Best Vehicle Finance Options: Make the Smart Choice

When it comes to purchasing a vehicle, whether it's a car, motorcycle, or even a boat, finding the right financing option is crucial. This decision impacts not just the monthly payments you'll make, but also the overall cost of your purchase, your financial health, and your future. In this comprehensive guide, we'll explore the best vehicle finance options available today, helping you make a smart choice that aligns with your financial goals and lifestyle needs.

Understanding Vehicle Financing

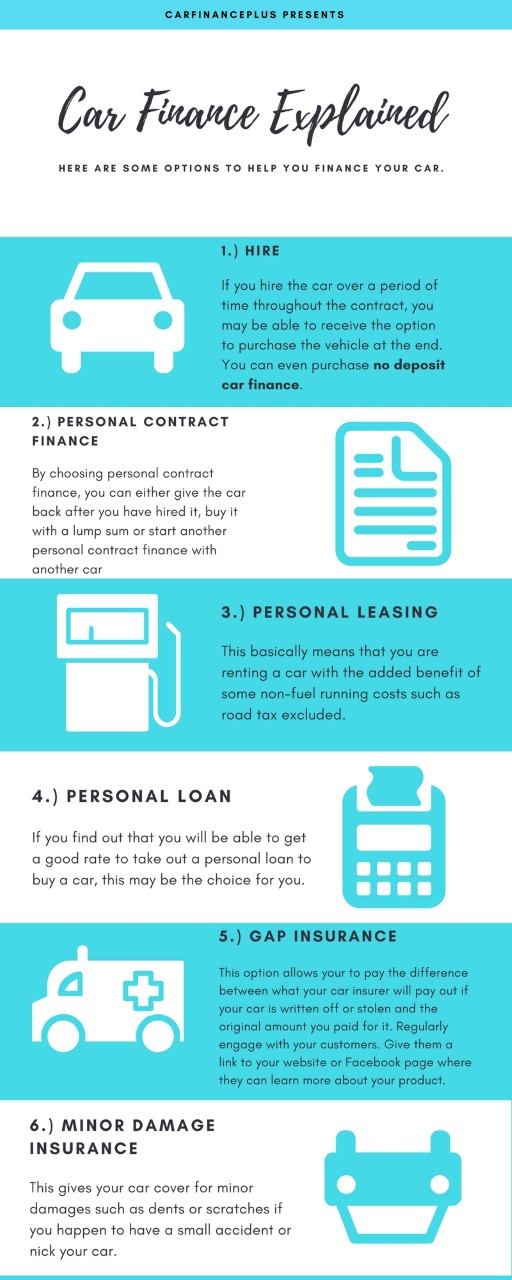

Vehicle financing isn’t just about getting a loan to buy a car; it’s about understanding different options, their advantages, and how they fit into your financial strategy:

- Traditional Auto Loans: Borrow money from a bank, credit union, or financing institution specifically for buying a vehicle.

- Dealer Financing: Finance directly through the dealership where you purchase the vehicle.

- Lease: You pay for the depreciation of the vehicle over a set term rather than the total value.

- Personal Loans: General-purpose loans that can be used for vehicle purchase but come with different terms.

Benefits of Each Financing Method

Traditional Auto Loans

Traditional auto loans offer several advantages:

- You own the vehicle outright once the loan is paid off.

- Fixed interest rates provide predictability in payments.

- Often lower interest rates for those with good credit.

Dealer Financing

Choosing to finance through a dealership can have its perks:

- Convenience; the dealership handles everything from purchase to finance.

- Sometimes offer promotions or rebates that make the vehicle cheaper upfront.

- Easier if you’re purchasing a new or a manufacturer’s certified pre-owned vehicle.

Leasing

Leasing provides different benefits:

- Lower monthly payments since you’re paying for the car’s depreciation.

- Opportunity to drive new vehicles more frequently without the long-term commitment.

- No worries about selling or trading in the vehicle at the end of the lease term.

Personal Loans

Personal loans can be used for car financing:

- Flexibility in how you use the funds; not limited to buying a vehicle.

- Unsecured nature, potentially benefiting those who want to avoid lien on their vehicle.

- Can be a good option for buying from private sellers or when traditional financing isn’t available.

| Financing Type | Interest Rate | Ownership | Monthly Payments |

|---|---|---|---|

| Traditional Auto Loan | 2%-7% | Full ownership at end of term | Moderate to High |

| Dealer Financing | 1%-8% | Full ownership at end of term | Can be competitive or promotional |

| Lease | N/A (residual value) | Return or purchase at end | Lower |

| Personal Loan | 5%-36% | Full ownership at end of term | Variable based on credit |

💡 Note: The above interest rates are approximate and can vary widely based on credit score, lender policies, and economic conditions.

What to Consider Before Choosing

When considering how to finance your vehicle, keep in mind:

- Total Cost: Look beyond monthly payments to the total interest paid over the life of the loan or lease.

- Down Payment: A higher down payment reduces the amount financed and thus the interest you’ll pay.

- Length of Ownership: If you like to change vehicles frequently, leasing might be better. If you want to keep a car for a long time, buying might make more sense.

- Maintenance and Mileage: With leasing, there are often mileage restrictions and wear-and-tear conditions you must follow.

- Future Financial Goals: How this finance option fits into your broader financial plan.

Tips for Getting the Best Deal

- Shop Around: Compare offers from different lenders or use pre-approved loans for negotiating power with dealers.

- Pre-approval for Loans: Get pre-approved to understand what interest rates and terms you qualify for.

- Consider Your Credit Score: Improve your credit score before applying for financing to secure lower interest rates.

- Negotiate Everything: The interest rate, down payment, and even the price of the vehicle are often negotiable.

- Read the Fine Print: Understand all terms, fees, and penalties associated with your finance agreement.

Choosing how to finance your vehicle is more than just picking the option with the lowest monthly payment. It involves a balance between immediate costs, long-term financial strategy, and your personal lifestyle preferences. Each financing method has its pros and cons, so it's crucial to assess which aligns best with your financial situation, driving habits, and future plans.

What is a good credit score for getting the best auto loan rates?

+

Generally, a credit score of 700 or above is considered good for securing competitive auto loan rates, with the best rates often reserved for scores above 740.

Can I finance a car with bad credit?

+

Yes, there are options like subprime loans or buy here pay here dealerships, though they typically come with higher interest rates and stricter terms.

How do I know if leasing or buying is better for me?

+

If you prefer driving newer cars and don’t mind having limitations on mileage and modifications, leasing might be beneficial. If you plan on keeping the car for many years, buying is usually more cost-effective over time.