5 Essential Tips for Car Finance Calculators

When you're in the market for a new car, understanding how much you'll need to pay monthly is crucial. Car finance calculators can demystify this process, allowing you to plan your budget effectively. Here are 5 essential tips for using car finance calculators to make your purchase decision more informed and financially sound:

1. Understand the Types of Loans

Car finance calculators often cater to various loan types. Here’s what you need to know:

- Simple Interest Loans: Interest is calculated on the outstanding loan balance. This type reduces the interest cost over time.

- Pre-computed Interest Loans: The interest is calculated at the start for the entire loan term. This means your interest payment stays the same regardless of how fast you pay off the loan.

- Residual Value Loans: Here, you pay for the depreciation of the car’s value over the loan term, leaving a ‘balloon payment’ at the end. This can make monthly payments more manageable but requires careful planning.

💡 Note: Understanding your loan type can significantly impact your monthly budget and total loan cost.

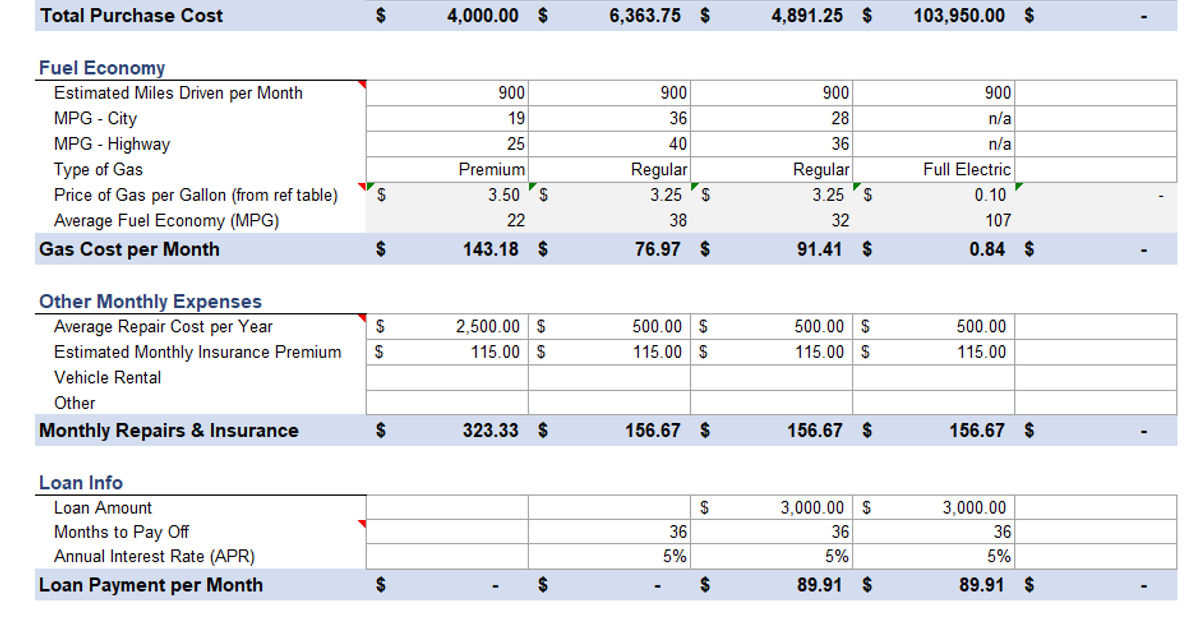

2. Check for All-Inclusive Calculations

Not all calculators include every possible cost. Look for calculators that consider:

- Interest Rates: Some might offer just a basic rate, missing out on compounding.

- Loan Fees: These might not be automatically included.

- Taxes: Sales tax or luxury tax might alter your monthly payment significantly.

- Insurance: Gap insurance or comprehensive coverage adds to your monthly cost.

| Component | Included in Basic Calculator? | Impact on Monthly Payment |

|---|---|---|

| Interest Rate | Yes | Direct and Proportional |

| Loan Fees | No | Additional Costs |

| Taxes | Maybe | Increases Payment |

| Insurance | No | Adds to Monthly Total |

📝 Note: Ensure your calculator includes all fees for accurate budgeting.

3. Experiment with Different Scenarios

Use the calculator to:

- Adjust the loan term to see how it affects your monthly payments and total interest.

- Change the down payment to understand how it impacts the overall loan.

