Explore HP Finance Options for Cars Near You

Choosing to finance your car through HP (Hire Purchase) offers a straightforward pathway to car ownership. This financing method allows you to drive your dream car with manageable monthly payments. In this comprehensive guide, we will delve into the intricacies of HP finance, exploring how it works, its benefits, potential drawbacks, and the application process to make your car buying experience smooth and informed.

What is HP Finance?

Hire Purchase, commonly known as HP, is a credit agreement where an individual hires a car from a finance provider, usually a bank or credit union, with the intention of purchasing it at the end of the term. Here’s how it operates:

- Down Payment: You’ll start by making a down payment, which can be anywhere from 10% to 30% of the car’s purchase price.

- Monthly Instalments: Over the term of the HP agreement, you’ll make fixed monthly payments that include principal and interest.

- Ownership: Upon fulfilling the agreement terms and paying the final instalment, you officially own the vehicle.

Advantages of HP Finance

Opting for HP finance comes with several advantages:

- Fixed Monthly Payments: Simplifies budgeting as you know exactly how much you’ll pay each month.

- Ownership: At the end of the term, the car is yours without needing to negotiate a new purchase.

- Lower Initial Costs: Compared to buying outright, HP finance can reduce your initial financial outlay.

- Vehicle Equity: You can build equity in your vehicle as you pay it off.

🔍 Note: Be mindful that despite owning the car at the end of the term, HP finance might not be the most cost-effective option compared to a personal loan or other financing methods.

Disadvantages of HP Finance

However, it’s important to consider some potential drawbacks:

- Interest Costs: You’ll incur interest over the life of the loan, increasing the overall cost of the car.

- Early Termination Fees: Should you decide to end the agreement early, there could be significant fees.

- Car Value Depreciation: You could end up paying more than the car’s depreciated value if you don’t keep up with payments.

- Limited Customization: Since the finance company technically owns the vehicle until the last payment, there are restrictions on modifications.

How to Apply for HP Finance

The process to secure HP finance for your car includes several steps:

- Choose Your Car: Decide on the make, model, and specifications that fit your needs and budget.

- Get a Quote: Reach out to finance providers for a quote. Consider multiple sources for the best rates.

- Application Submission: Fill out an application form with personal and financial information.

- Down Payment: Upon approval, prepare to make the initial down payment.

- Agreement Signing: Review and sign the HP finance agreement carefully.

👁 Note: Always read the fine print to understand your obligations regarding insurance, maintenance, and penalties for early termination or defaults.

| Steps | Actions |

|---|---|

| 1 | Choose the Car |

| 2 | Request Quotes |

| 3 | Submit Application |

| 4 | Down Payment |

| 5 | Sign Agreement |

Choosing the Right Dealer or Finance Company

When choosing an HP finance provider, consider the following:

- Reputation: Research the company’s track record for customer satisfaction.

- Interest Rates: Compare rates from different providers to find the most competitive.

- Terms and Flexibility: Look for favorable terms, like lower down payments or flexible payment schedules.

- Customer Service: Good support can make all the difference in your financing experience.

The Future of HP Finance

HP finance is evolving to meet the changing needs of consumers:

- Online Applications: Streamlined digital processes for faster and more convenient applications.

- Electric and Hybrid Vehicles: Specialized finance options to accommodate the rising popularity of eco-friendly cars.

- Regulation and Consumer Protection: Increased scrutiny from regulators to ensure fair practices in the finance industry.

Having considered the various aspects of HP finance, it's clear that it offers a viable route to car ownership with fixed payments, clear ownership transfer, and a structured path to equity. However, it's essential to weigh the interest costs, potential early termination fees, and the impact of vehicle depreciation against the benefits. Ensuring you choose a reputable finance provider with competitive rates and favorable terms is also crucial. By understanding the process, considering all your options, and making an informed decision, you can make the most of HP finance to drive away in your dream car with confidence.

What happens if I miss an HP finance payment?

+

If you miss a payment, you may incur late fees, and repeated misses could result in the finance company repossessing the car. It’s important to communicate with your finance provider if you’re facing financial difficulties.

Can I trade in my car before paying off my HP finance?

+

Yes, you can. However, you’ll need to settle any outstanding finance before you can trade in or sell the vehicle. Some finance providers allow for part exchange, where the equity in your current car can be used towards your next purchase.

