7 Essential Tips for Mastering Personal Finance

In today's fast-paced world, understanding how to manage your finances effectively is more important than ever. Mastering personal finance not only helps you live a financially secure life but also offers peace of mind in knowing that your future is well planned. Whether you're looking to save for retirement, invest for the future, or simply pay your bills on time, these seven essential tips will guide you towards financial freedom.

1. Establish Clear Financial Goals

Before you can effectively manage your personal finance, you need a clear understanding of what you’re aiming for. Financial goals can range from short-term objectives like saving for a vacation, to long-term aspirations like buying a home or preparing for retirement.

- Short-term goals: These are objectives you plan to achieve within a year or less. Examples include saving for a new gadget, an emergency fund, or a holiday trip.

- Medium-term goals: Goals that you aim to achieve in 1-5 years might include buying a car, paying off credit card debt, or setting up a wedding fund.

- Long-term goals: These can extend from 5 to 30 years or more, such as retirement savings, buying a home, or funding your children’s education.

💡 Note: Setting SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound) can make your financial objectives more tangible and reachable.

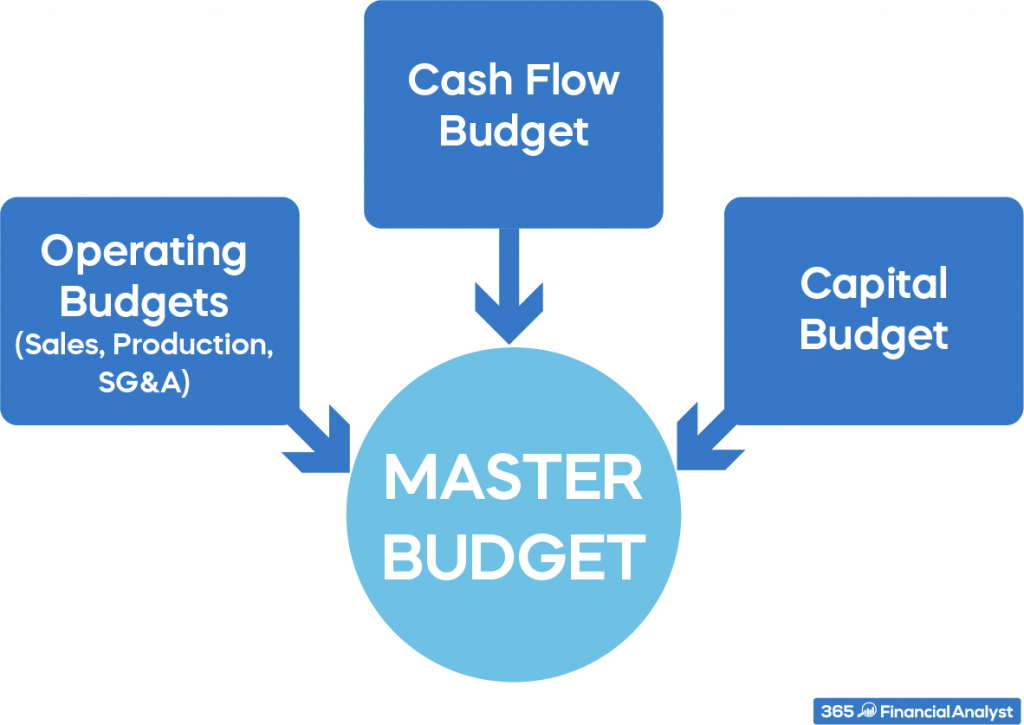

2. Develop a Comprehensive Budget

The cornerstone of personal finance is a well-structured budget. Here’s how you can develop one:

- Track your income: List all your income sources, including your salary, freelance work, or passive income like investments.

- Document your expenses: Categorize your spending into fixed (e.g., rent, utilities) and variable expenses (e.g., entertainment, dining out).

- Allocate funds to goals: After covering essential expenses, direct funds towards your financial goals.

- Adjust as necessary: Life changes, so should your budget. Regularly review and tweak it to align with your current situation.

