5 Ways City University Students Can Manage Finances

Balancing academics, social life, and financial responsibility as a City University student can be a daunting task. Many students are not just dealing with tuition costs, but also everyday living expenses, books, transport, and more. Here, we explore five effective ways city university students can manage their finances, ensuring they can enjoy their student life without undue financial stress.

1. Create a Student Budget

The cornerstone of financial management is budgeting. Here’s how you can do it:

- Track Income: List all sources of income, including loans, grants, part-time job earnings, and any contributions from family.

- List Expenses: Categorize expenses into essentials like rent, utilities, food, transport, and discretionary spending like entertainment and clothing.

- Budget Software: Use tools like Mint, YNAB (You Need A Budget), or simple Excel sheets to keep track of your finances.

💡 Note: Remember to review your budget regularly and adjust for any changes in your financial situation.

2. Utilize Student Discounts and Benefits

City universities often come with a variety of student benefits designed to ease your financial load:

- Student Discounts: From travel passes to restaurant deals, make sure to always carry your student ID to take advantage of discounts.

- Bank Offers: Banks offer student accounts with perks like interest-free overdrafts, cashback, or savings accounts with competitive rates.

- Scholarships and Bursaries: Keep an eye out for scholarships, bursaries, and grants which can significantly reduce your financial burden.

3. Smart Accommodation Choices

Your choice of accommodation can make or break your financial health:

- On-Campus vs. Off-Campus: Weigh the pros and cons of living on or off-campus. On-campus might provide more amenities but could be more expensive than shared housing.

- Shared Housing: Splitting rent, utilities, and other expenses can drastically cut down costs. Look into house-sharing apps or university notice boards.

- Internships with Housing: Some internships offer accommodation, providing a dual benefit of housing and work experience.

🚪 Note: Always check the fine print before signing any rental agreement to avoid unforeseen costs.

4. Part-Time Work and Internships

Balancing work with studies is crucial:

- On-Campus Jobs: Universities often have jobs available for students that can fit around your class schedule.

- Freelancing: If your skills allow, freelance work in writing, design, or tech can be lucrative and flexible.

- Internships: Not only do they provide experience, but internships can also come with stipends or even part-time pay.

5. Financial Literacy and Counseling

Understanding money management can save you from future financial woes:

