5 Ways to Manage Finances with Your Close Brother

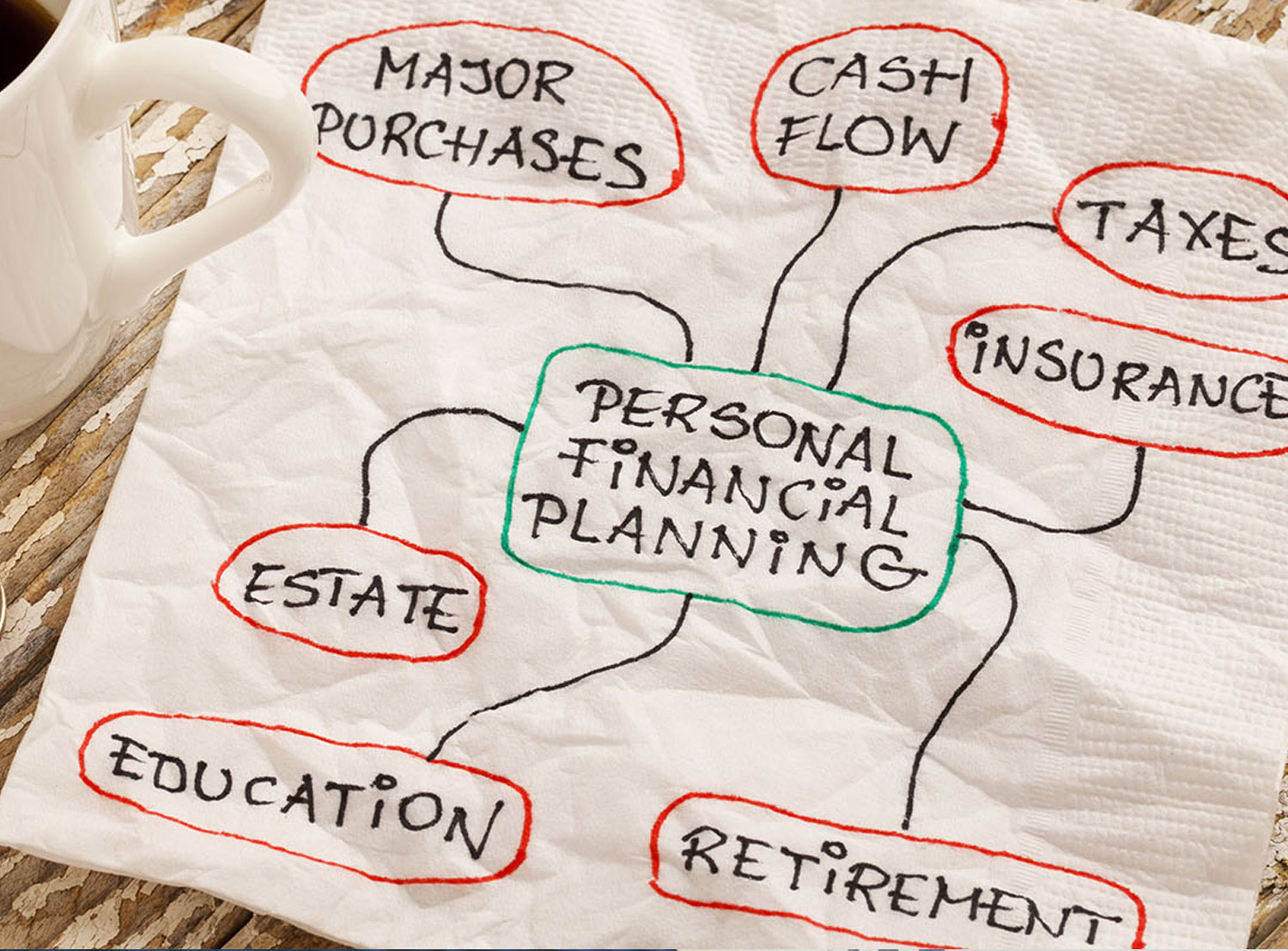

An Introduction to Managing Finances Together

When it comes to managing finances with a close brother, the dynamics can be both rewarding and challenging. Whether you’re planning a business venture, investing in property, or simply looking to better manage shared household finances, there are several strategies that can ensure both parties benefit and maintain a harmonious relationship.

