5 Car Finance Tips in Swindon

Looking for the best car finance options in Swindon can be a daunting task. With numerous deals, varying interest rates, and a plethora of financial products available, understanding how to navigate this market effectively can save you both time and money. Here's how you can secure the best car finance options in Swindon:

1. Know Your Credit Score

Your credit score is pivotal when it comes to car finance. It determines the interest rates you’ll qualify for and the terms of repayment. Here’s what you should do:

- Obtain a copy of your credit report from major credit agencies like Equifax, Experian, or TransUnion.

- Review the report for inaccuracies or discrepancies and rectify any errors.

- If your score is lower than desired, work on improving it by reducing outstanding debts or settling any disputes.

Knowing your credit score allows you to approach lenders with a clear picture of what to expect.

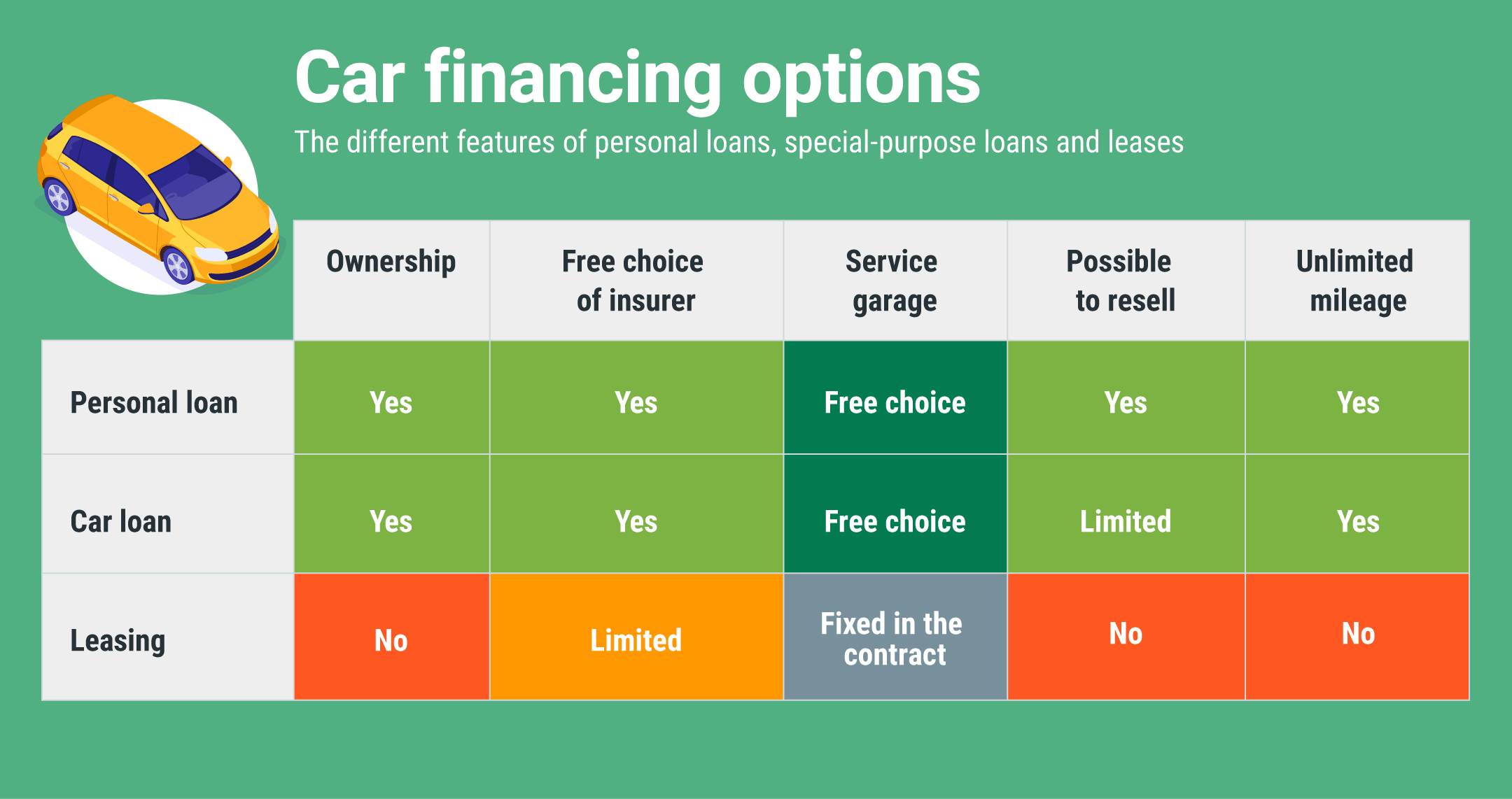

2. Understand the Types of Car Finance

Car finance in Swindon comes in several forms:

| Finance Type | Description |

|---|---|

| Hire Purchase (HP) | You make fixed monthly payments to eventually own the car. Interest rates can be variable or fixed. |

| Personal Contract Purchase (PCP) | Here, you have lower monthly payments with an option to own the car by paying a final balloon payment. If not, you can return the car or start a new agreement. |

| Personal Loans | Securing a loan against your car can be an option if you want a one-time cash amount for other purposes. |

Each option has its pros and cons, and understanding these can help you make an informed decision.

⚠️ Note: PCPs might look attractive due to lower monthly payments, but the total cost over time could be higher, especially if you choose to return the vehicle at the end of the term.

3. Shop Around for the Best Deal

In Swindon, as in any town, the market for car finance is competitive. Here’s how to find the best:

- Compare Rates: Use online comparison tools to see the different offers from lenders.

- Look Beyond Banks: Sometimes, car dealerships, credit unions, or specialist car finance companies offer better deals.

- Negotiate: Don’t settle for the first offer; rates and terms can often be negotiated, especially if you have a good credit score or can offer a substantial down payment.

💡 Note: Always remember that the lowest interest rate doesn’t always mean the best deal; consider the total cost of the loan, including all fees and charges.

4. Consider the Length of the Loan

The duration of your car finance agreement impacts your monthly payments and the total amount you’ll pay:

- Short-Term Loans: Lower interest rates but higher monthly payments.

