Car Finance Options for Students: Easy Guide

As a student, managing finances can be daunting, especially when it comes to purchasing a car. Whether you're looking to commute to college, manage errands, or enjoy some weekend trips, owning a car offers a lot of freedom. But what are the best ways for students to finance a vehicle? This guide will explore several car finance options for students, detailing how you can get behind the wheel without overwhelming yourself with debt.

Understanding Your Financial Position

Before delving into the options, it’s crucial for students to assess their financial health. Here are steps to take:

- Evaluate your budget, including income from jobs, savings, and potential future earnings.

- Consider your credit score, as this can influence the rates you receive.

- Account for maintenance, insurance, and fuel costs along with your monthly car payments.

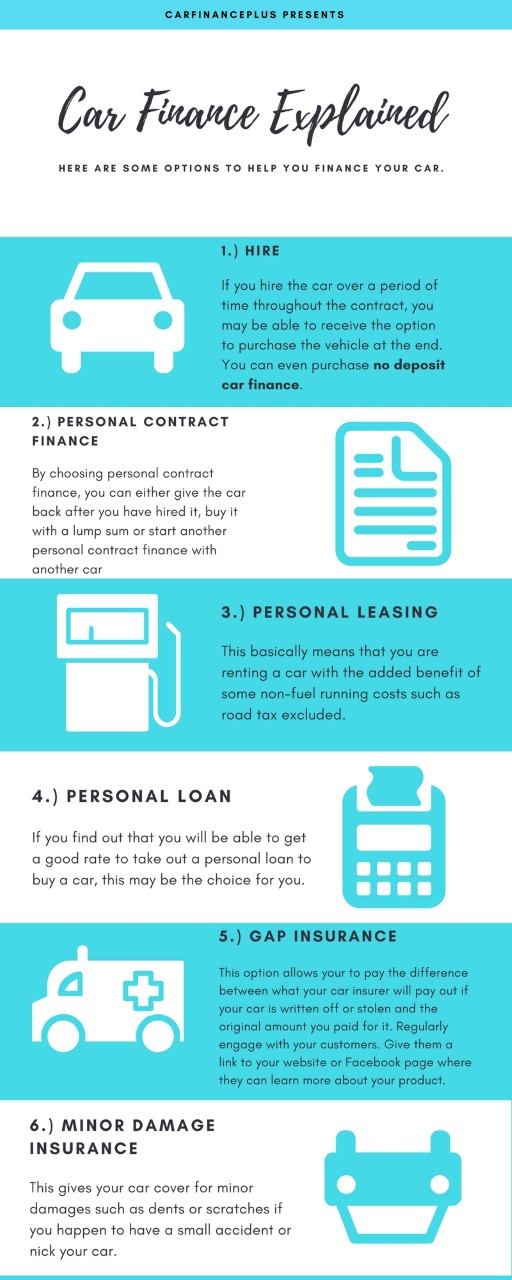

Traditional Loans

Traditional auto loans are the most common financing method. Here’s what you need to know:

- Banks: Often require a good credit history, which many students might lack. A co-signer can help overcome this hurdle.

- Credit Unions: Known for better rates, especially for members, but might still require a co-signer or good credit.

- Interest Rates: Can vary greatly based on credit scores, co-signers, and down payments.

Steps to Securing a Traditional Loan:

- Check your credit report for any errors or areas to improve your score.

- Shop around for the best interest rates.

- Secure a co-signer if needed.

- Make a down payment if possible to lower monthly payments.

📌 Note: When choosing a traditional loan, be wary of prepayment penalties and the total cost of the loan.

Student-Specific Financing Programs

Some lenders offer programs tailored for students:

- Special Student Deals: Some car dealerships or finance companies offer incentives or lower interest rates for students.

- Deferred Payments: Options to delay your first payment for a few months, giving you time to settle into your finances.

Leasing

Leasing can be an attractive option for students:

- Lower monthly payments than purchasing.

- The ability to upgrade cars every few years.

- Maintenance is often covered under the lease agreement.

However, leasing doesn’t build equity, and there can be penalties for mileage or wear and tear at the end of the lease.

Buying Used Cars

Opting for a used car can significantly reduce the amount you need to finance:

- Less depreciation compared to new cars.

- More affordable and possibly more flexible financing options.

- Consider certified pre-owned vehicles for an extra layer of reliability.

Benefits and Considerations:

| Benefit | Consideration |

|---|---|

| Lower Purchase Price | Higher Maintenance Costs |

| Possibly Lower Insurance | No Warranty/End of Warranty |

| Less Depreciation | Vehicle Condition Variability |

Parental Co-Signer or Loan

If your credit isn’t great, parents can be a big help:

- They can co-sign the loan to improve approval odds.

- Some parents might even finance the car for you, treating it as a loan you’ll repay over time.

Government or Educational Loans

Although not common for car purchases, some countries provide:

- Student loans that can be used for any educational expense, including transportation.

- Grants or scholarships, which indirectly increase your buying power for a car.

In wrapping up, choosing the right car finance option for students involves a careful balance of financial responsibility, future income potential, and personal needs. Whether you opt for a traditional loan with a co-signer, explore student-specific finance programs, consider leasing, or decide on buying a used car, the key is to make an informed decision. This decision should align with your current financial situation, educational goals, and the convenience and necessity of having your own transportation. Remember, managing debt as a student is about smart planning, ensuring you enjoy the freedom a car provides without compromising your financial stability or future opportunities.

Can I finance a car as a student with no job?

+

Yes, with a co-signer or through alternative methods like parental loans, or using student loans if allowed by your country’s regulations. However, it’s important to have a plan for repayment.

Is it better to lease or buy a car as a student?

+

It depends on your situation. Leasing can mean lower monthly payments and newer cars, but it doesn’t build equity. Buying, especially a used car, can be more cost-effective long-term.

What are the downsides of using a co-signer for a car loan?

+

The co-signer becomes equally responsible for the loan, which can strain relationships if payments are missed. Additionally, both parties’ credit scores can be affected.