5 Easy Finance Tips for Beginners

Starting your journey in managing finances can feel overwhelming, especially with the myriad of options and jargon you encounter. Whether you're just out of school, starting your first job, or simply looking to take control of your financial future, knowing where to begin is crucial. Here are five simple finance tips that can set you on the path to financial security:

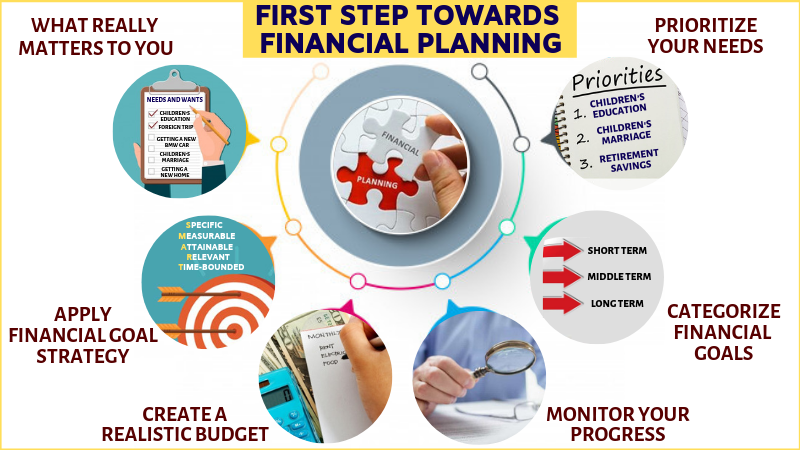

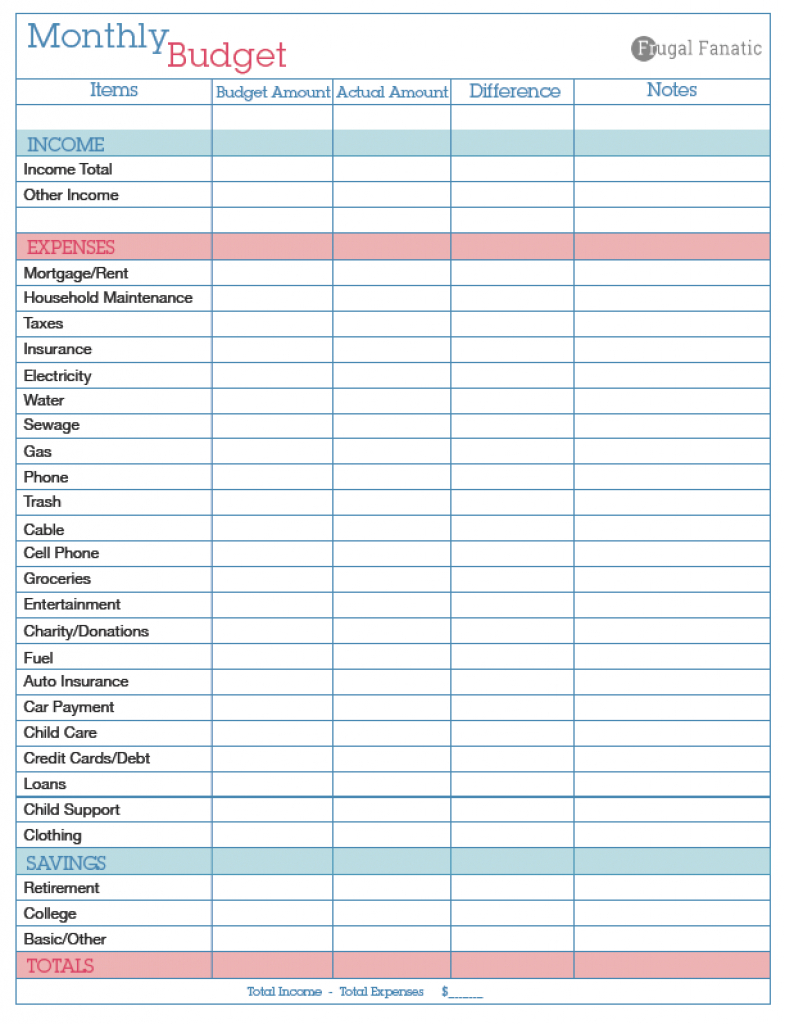

1. Create a Budget

The cornerstone of personal finance is understanding where your money comes from and where it goes. Creating a budget helps you:

- Track your income.

