Best Car Finance Options in Luton Revealed

When searching for the best car finance options in Luton, it's important to understand that the financial landscape has evolved significantly, offering consumers more choices than ever before. Whether you're a first-time buyer, looking to upgrade your current vehicle, or merely interested in the financial mechanisms available, this guide aims to demystify car finance in Luton and help you make an informed decision.

Types of Car Finance Available

Car finance comes in various forms, each tailored to different needs:

- Personal Contract Purchase (PCP): A flexible payment plan where you pay a deposit, followed by monthly installments for the depreciating value of the car. At the end of the term, you have the option to return the vehicle, make a balloon payment to keep the car, or trade it in for a new one.

- Hire Purchase (HP): With HP, you pay an initial deposit followed by monthly payments until the car is fully paid for. Once you've completed payments, the vehicle is yours to keep.

- Personal Loans: This involves taking out a loan to finance the car, which you repay over time with interest. The vehicle becomes yours once you've paid off the loan.

- Lease Purchase: Similar to HP, but you might not legally own the car until you've made the final payment, including any balloon payment if applicable.

- Car Subscription Services: A newer model where you subscribe to a car for a monthly fee that includes insurance, maintenance, and sometimes even fuel, offering convenience and flexibility without long-term commitment.

💡 Note: Each type of finance has its advantages and potential drawbacks. It's important to assess your financial situation, future plans, and how often you might want to change your car before deciding on the best option.

Choosing the Right Finance Option in Luton

To select the best car finance in Luton, consider the following steps:

- Budget Analysis: Determine how much you can realistically afford to spend on monthly repayments, alongside other car-related expenses.

- Loan Term: Shorter terms generally mean higher monthly payments but less interest paid over time. Longer terms lower monthly payments but increase the total cost of the vehicle due to interest.

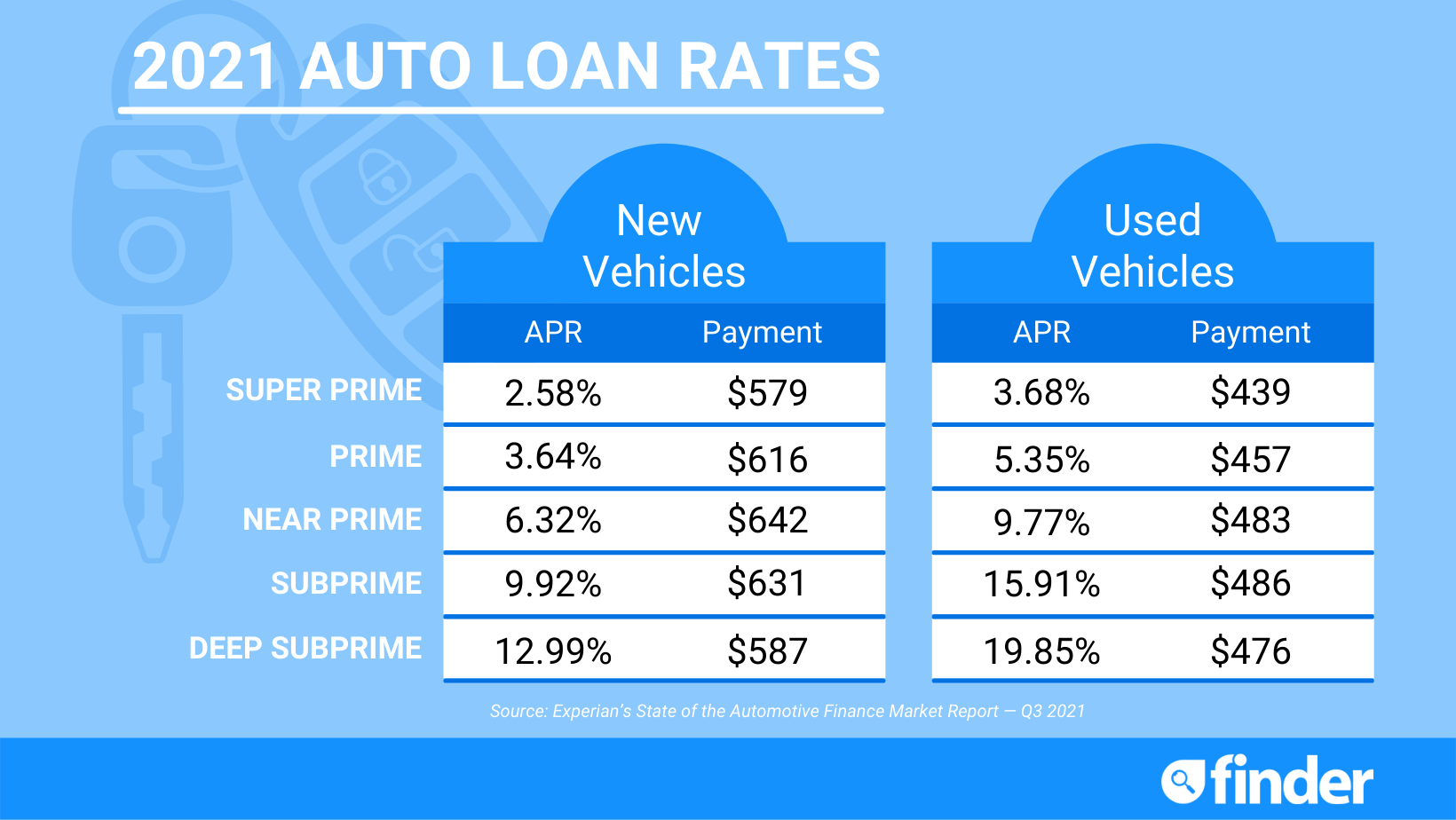

- Interest Rates: Shop around for the best rates. Fixed rates offer stability, while variable rates can change during your repayment period.

