5 Best Car Finance Options for 2023

The financial landscape for buying a car in 2023 has evolved, offering numerous pathways to vehicle ownership. Choosing the best car finance option can be pivotal in ensuring you get the most value out of your investment. In this article, we'll explore the five best car finance options for the year, each with unique benefits tailored to different needs and preferences.

1. Traditional Auto Loans

Traditional auto loans from banks or credit unions remain a reliable choice for many car buyers. Here’s what you need to know:

- Interest Rates: They offer competitive interest rates, especially if you have a good credit score.

- Loan Terms: Terms can range from 36 to 72 months, allowing you to tailor payments to your budget.

- Prepayment: There are generally no penalties for early loan payoff, which can save on interest over time.

📝 Note: Always compare rates from different lenders to ensure you’re getting the best deal on your auto loan.

2. Dealership Financing

Many car dealerships offer their financing options which can come with:

- Convenience: You can arrange everything at the dealership, reducing the hassle of going to a bank.

- Manufacturer Incentives: Special rates or rebates might be available through dealer financing.

- Negotiability: Sometimes, you can negotiate the interest rate, especially if you’re a returning customer or if it’s a slow sales period.

3. Credit Unions

Credit unions can offer some of the best car finance rates because:

- Member Focus: Being member-owned, they focus on the benefits to members rather than profit maximization.

- Lower Interest Rates: Often, credit unions provide lower rates than traditional banks due to their not-for-profit structure.

- Personalized Service: You might receive more personalized service and financial advice.

4. Online Lenders

Online lending platforms have become increasingly popular, providing:

- Convenience: Apply from the comfort of your home at any time.

- Instant Approval: Many offer instant or near-instant approval processes.

- Wide Options: You can easily compare offers from multiple lenders in one place.

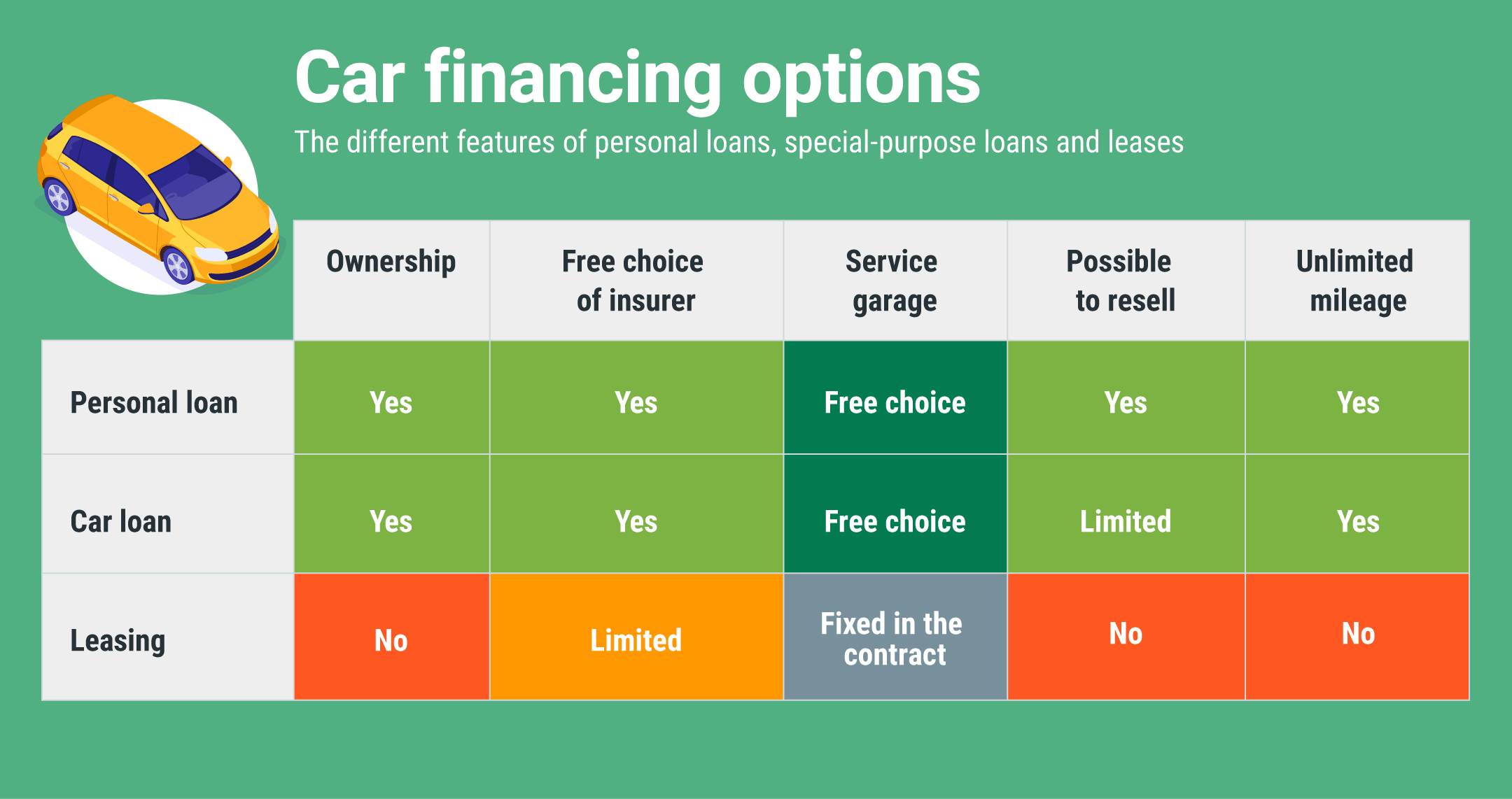

5. Car Leasing

Leasing can be an attractive option if you:

- Prefer Lower Monthly Payments: Leases often come with lower monthly payments than purchasing a vehicle.

- Want to Drive New Cars Frequently: Leasing allows you to upgrade to a new model every few years without the hassle of selling a car.

- Care About Mileage: Leases have mileage limits, so if you drive less, this might save you money.

⚠️ Note: Be mindful of mileage restrictions and potential wear-and-tear fees at the end of your lease term.

In conclusion, the selection of your car finance option should align with your financial situation, driving habits, and long-term plans. Traditional auto loans offer flexibility and control, while credit unions provide competitive rates and personalized service. Online lenders bring convenience and speed, and leasing can be the go-to choice for those looking to drive the latest models with lower upfront costs. As you consider these options, remember to review terms, rates, and potential fees thoroughly. Your choice will dictate your relationship with your vehicle and your wallet for years to come.

What is the advantage of dealership financing over bank loans?

+

Dealership financing can sometimes offer manufacturer incentives or special financing deals that might not be available through banks. Additionally, the convenience of handling everything in one place can be beneficial.

How do credit unions differ from banks for car financing?

+

Credit unions are not-for-profit, member-owned institutions, which often results in lower interest rates on loans and better customer service focused on members’ needs rather than profit.

What should I be cautious about with car leasing?

+

You should be wary of mileage limits, which, if exceeded, can result in significant fees. Also, remember to check for any potential wear and tear charges at the end of your lease term, as cars must be returned in good condition.