- Monitor your spending.

- Plan for savings and investments.

Here's how to get started:

- List all sources of income - salaries, freelance work, investments, etc.

- Document your expenses by categorizing them (e.g., food, entertainment, utilities, rent/mortgage, etc.)

- Allocate funds for each category. Be realistic and make sure you cover essentials first.

- Set aside money for savings and investments after accounting for your expenses.

- Review and adjust your budget monthly or when there are significant changes in your financial situation.

💡 Note: A budget isn't set in stone; it’s meant to adapt as your life changes.

2. Start an Emergency Fund

Life is unpredictable, and having an emergency fund can provide peace of mind and financial stability during unexpected events:

- Aim for an amount that covers 3-6 months of living expenses.

- Keep this fund in a readily accessible savings account or similar low-risk, liquid investment.

Start by:

- Automating a small portion of your salary to go into an emergency fund each month.

- Depositing any unexpected income (like tax refunds or bonuses) into this fund.

💡 Note: An emergency fund is not for regular expenses or discretionary spending; it's for true emergencies like sudden job loss or urgent repairs.

3. Pay Yourself First

The “pay yourself first” strategy involves saving or investing a portion of your income before spending on anything else. Here’s how it works:

- Decide on a percentage of your income to save or invest each month.

- Transfer this amount into a savings or investment account right after receiving your income.

- Live off what remains.

Benefits include:

- Ensuring you always save something, even if it's small.

- Building wealth over time through compound interest.

💡 Note: This approach forces discipline in managing your finances by prioritizing your future financial health.

4. Understand Debt and Credit

Here are key points to manage debt and credit wisely:

- Understand Interest Rates: Higher rates mean you pay more over time for the same amount of debt. Prioritize paying off high-interest debts.

- Credit Score: Your score affects loan rates, insurance costs, and even rental agreements. Pay bills on time, use less than 30% of your available credit, and check your credit report for errors.

- Debt Repayment Strategies: Consider methods like the debt snowball or avalanche where you pay off smaller balances or highest interest rates first, respectively.

💡 Note: Credit is not inherently bad, but how you manage it can greatly affect your financial health.

5. Start Investing

Investing doesn’t require being a financial wizard; here are some beginner steps:

- Learn the basics of stocks, bonds, and funds.

- Consider opening an investment account (e.g., a 401(k) if available through your employer or an IRA).

- Begin with low-cost index funds or ETFs for diversification with minimal risk.

- Use dollar-cost averaging to spread out your investment over time, reducing the risk of market timing.

To ensure you're set for success:

- Stay informed about market trends but don’t react to daily fluctuations.

- Focus on long-term goals rather than short-term gains.

💡 Note: Investing is for growing wealth over the long haul, not for quick wins or getting rich overnight.

Wrapping up, embarking on your financial journey is both empowering and exciting. By implementing a budget, securing an emergency fund, prioritizing savings, understanding debt, and venturing into investments, you're laying the groundwork for lasting financial independence. Each tip offers practical steps you can start today, and as your confidence and knowledge grow, so too will your ability to manage and increase your wealth. The key is to remain committed, be adaptable to changes in your life, and maintain a long-term perspective. With these finance tips for beginners, you're well on your way to financial freedom.

How much should I save for my emergency fund?

+

Ideally, an emergency fund should cover 3 to 6 months’ worth of living expenses. However, this can vary based on your job stability, family size, and other personal circumstances.

What’s the best way to start investing as a beginner?

+

Begin with low-cost index funds or ETFs to spread your investment across various sectors, reducing risk. You can also explore retirement accounts like a 401(k) or IRA for tax benefits.

Can I still save if I have debts?

+

Yes, you should. Prioritize high-interest debts but don’t ignore saving altogether. Start with an emergency fund, even if it’s small, and continue saving while paying off debts.

How often should I review my budget?

+

Reviewing your budget monthly helps adapt to any changes in income or expenses. However, significant changes in your financial situation, like a job change or unexpected expenses, should prompt an immediate review.

What if I struggle to stick to my budget?

+

Look for areas to cut back or find ways to increase your income. Automate savings and consider using budgeting apps to track your spending more effortlessly. Remember, the goal is progress, not perfection.