- Long-Term Loans: More manageable monthly payments but potentially higher interest over the life of the loan.

Choose wisely based on your budget and financial stability. Remember, while longer terms might seem attractive for lower monthly payments, the total interest paid could be significantly higher.

5. Read the Fine Print

Before signing any car finance agreement, thoroughly review all the terms:

- Look for additional charges like processing fees, early repayment penalties, or balloon payments.

- Understand the implications of early settlement or missed payments.

- Ask for clarification on any point you’re not clear about. Lenders are required by law to explain everything in understandable terms.

Financing a car is a significant commitment, and being fully informed can prevent future headaches.

By following these tips, you can navigate the car finance landscape in Swindon with confidence. Whether you’re after a brand-new car or opting for a second-hand one, securing finance with the best terms possible will ensure you're driving with peace of mind. Each step involves careful consideration, from checking your credit score to understanding the various finance options available. This not only puts you in the driver’s seat but also ensures your journey into car ownership is smooth and financially sound.

What documents do I need when applying for car finance in Swindon?

+

Typically, you’ll need proof of income, identity, address, and your driver’s license. Some lenders might also require bank statements or a recent utility bill.

Can I get car finance with a poor credit history?

+

Yes, though options might be limited, and interest rates could be higher. Some lenders specialize in financing for those with poor credit scores. It’s beneficial to work on improving your credit score or look for lenders willing to negotiate on terms.

What are the advantages of PCP over Hire Purchase?

+

PCP offers lower monthly payments and the flexibility to either return the car at the end of the term or purchase it by paying a final balloon payment. HP, on the other hand, leads to outright ownership but with potentially higher monthly payments due to the inclusion of the final value of the car in the loan amount.

Can I settle my car finance early, and what are the benefits?

+

Yes, you can often settle early, but check for any penalties. Benefits include saving on interest, owning the car outright sooner, or reducing your debt to secure better financing rates in the future.

What if I miss a payment?

+

Missing a payment can negatively impact your credit score, and after a certain number of missed payments, the lender can repossess your car. However, lenders usually offer a grace period or the option to work out an arrangement if you communicate proactively.