Car Finance Options with CCJ: Your Complete Guide

Exploring Car Finance Options with CCJ

Obtaining car finance when you have a County Court Judgement (CCJ) can be challenging, but it's not impossible. A CCJ can significantly impact your credit score, making traditional lending institutions wary, but there are pathways designed for individuals in this situation. This comprehensive guide will explore various car finance options available to those with a CCJ, detailing the processes, eligibility criteria, and tips for securing finance despite your credit history.

Understanding the Impact of CCJ

Before delving into finance options, it's critical to understand how a CCJ affects your ability to borrow:

- A CCJ on your credit file can lead to a negative credit rating, making traditional lenders less likely to approve your loan application.

- The presence of a CCJ signals to lenders that you have had trouble managing debt in the past, which can result in higher interest rates or outright rejection.

- The time elapsed since the CCJ was issued, its status (whether it's still active or has been satisfied), and its amount all play a role in the lender's decision.

💡 Note: A CCJ can remain on your credit file for six years, and even after it's paid off, it continues to influence your credit score. However, paying it off and improving your credit score can enhance your chances of getting finance.

Your Finance Options

1. Specialist Lenders

Specialist lenders or subprime car finance companies cater to individuals with a poor credit history, including those with a CCJ:

- These lenders typically have higher interest rates due to the increased risk associated with lending to those with poor credit.

- They might require a larger deposit (often 20% to 50% of the car's value) to reduce their risk.

- Eligibility often depends on your current financial situation, employment status, and how recent the CCJ is.

| Option | Interest Rates | Deposit Requirement |

|---|---|---|

| Subprime Lenders | Higher | 20-50% |

| Traditional Lenders | Standard | 10-20% |

2. Guarantor Loans

If your credit rating is poor due to a CCJ, you might consider a guarantor loan:

- A guarantor, usually someone with a good credit score, agrees to step in if you fail to make payments.

- Interest rates can be lower than those from subprime lenders, as the guarantor reduces the lender's risk.