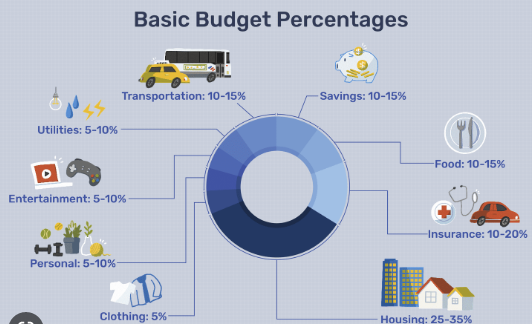

| Category | Example | Suggested Allocation |

|---|---|---|

| Housing | Rent/Mortgage | 30% |

| Utilities | Electricity, Water, Internet | 10% |

| Food | Groceries, Eating Out | 15% |

| Savings and Investments | Emergency Fund, Retirement | 20% |

| Transportation | Car Payments, Public Transport | 10% |

| Discretionary | Entertainment, Clothing | 15% |

3. Build an Emergency Fund

An emergency fund acts as a financial buffer for unexpected expenses like medical emergencies, job loss, or urgent home repairs. Here are some strategies:

- Start small: Even $500 can be a significant help in times of need.

- Automate savings: Have a portion of your income automatically transferred to this fund each month.

- Use windfalls: Tax refunds or bonuses can quickly boost your emergency fund.

4. Manage Debt Efficiently

Debt, if not managed properly, can spiral out of control. Here’s how to keep it in check:

- Understand your debt: Know the interest rates, minimum payments, and total balances of your debts.

- Prioritize high-interest debts: These cost you the most over time, so focus on clearing them first.

- Consider debt consolidation: If you have multiple high-interest debts, consolidating them might lower your interest rate.

- Stick to a plan: Whether it’s the avalanche or snowball method, choose a strategy and stick with it.

5. Invest for Growth

Investment isn’t just for the wealthy; it’s a tool for wealth creation. Here’s how you can start:

- Start with education: Understand basic investment vehicles like stocks, bonds, mutual funds, and ETFs.

- Assess your risk tolerance: Your investment choices should reflect how much risk you’re willing to take.

- Diversify: Spread your investments to mitigate risk.

- Invest regularly: Use dollar-cost averaging to invest a fixed amount at regular intervals.

- Re-evaluate periodically: Your investment strategy should evolve as your financial situation and goals change.

6. Plan for Retirement

Retirement might seem far away, but planning for it early is crucial:

- Understand your retirement needs: Estimate how much you’ll need based on your lifestyle expectations.

- Maximize retirement accounts: Utilize 401(k), IRAs, or other pension plans with tax advantages.

- Invest in growth-oriented assets: While young, you can afford to take more risk for potentially higher returns.

- Adjust as you age: Shift towards more conservative investments as you get closer to retirement age.

7. Continuously Educate Yourself

Personal finance is an ever-evolving field. Here’s how you can stay informed:

- Read books, blogs, and listen to podcasts on financial management.

- Attend workshops or seminars on personal finance.

- Engage with online communities or forums to share and gain insights.

- Keep up with financial news and policy changes that might affect your strategies.

In summary, personal finance mastery is about discipline, strategic planning, and continuous learning. By setting clear financial goals, creating a budget, managing debt, investing for growth, preparing for retirement, and staying educated, you pave the way for a secure and prosperous future. Remember, the journey to financial independence is not a sprint but a marathon, where each step taken with knowledge and foresight can lead to long-term success.

How often should I update my budget?

+

It’s beneficial to review your budget monthly to adjust for any changes in income or expenses, or at least quarterly if monthly reviews are not feasible.

What’s the best way to start saving for an emergency fund?

+

Begin by setting a small, achievable goal like saving $500. Automate savings from your income each month, and consider using any unexpected windfalls like tax refunds or bonuses to boost your fund.

Can I invest even if I have debt?

+

Yes, but prioritize your high-interest debt first. Once you’ve got a handle on your debts, you can begin investing, potentially balancing debt payments with small, regular investments.