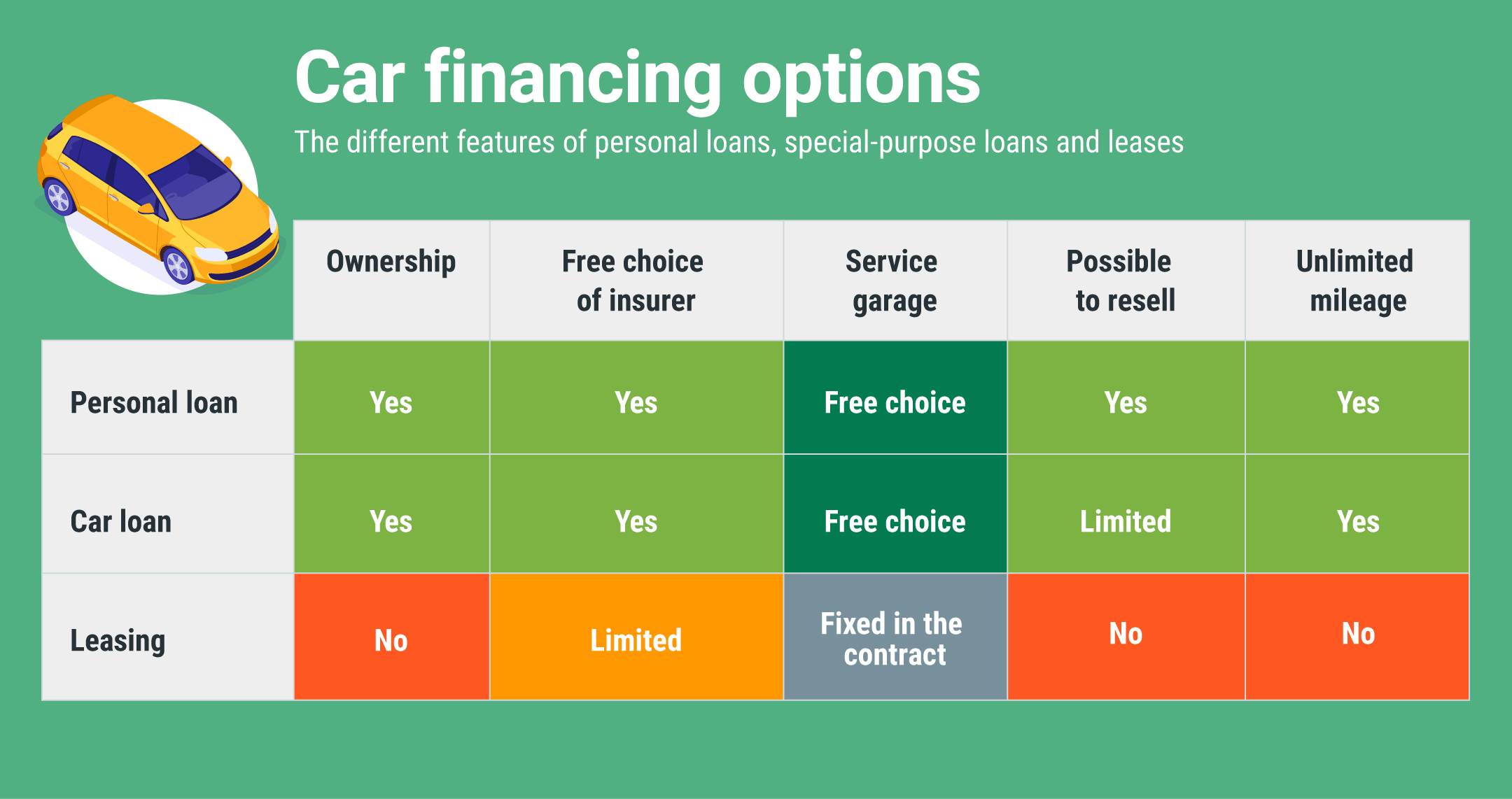

How does HP finance compare to a personal car loan?

+

HP finance provides fixed monthly payments and an end-of-term ownership guarantee. Personal loans might offer lower interest rates and more flexibility in terms but require you to own the car outright before applying for finance, and there might not be a guarantee of ownership upon payoff.