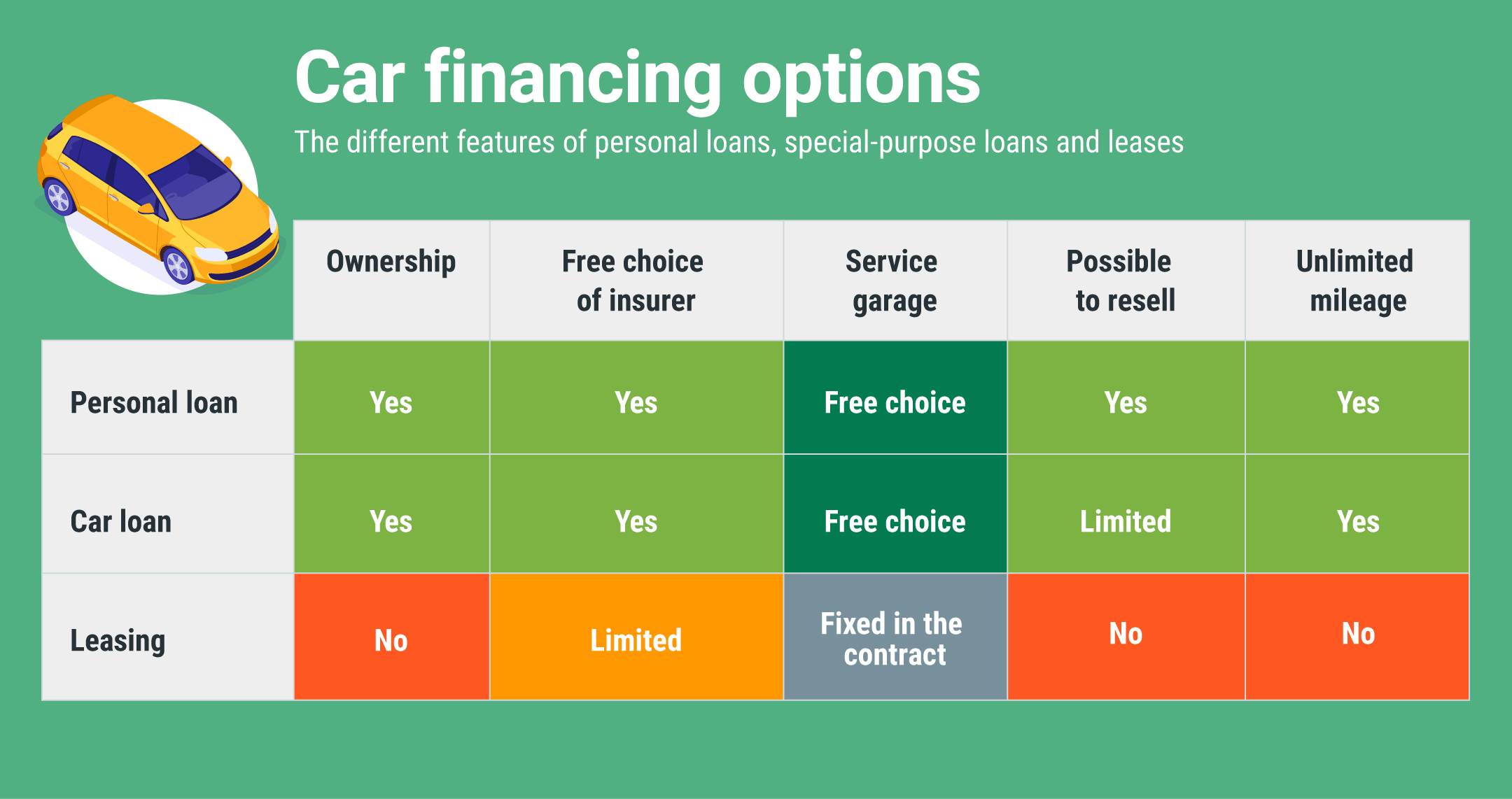

3. Hire Purchase (HP)

Hire Purchase allows you to:

- Use the car while paying it off over time with interest.

- Ownership transfers once the final payment is made, which could be beneficial for credit building.

💡 Note: Make sure the terms are clear with any lender, especially with the higher interest rates associated with bad credit finance. Always compare rates and terms from multiple lenders to find the best deal.

Steps to Secure Car Finance with a CCJ

1. Check Your Credit Report

Start by reviewing your credit file:

- Correct any inaccuracies or outdated information.

- Consider a credit repair agency if necessary, although it's prudent to know that this can take time.

2. Save for a Deposit

The higher the deposit, the better your chances of getting approved:

- A substantial deposit reduces the lender's risk, making your loan application more appealing.

3. Look for Specialist Lenders

Seek out lenders who specialize in bad credit loans:

- Brokers can help you find suitable lenders, but their services might come with a fee.

4. Apply Strategically

Limit the number of credit applications to prevent multiple hard inquiries affecting your score:

- Each hard inquiry can lower your score, so apply only after you've researched your options.

5. Provide Full Financial Disclosure

Be transparent about your financial situation:

- Honesty can influence a lender's decision in your favor, showing you're serious about managing debt.

Wrapping Up

Navigating car finance with a CCJ requires patience and preparation. By understanding how a CCJ impacts your credit, exploring alternative finance options like specialist lenders, guarantor loans, and Hire Purchase, and following strategic steps like saving for a deposit and checking your credit report, you can increase your chances of securing car finance. Remember, improving your credit score over time can open more standard lending options in the future.

💡 Note: Regularly making payments on time and reducing debt can help rebuild your credit score, enhancing future finance applications.

Can I get car finance with a CCJ?

+

Yes, although it can be more challenging, there are specialist lenders, guarantor loans, and hire purchase options designed for people with CCJs.

What is a good credit score for car finance?

+

In the UK, a score above 600 is generally considered good, but lenders might have different thresholds for approval.

How does a CCJ impact my ability to get finance?

+

A CCJ signals to lenders that you’ve had issues managing debt, leading to higher interest rates or loan denial. Even after it’s paid, it remains on your credit file for six years, affecting your score.