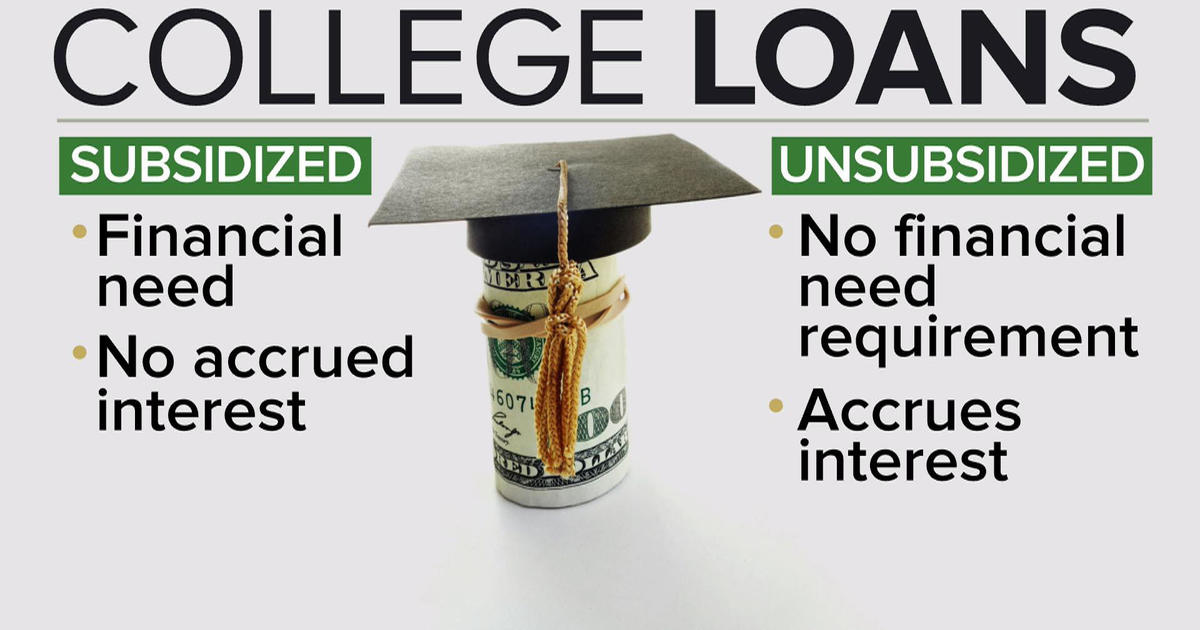

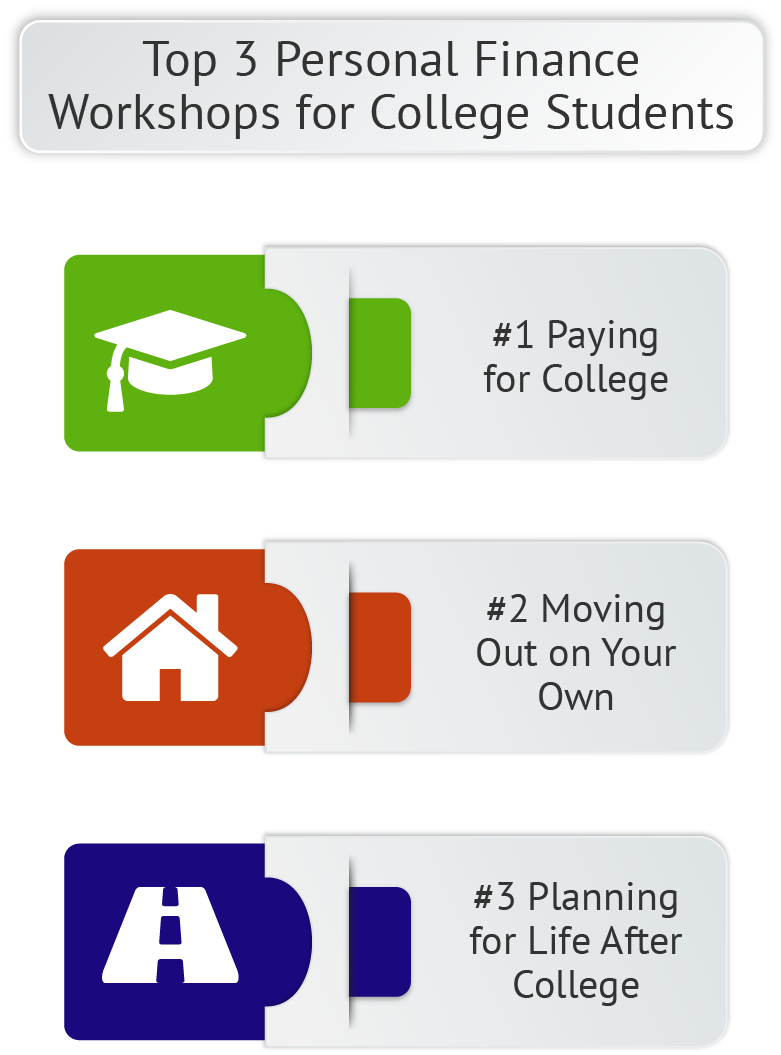

- Workshops: Many universities offer free financial literacy workshops. Attend them to learn about credit, saving, and investment.

- Counseling Services: Use the student services or financial aid offices for personalized advice or to deal with unexpected financial issues.

Effective financial management as a city university student involves a mix of smart budgeting, leveraging student discounts, choosing the right accommodation, balancing part-time work, and enhancing financial literacy. By adopting these strategies, students can ensure their time at university is financially sustainable, allowing for a rich, memorable academic and social experience.

How can I find student discounts?

+

Many universities offer a student discount card or have a list of partners where you can get discounts. Check your university’s website or student services for details.

Is it better to live on-campus or off-campus?

+

It depends on your preferences for convenience, independence, and community. On-campus living might be more expensive but is often close to classes and includes utilities. Off-campus might be cheaper but involves commute time and other considerations like internet and parking.

What should I do if I’m struggling financially?

+

Seek out financial counseling at your university, explore emergency aid funds, or consider part-time work or additional scholarships. It’s also beneficial to talk to a financial aid advisor for personalized advice.

Can I save money while at university?

+

Absolutely! By creating a budget, minimizing unnecessary expenses, and using student discounts wisely, you can not only manage your finances but also save some money for future needs.

What are the benefits of an internship with housing?

+

Internships offering housing reduce your living costs significantly and provide you with real-world work experience, enhancing your CV, while also saving on rent.