Drive Your Dream Car with Finance in Ipswich

Embarking on the journey to own your dream car can be both exhilarating and daunting, especially when it comes to the financial aspect of such a significant investment. In Ipswich, the thriving car market, coupled with a variety of financing options, makes the dream more attainable than one might think. Whether you're a first-time buyer or looking to upgrade to a luxury vehicle, understanding how to finance your car purchase in Ipswich is crucial. This guide will walk you through the steps and considerations to help you drive off in the car you've always wanted.

Understanding Car Financing in Ipswich

Car financing in Ipswich, like anywhere else, revolves around two main avenues: dealership financing and bank loans. Here's a breakdown:

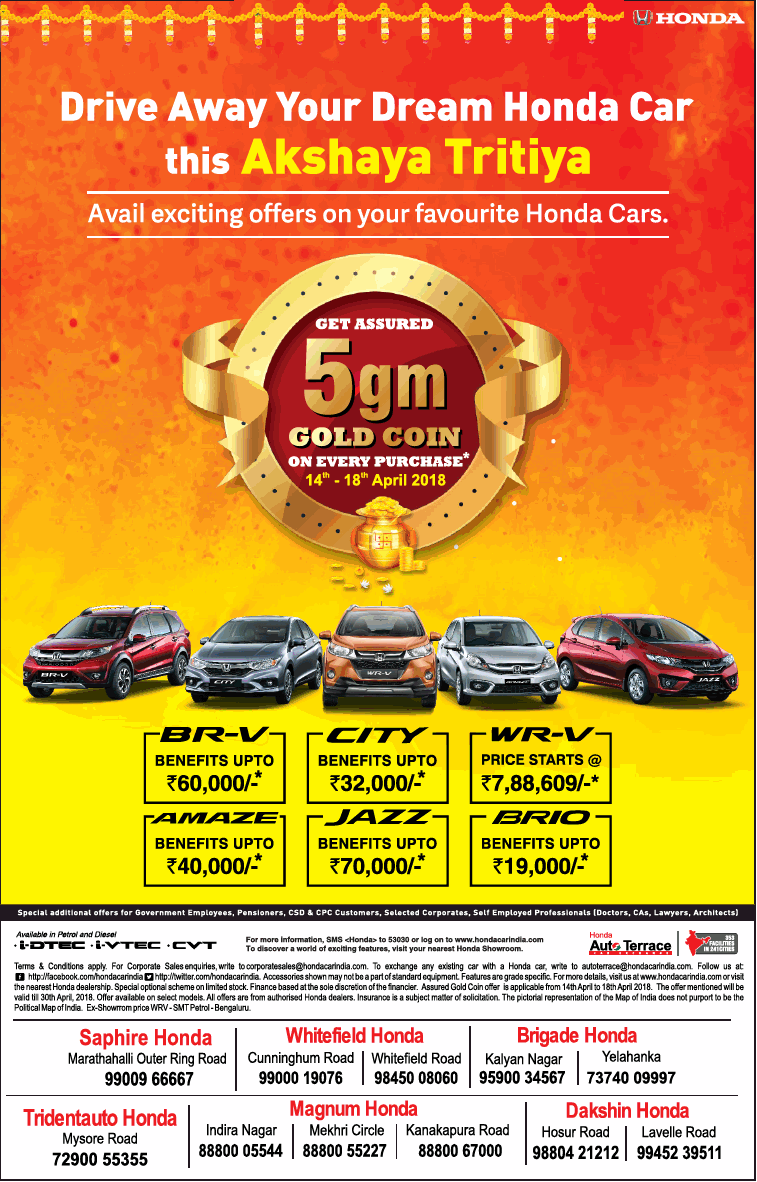

- Dealership Financing: Many dealerships have in-house finance teams or arrangements with financial institutions, offering specific car loans or hire purchase agreements.

- Bank Loans: Traditional bank loans might be secured or unsecured, with varying interest rates and terms.

Each method has its pros and cons, affecting the overall cost and flexibility of your car ownership experience.

What to Consider When Financing a Car

Before diving into the specifics, consider the following:

- Interest Rates: Shop around to compare rates from different lenders.

- Down Payment: A higher down payment might reduce your monthly payments and overall interest.

- Loan Term: Longer terms lower monthly payments but increase total interest paid.

- Credit Score: A better credit score can unlock better finance rates.

- Total Cost: Consider not just the car's price but also insurance, maintenance, and other related expenses.

Steps to Finance Your Dream Car

Here's a detailed roadmap to finance your dream car in Ipswich:

Evaluate Your Budget

Understanding your financial limits is the first step. Look at:

- Your income vs. expenses

- Current debts and payments

- How much you can afford for a down payment and monthly payments

Check Your Credit Score

Your credit score significantly impacts the loan terms you'll receive. In Ipswich:

- Get a free credit report to understand your score.

- If your score is not up to par, consider credit repair options or wait until it improves.

Research Loans and Finance Options

Once you know your budget:

- Explore local banks, credit unions, and dealership finance offers.

- Use online calculators to estimate monthly payments with different scenarios.

Get Pre-Approval

Pre-approval gives you:

- An estimate of your loan limit.

- Negotiation power at the dealership.

Visit Dealerships

With pre-approval in hand, you can:

- Shop with confidence, knowing your financial limits.

- Compare models, negotiate prices, and understand dealer finance options.

Consider Additional Costs

Don't forget about:

- Vehicle registration and transfer fees

- Insurance - consider comprehensive coverage.

- Regular maintenance and potential repairs

Finalize the Loan and Paperwork

Once you've chosen your car:

- Finalize loan terms with your chosen lender.

- Understand all the terms, conditions, and repayment schedule.

- Complete all necessary paperwork, keeping copies for your records.

Make Payments on Time

To maintain your financial health:

- Set up automatic payments or calendar reminders.

- Monitor your loan balance and consider making extra payments to reduce interest.

✅ Note: Always read the fine print, understand the APR, and be aware of any potential penalties or fees.

In closing, financing your dream car in Ipswich involves a blend of financial literacy, careful planning, and strategic decision-making. By understanding your credit profile, exploring your options, and setting realistic goals, you position yourself to navigate the market successfully. Remember, the journey to drive your dream car is not just about the destination; it's about managing your finances wisely to ensure that the experience remains enjoyable and financially sound over time.

What are the benefits of dealership financing?

+

Dealership financing can offer tailored loan packages, sometimes with special promotions or incentives not available with bank loans. They might also provide more flexibility with credit requirements.

Can I finance a car with bad credit in Ipswich?

+

Yes, there are options for those with less-than-ideal credit. Dealerships often have arrangements with lenders catering to various credit situations, though expect higher interest rates.

How long should I take to repay my car loan?

+

Loan terms can range from 12 to 72 months, or even longer. Shorter terms result in higher monthly payments but less interest over time, while longer terms offer lower monthly costs but can double or more in total interest paid.