- Consider different interest rates or promotional offers from lenders.

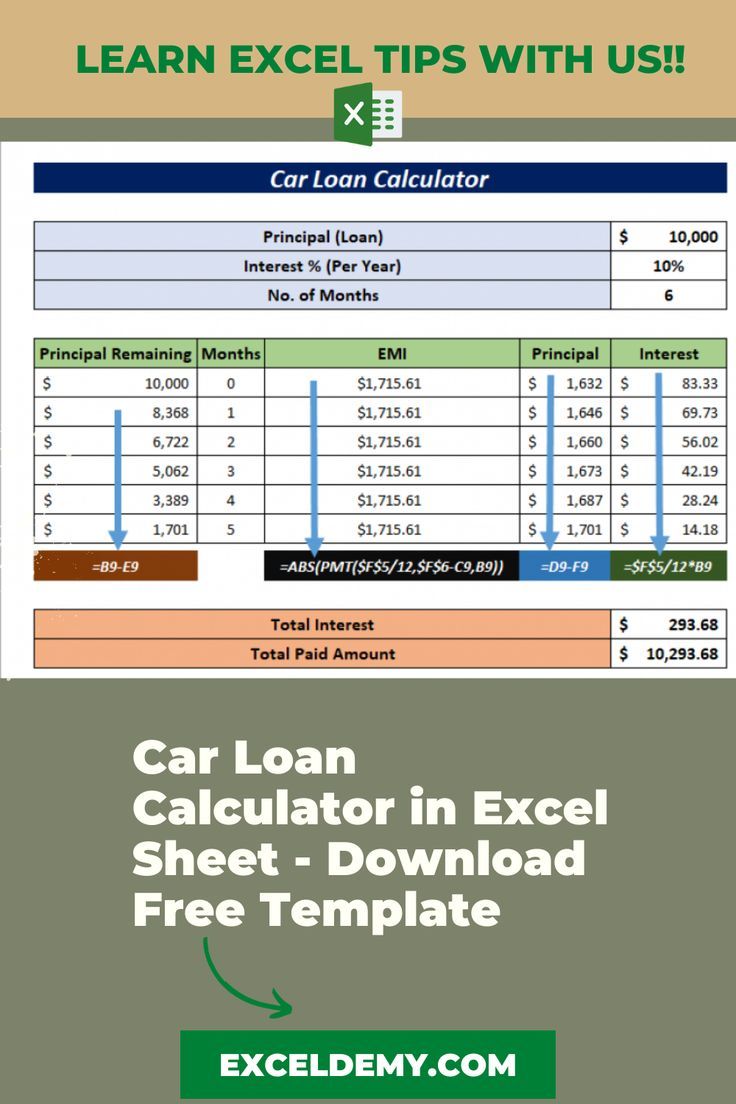

4. Compare with Amortization Schedules

An amortization schedule breaks down how your payments are distributed over time:

- Shows the balance paid down monthly.

- Reveals the proportion of interest versus principal in each payment.

- Helps visualize how quickly or slowly you’re building equity in your vehicle.

5. Factor in Your Financial Health

Before finalizing any loan, consider:

- Credit Score: A higher score can secure you better rates.

- Debt-to-Income Ratio: Lower ratios might get you better loan terms.

- Down Payment: Higher down payments might lower interest rates or extend promotional offers.

Understanding car finance calculators can transform your car buying experience into a more financially informed one. By exploring loan types, ensuring all costs are considered, running various scenarios, comparing with amortization schedules, and assessing your financial health, you're not just buying a car but making a strategic financial decision.

What makes a car loan calculation inaccurate?

+

Car loan calculations can be inaccurate if they omit important variables like fees, taxes, or not accounting for compounding interest rates.

How does a lower down payment affect my car loan?

+

A lower down payment increases the loan amount, leading to higher monthly payments and more interest paid over the life of the loan.

What are the benefits of a residual value loan?

+

Residual value loans offer lower monthly payments but require a balloon payment at the end, which can be paid off, refinanced, or used to buy the car outright.

Can I negotiate car finance terms?

+

Yes, you can negotiate terms such as interest rates, loan fees, or down payment requirements with lenders or dealerships.

Why should I compare different loan calculators?

+

Comparing calculators helps you understand different calculation methods, ensuring you’re aware of all costs and can make an informed decision.