5 Ways to Secure Car Finance with Included Insurance

Understanding Car Finance and Insurance

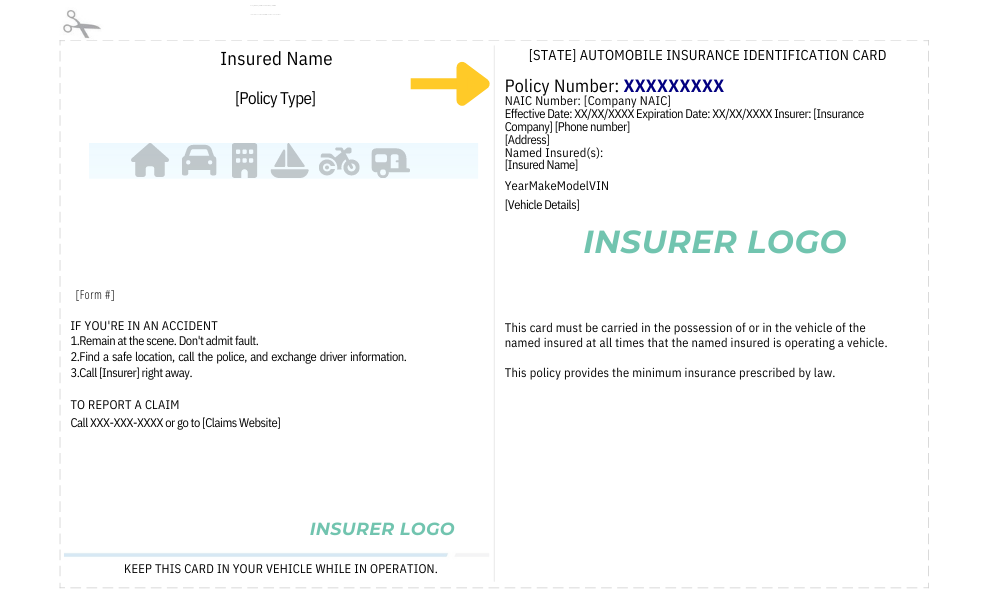

The process of buying a car is often exciting, but it comes with its own set of considerations, notably around finance and insurance. Securing car finance, especially when it includes insurance, offers a comprehensive package that can ease the burden of ownership. Here are five effective ways to secure car finance with insurance included:

1. Dealership Financing

Many car dealerships offer finance options that come with the added benefit of insurance:

- Integrated Deal: Dealerships often partner with finance companies or banks, allowing for a streamlined process where finance and insurance are handled in one go.

- Packages: Car sellers sometimes package finance deals with insurance as a promotional offer, providing a discount or added value for buying both at once.

- Customization: Buyers can negotiate terms including the type of insurance required, whether it's comprehensive or third party, fire, and theft.

2. Bank or Credit Union Loans

Traditional financial institutions provide the following options:

- Loan and Insurance Bundles: Banks and credit unions might offer bundled packages where the interest rate on the car loan could be lower if the insurance is obtained from them.

- Insurance Add-On: If a bank does not directly provide insurance, they may require proof of insurance from a third party, which can be negotiated into the loan terms.

3. Online Finance Brokers

Online brokers are becoming popular for their convenience:

- Comparative Shopping: These brokers compare rates and terms from various providers, presenting a selection of deals that might include insurance options.

- Streamlined Process: Some brokers can handle the paperwork for both finance and insurance, simplifying the purchasing process.

4. Lease Agreements

Leasing a car can be an alternative to buying, with the following considerations:

- Included Insurance: Some lease agreements require full coverage insurance, which can sometimes be offered by the lessor or their partners.

- Lower Monthly Payments: Leasing might offer lower monthly payments compared to buying outright, with insurance sometimes included as part of the package.

5. Manufacturer’s Finance Programs

Car manufacturers have their own finance arms:

- Brand-Specific Incentives: These programs can include special financing rates or insurance offers, especially on new models or during promotional periods.

- Warranty and Insurance Bundles: Manufacturers might bundle warranties with finance and insurance options to make their vehicles more attractive to buyers.

Each of these avenues has its own merits, and understanding the nuances can help you make an informed decision when securing car finance with insurance. Here's what you need to consider:

| Finance Option | Pros | Cons |

|---|---|---|

| Dealership Financing | Convenient, often pre-approved, customized options | Might have higher rates, limited negotiation power |

| Bank or Credit Union | Trusted, often competitive rates, potential for future business | Separate steps for finance and insurance, less integrated |

| Online Brokers | Wide comparison, quick application, easy documentation | Service quality varies, requires due diligence |

| Leasing | Lower monthly payments, included insurance, vehicle upgrades | Long-term cost, mileage limitations, no equity in vehicle |

| Manufacturer's Finance | Special incentives, brand alignment, potential for bundled offerings | Requires new vehicle purchase, terms might be restrictive |

🔎 Note: Always read the fine print and consider all available options to find the best finance and insurance package tailored to your needs.

The journey to securing car finance with insurance doesn't have to be daunting. By exploring these five avenues, you can find a solution that not only meets your financial needs but also protects your investment. From dealership packages to manufacturer incentives, understanding your options allows for a more informed and potentially cost-effective car purchase.

Can I finance my car purchase if my credit score is not excellent?

+

Yes, options like online finance brokers often have lenders specializing in subprime credit. However, expect higher interest rates, and consider improving your credit score for better terms.

Is it always better to get insurance from the finance provider?

+

Not necessarily. While convenient, always compare premiums and coverage levels from different insurers. Sometimes, obtaining insurance separately can yield more cost-effective and tailored coverage.

How can I lower the overall cost of financing my car?

+

Consider a larger down payment, opt for a shorter loan term, shop around for the best rates, negotiate with dealers, maintain a good credit score, and compare bundled offers versus separate purchases.

What happens if I want to change insurance providers after financing?

+

You generally can, but inform your finance provider first. Some loan agreements require continuous coverage, and you might have to ensure that your new insurance meets the lender’s requirements.

Can I include extras like gap insurance in my finance deal?

+

Yes, many finance deals allow for add-ons like gap insurance, extended warranties, and tire and wheel coverage. These can often be financed along with the car, increasing your monthly payments but providing peace of mind.