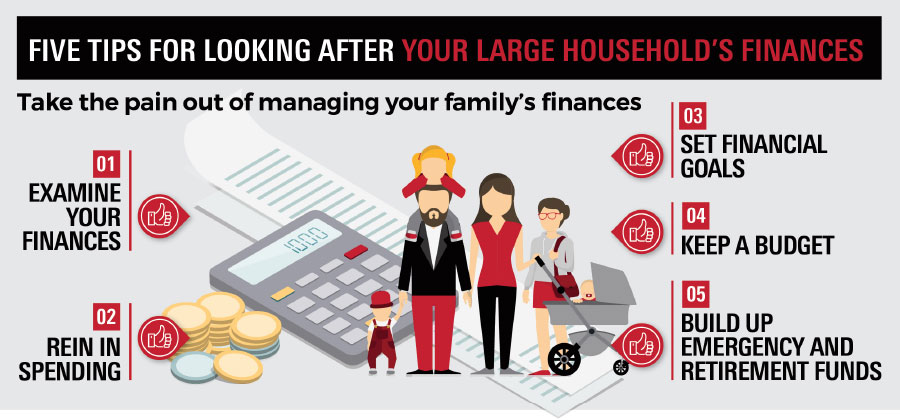

1. Establish Clear Financial Goals

Before any financial partnership can thrive, it’s crucial to set clear, mutual goals:

- Define Objectives: Are you saving for a common purchase like a car, planning an investment, or setting up an emergency fund?

- Set Timelines: Determine short-term, medium-term, and long-term goals with specific deadlines.

- Prioritize: Not all goals are created equal. Rank them based on importance and immediacy.

💡 Note: Discussing financial goals openly helps prevent misunderstandings and fosters trust.

2. Open a Joint Account

A joint account can streamline your financial management:

- Accessibility: Both parties have access, making it easier to handle shared expenses.

- Transparency: Every transaction is visible, promoting accountability.

- Contribution Agreement: Decide how each person will contribute based on income or another fair metric.

