5 Insider Secrets to Close Brothers Finance Success

Introduction

Close Brothers Finance, a name synonymous with excellence in the financial industry, has established a reputation for delivering bespoke financial solutions to businesses and individuals. Their success in the competitive finance landscape can be attributed to a mix of innovative strategies, customer-focused services, and an unwavering commitment to ethical practices. Let’s delve into the 5 insider secrets that have propelled Close Brothers Finance to its current heights.

1. Tailored Financial Solutions

At the core of Close Brothers Finance's strategy is the development of financial products that are not just off-the-shelf solutions but are tailored to meet the unique needs of their clients. Here's how they achieve this:

- Personalized Loan Structures: Whether it’s asset finance, invoice finance, or any other financial product, Close Brothers Finance works closely with clients to structure loans that fit their cash flow and financial planning.

- Risk Assessment: By understanding each client’s risk profile, they can tailor solutions that minimize risk while maximizing financial flexibility.

- Flexibility in Repayment: They offer flexible repayment schedules which can be adapted to seasonal business fluctuations or personal financial events.

Notes on Tailored Solutions:

💡 Note: The secret to success lies in listening to what the client needs rather than what the bank wants to sell.

2. Relationship Management

The second secret behind Close Brothers Finance's success is its unparalleled approach to relationship management:

- Direct Communication: They foster direct lines of communication between relationship managers and clients, ensuring that there’s always someone who understands your business's needs.

- Proactive Engagement: Regular check-ins, updates on market trends, and personal support during financial challenges help maintain a strong relationship.

- Long-term Vision: Instead of short-term gains, Close Brothers Finance focuses on nurturing long-term client relationships for sustainable growth.

Notes on Relationship Management:

👥 Note: Building trust through consistent communication and understanding your client's business is key to lasting relationships.

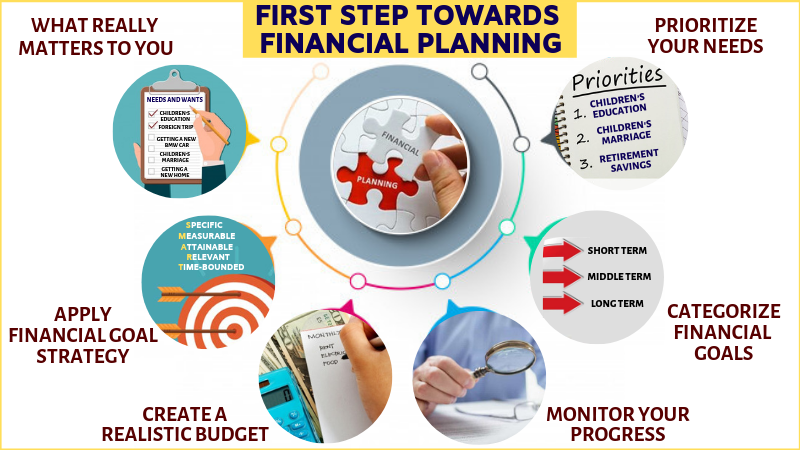

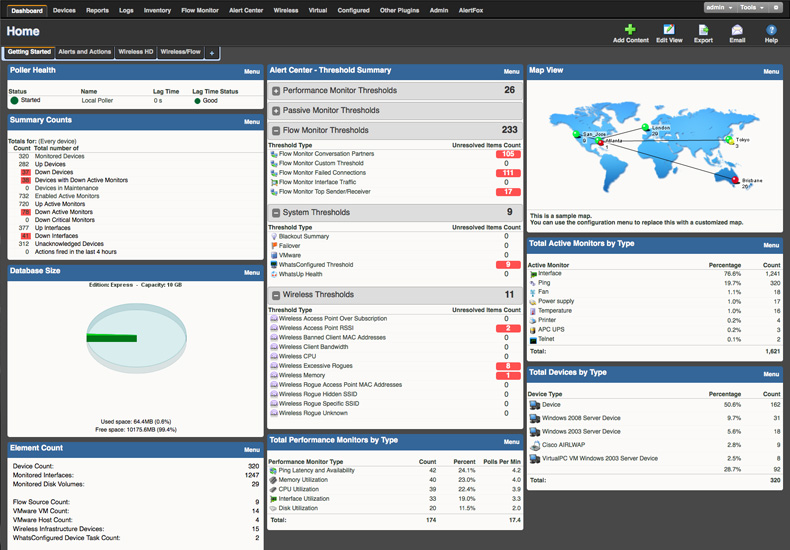

3. Technology Integration

Close Brothers Finance has embraced technology to streamline processes, enhance customer experience, and stay ahead in the market:

- Digital Solutions: They offer digital platforms for application, monitoring, and managing finance solutions, reducing the time and effort for clients.

- Data Analytics: Use of advanced analytics to provide insights into market trends, risk assessment, and client behavior.

- Innovation: They invest in fintech innovations to improve service delivery and stay competitive.

Notes on Technology Integration:

🖥️ Note: Technology should enhance human interaction, not replace it; it's about making your client's life easier.

4. Ethical Practices and Compliance

At Close Brothers Finance, ethical practices and compliance aren't just buzzwords; they are integral to their corporate culture:

- Transparency: Clients are fully aware of terms, conditions, and costs associated with financial products.

- Regulatory Adherence: They adhere strictly to financial regulations, ensuring all practices are above board.

- Community Responsibility: Their commitment to social and environmental responsibility fosters a positive corporate image.

Notes on Ethics and Compliance:

⚖️ Note: Doing the right thing not only builds trust but also prevents legal issues that could harm reputation and business.

5. Continuous Improvement and Innovation

Close Brothers Finance doesn't rest on its laurels. Here's how they keep improving:

- Feedback Loops: They have an effective feedback mechanism to gather insights from clients and employees.

- Employee Development: Continuous training programs ensure that staff are up-to-date with the latest financial knowledge and practices.

- Adaptive Strategies: They adjust their strategies based on market changes, technological advancements, and client needs.

Notes on Continuous Improvement:

📈 Note: Innovation should be a continuous process, not a one-off event, for sustained growth and relevance.

In summary, the journey of Close Brothers Finance to becoming a pillar of trust and innovation in finance involves tailored solutions, strong relationship management, embracing technology, ethical conduct, and a relentless drive towards improvement. By following these insider secrets, businesses and individuals can not only enhance their financial strategies but also ensure long-term success in a dynamic economic environment.

What makes Close Brothers Finance different from other financial institutions?

+

Close Brothers Finance stands out for its bespoke financial solutions, strong emphasis on relationship management, integration of cutting-edge technology, ethical practices, and a commitment to continuous improvement and innovation.

How does Close Brothers Finance tailor financial solutions?

+

They tailor solutions by understanding each client’s unique needs through direct communication, risk assessment, and by providing flexibility in repayment structures that match the client’s financial cycles.

Can businesses benefit from the technology integration at Close Brothers Finance?

+

Yes, the integration of technology provides businesses with digital platforms for efficient loan management, real-time analytics, and innovative financing options tailored to modern business needs.

What ethical practices does Close Brothers Finance focus on?

+

Close Brothers Finance emphasizes transparency in financial dealings, strict adherence to regulations, and a commitment to social and environmental responsibility.