5 Ways Debt Financing Fuels Business Growth

Debt financing has long been a crucial avenue for businesses seeking to expand, innovate, and solidify their market position. Whether it's through loans, bonds, or lines of credit, leveraging debt can provide the necessary funds to fuel business growth. In this post, we'll explore five compelling ways debt financing can be a strategic tool for businesses aiming to scale up, highlighting how it not only supports expansion but also offers various financial and strategic advantages.

1. Capital for Expansion

One of the primary benefits of debt financing is access to immediate capital for expansion. This can manifest in several ways:

- Physical Expansion: Acquiring new premises or expanding existing facilities.

- Product or Service Diversification: Introducing new products or services to meet market demand.

- Market Penetration: Entering new markets or increasing market share in existing ones.

📌 Note: Careful financial planning is essential to ensure that the revenue from expansion covers the cost of debt and interest.

2. Boosting Working Capital

Beyond physical expansion, debt financing can significantly boost a company’s working capital:

- Inventory Management: Enabling businesses to purchase larger quantities or invest in premium inventory.

- Cash Flow Management: Smoothing out cash flow fluctuations through lines of credit or short-term loans.

- Operational Efficiency: Investing in technology or training to increase productivity and reduce costs.

3. Leveraging for Strategic Acquisitions

Debt can be used to fund strategic acquisitions:

- Competitive Advantage: Acquiring competitors to increase market share or eliminate competition.

- Vertical Integration: Owning supply chain segments to control costs and quality.

- Horizontal Expansion: Expanding product or service lines through acquisition.

4. Reducing Tax Liability

Debt financing can offer significant tax benefits:

- Interest Expense Deduction: The interest paid on loans is often tax-deductible, reducing overall tax liability.

- Increased Cash Flow: By reducing the tax burden, more cash is available for reinvestment or paying down the debt faster.

5. Enhancing Credit Profile

Regularly servicing debt can improve a company’s creditworthiness:

- Building Credit History: Timely debt repayment establishes a positive credit history.

- Access to Better Rates: A good credit rating can lead to lower interest rates on future borrowing.

- Strengthening Financial Standing: Enhanced creditworthiness opens doors to more financial opportunities.

As we reflect on the ways debt financing fuels business growth, it's clear that when used strategically, debt can be a powerful lever for achieving business objectives. Companies need to weigh the costs against potential benefits, ensuring that the chosen financing strategy aligns with long-term goals. From providing capital for expansion to offering tax advantages, debt financing serves as a multifaceted tool that, when managed wisely, can propel a business towards its envisioned success.

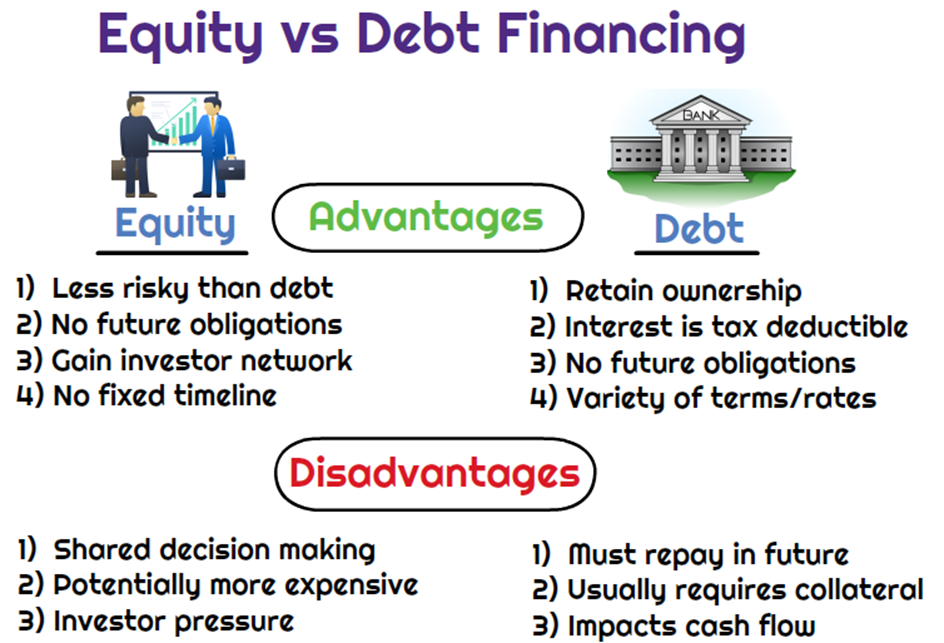

What’s the difference between debt and equity financing?

+

Debt financing involves borrowing money that must be paid back with interest, whereas equity financing involves selling a portion of business ownership in exchange for funds. Debt financing retains full ownership but has a repayment obligation; equity financing dilutes ownership but usually doesn’t require repayment.

How do I know if debt financing is right for my business?

+

To determine if debt financing suits your business, consider your ability to service the debt through existing cash flows, your credit profile, and whether the investment funded by debt will generate sufficient returns to cover the debt service cost. Also, evaluate the impact on your financial structure and growth strategy.

Can debt financing negatively impact a business?

+

Yes, if not managed properly, debt can lead to cash flow problems, reduce financial flexibility, and potentially result in bankruptcy if the business cannot meet its repayment obligations. High debt levels can also scare off future investors or lenders due to perceived financial risk.