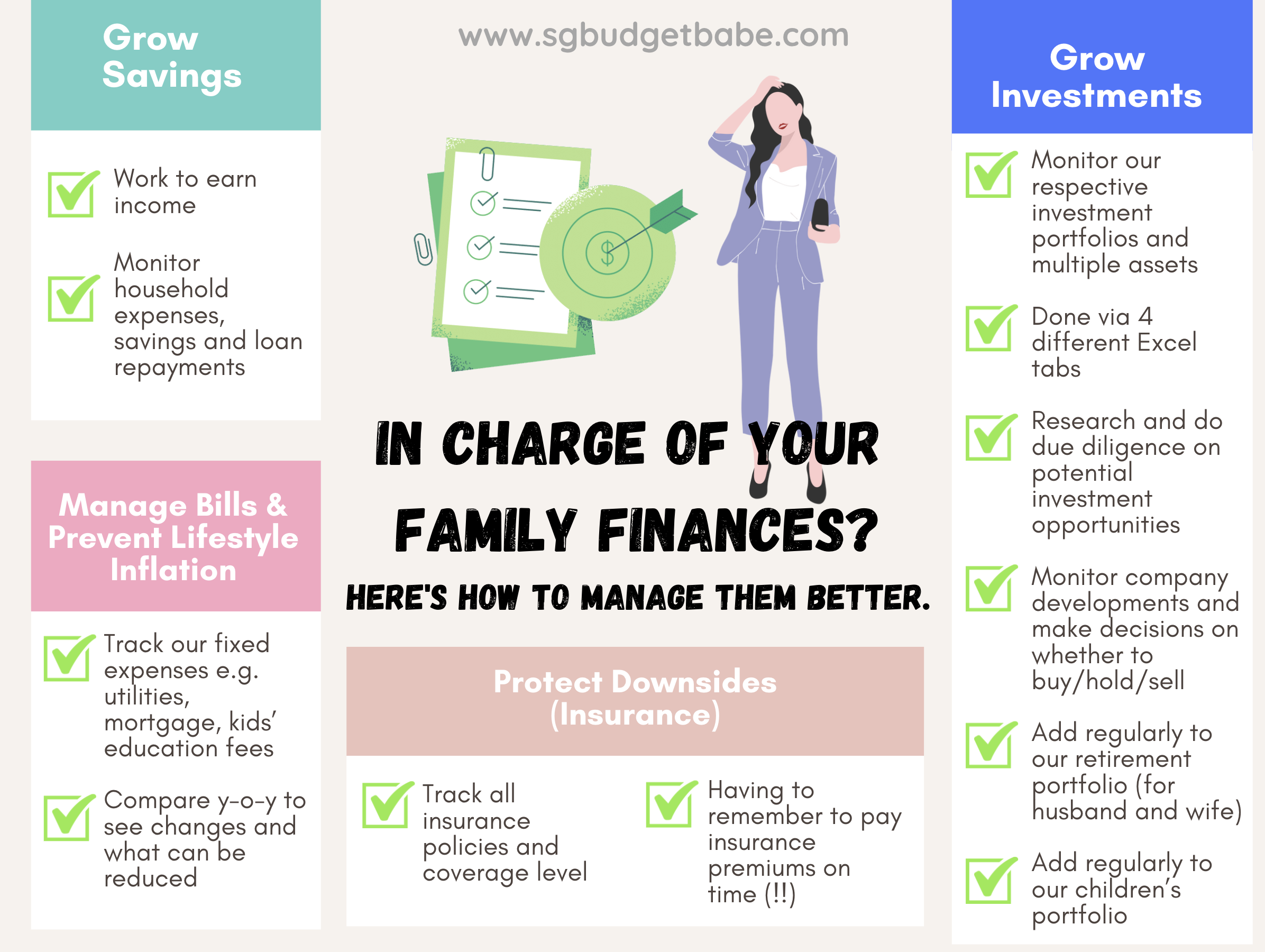

3. Investment and Savings Strategy

Collaborative investment and saving can amplify your financial growth:

| Investment Type | Benefits |

|---|---|

| Stocks | High potential returns |

| Real Estate | Steady rental income, potential property value increase |

| Savings Accounts | Low risk, high liquidity |

| Bonds | Stable but lower returns than stocks |

- Diversify: Spread investments to mitigate risk.

- Regular Review: Continuously reassess investment performance and market conditions.

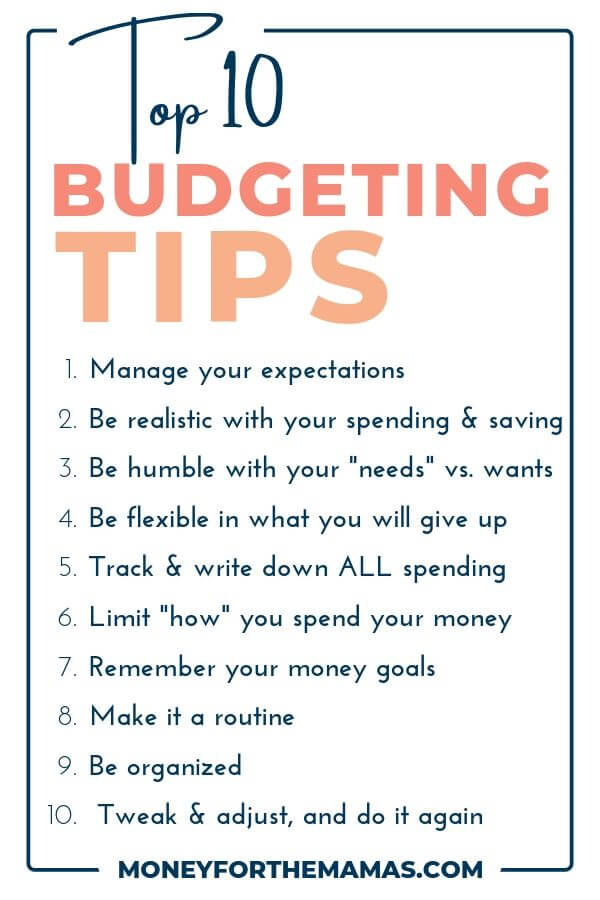

4. Communication is Key

Effective communication can prevent financial conflicts:

- Regular Meetings: Schedule time to discuss finances, goals, and any concerns.

- Open Dialog: Encourage an environment where discussing money is not taboo.

- Professional Mediation: If necessary, involve a financial advisor to keep discussions on track.

⚠️ Note: Miscommunication can lead to resentment, so clear and honest communication is essential.

5. Legal and Tax Considerations

Financial partnerships have legal and tax implications:

- Legal Agreements: Draft a partnership agreement or a will to clarify rights, responsibilities, and asset distribution.

- Tax Planning: Understand the tax implications of shared finances, like joint ownership of property or investments.

- Professional Advice: Consult with an accountant or a tax advisor for complex financial setups.

Ultimately, managing finances with a close brother, while potentially complex, offers numerous benefits when approached with planning, transparency, and mutual respect. It can enhance the bond between siblings, provide financial security, and open doors to opportunities not possible individually. As you navigate this journey together, remember that the cornerstone of successful financial co-management is a blend of trust, clear communication, and strategic planning. This not only helps in achieving your shared financial objectives but also in preserving and strengthening your familial ties.

What are the benefits of managing finances with a brother?

+

Collaborating on financial matters with a brother can provide emotional and financial support, better decision-making due to diverse perspectives, and increased investment opportunities. It also fosters a deeper relationship and shared goals.

How should we handle disagreements?

+

Disagreements are natural. Establish a mechanism for resolving conflicts, such as regular meetings, professional mediation, or even pre-agreed arbitration methods to keep the partnership intact.

Can we dissolve our financial partnership if necessary?

+

Yes, but it should be done thoughtfully. Legal agreements can outline the terms of dissolution, ensuring that the process is as smooth and fair as possible.