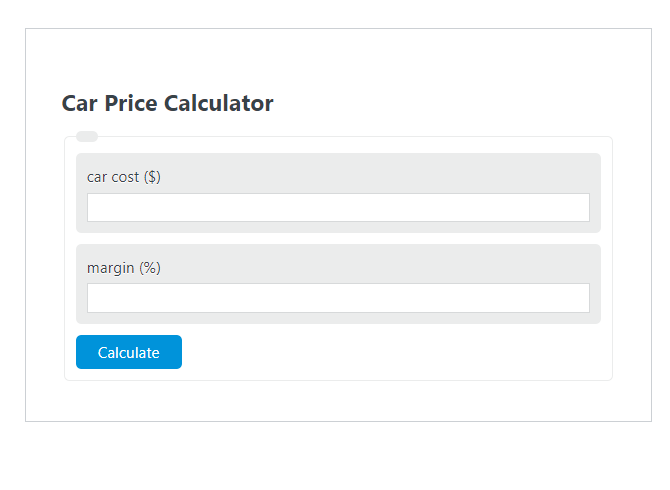

How to Use the Car Loan Calculator?

Using our car loan calculator is as easy as selecting the car model you’re eyeing. Here’s a step-by-step guide:

- Vehicle Price: Enter the total cost of the car, including any additional features or packages you’re interested in.

- Down Payment: Specify your down payment, if applicable. This reduces the amount you finance, potentially lowering monthly payments.

- Loan Term: Choose how long you’d like to finance the vehicle, typically from 24 to 72 months. Remember, longer terms often mean lower monthly payments but more interest paid over time.

- Interest Rate: Input the rate provided by your lender, which can vary based on credit score, vehicle type, or current market rates.

- Click Calculate: With these details, the calculator provides:

- Monthly Payment: The amount you’ll need to pay each month.

- Total Interest: The cumulative interest you’ll pay over the loan term.

- Loan Amortization: A schedule of how your loan balance decreases with each payment.

Understanding Car Loan Terms

Before you dive into the numbers, here are some terms you should be familiar with:

| Term | Definition |

|---|---|

| Principal | The actual amount borrowed or the remaining balance of the loan. |

| Interest Rate | The cost of borrowing money, usually expressed as an annual percentage of the loan amount. |

| Amortization | The process of gradually paying off the loan through regular payments, part of which covers interest while reducing the principal. |

| Loan Term | The length of time over which you will repay the loan, typically expressed in months. |

| APR | Annual Percentage Rate; this includes the interest rate plus any additional fees or costs associated with the loan, providing a more comprehensive view of the loan’s cost. |

| Residual Value | The estimated value of the car at the end of the loan term, which can affect lease payments or buyout options. |

🔍 Note: The interest rate and loan term significantly impact your monthly payments and total interest paid. Always negotiate for the best rate and consider shorter terms if your monthly budget allows, to save on interest over time.

Maximizing the Benefits of Car Loan Calculators

Beyond just determining affordability, here are strategic ways to leverage the calculator:

- Compare Different Loans: Experiment with various lenders’ rates and terms to find the most favorable offer.

- Understand Monthly Impact: Assess how car payments will fit into your monthly budget, allowing for unexpected expenses or changes in income.

- Explore Early Payoffs: Some calculators show how extra payments can shorten loan duration or lower overall interest.

🌟 Note: Calculators often come with tools to calculate insurance and maintenance costs, giving a holistic view of vehicle ownership expenses.

Considerations Before Finalizing Your Car Loan

Even with a handy tool like our loan calculator, here are additional elements to consider:

- Credit Score: Your credit rating significantly affects the interest rate you’ll receive, so it’s worth reviewing and improving it beforehand.

- Vehicle Type: New cars often qualify for better loan terms than used ones; however, new cars depreciate rapidly.

- Loan-to-Value Ratio (LTV): Lenders look at this when setting loan terms. A higher down payment might lower this ratio, potentially reducing interest rates.

- Future Value: Consider how much the car will be worth at the end of the loan term, especially if you plan on trading in or selling the vehicle.

As you approach the conclusion of your automotive purchase journey, reflecting on the insights gained from our car loan calculator is essential. This journey began with the excitement of choosing a dream car and evolved into a quest for financial clarity. Armed with this tool, you've navigated through complex financial calculations, turning the abstract into the tangible. Now, you possess the confidence to make informed decisions, understanding how different variables like loan terms, down payments, and interest rates intertwine to shape your car ownership experience. This knowledge is your ally, ensuring that when you finally drive away in your new car, you do so with a clear understanding of your financial commitments. Whether it's about monthly budgeting, exploring loan options, or anticipating future vehicle value, the calculator has provided you with the keys to financial freedom in your car ownership journey.

What’s the minimum down payment required for a car loan?

+

While some lenders might allow for zero down payment, a common minimum down payment for a car loan is between 10% to 20% of the car’s purchase price. This not only reduces the loan amount but can also lead to better loan terms and lower interest rates.

Can I use the car loan calculator to compare different lenders?

+

Yes, by adjusting the interest rates and other loan terms in the calculator, you can simulate offers from different lenders to find the best deal for your circumstances.

How does my credit score affect my car loan interest rate?

+

Your credit score is a major determinant of your interest rate. A higher credit score often results in a lower interest rate due to the reduced risk for lenders. Conversely, a lower score might lead to higher interest rates or even loan denial.