- Depreciation: Consider how quickly the car depreciates, as this impacts the cost-effectiveness of different finance options, especially PCP.

- Total Cost of Ownership: Beyond the finance, consider maintenance, insurance, tax, and fuel costs when choosing your car.

Top Lenders in Luton

Luton boasts a variety of finance options from local and national providers:

| Lender | Type of Finance | Highlights |

|---|---|---|

| Luton Credit Union | Personal Loans | Competitive rates, community-focused |

| Car Finance 247 | PCP, HP | Fast approvals, no deposit options |

| Lex Autolease | Car Leasing | Wide range of vehicles, flexible contracts |

| Volo Car Finance | HP, PCP | Poor credit options, personal service |

⚠️ Note: Always compare deals, interest rates, and terms to ensure you're getting the best offer possible. Be wary of hidden fees or less favorable repayment terms.

Application Process

Here’s how to apply for car finance in Luton:

- Research: Use online tools to pre-calculate finance options, understand what you qualify for based on your credit history.

- Get Pre-Approved: Many lenders offer pre-approval, which gives you an idea of your budget and what's available to you.

- Choose Your Car: Once pre-approved, choose a car that fits your lifestyle and financial plan.

- Documentation: Prepare documents like ID, proof of income, proof of address, and any credit report if available.

- Apply: Fill out the lender's application form, either online or in-person at their office or a car dealership.

- Review and Accept: After receiving your finance offer, review all terms, conditions, and repayment schedules. Ensure everything is clear before signing.

Additional Considerations

When deciding on car finance, keep the following in mind:

- Early Settlement: Some finance options allow early repayment, potentially saving on interest. However, always check for early repayment penalties.

- Credit Score: Your credit history can significantly impact your finance options. Lenders in Luton might be more lenient, but good credit still helps.

- Dealer vs. Direct: Financing through a dealership can be convenient, but you might get a better deal by shopping around or using a broker.

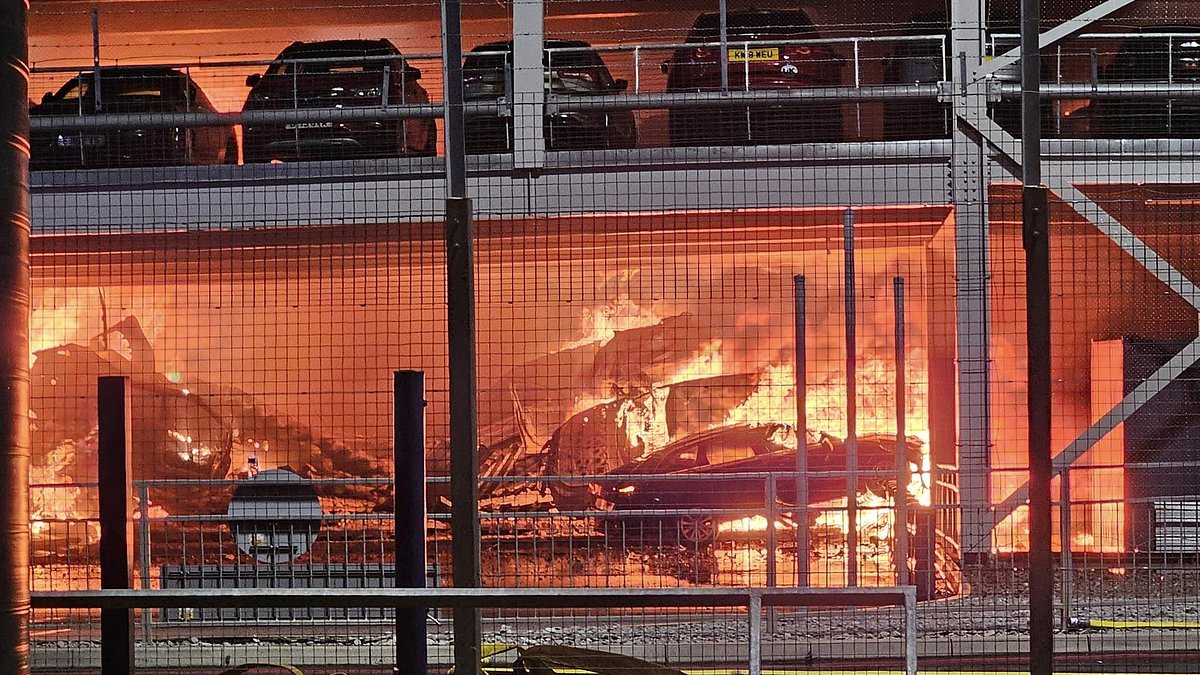

- GAP Insurance: Consider this insurance to cover the difference between what your car is worth and how much you owe if it's written off or stolen.

Having explored the various car finance options available in Luton, it's clear that making an informed choice requires careful consideration of your personal circumstances, financial situation, and future plans. Whether you opt for a PCP, HP, a personal loan, lease purchase, or a subscription service, understanding the terms, total cost, and implications of each option is key to finding the best deal for you. Remember, it's not just about the monthly payments but the overall financial impact and flexibility the finance option provides. By comparing lenders, understanding the terms, and considering additional factors like early settlement or credit score, you're setting yourself up for a financially sound decision when purchasing your next vehicle in Luton.

What is the difference between PCP and HP?

+

PCP (Personal Contract Purchase) allows for lower monthly payments with the option to return the car, pay the balloon payment to keep it, or part exchange at the end. HP (Hire Purchase) involves monthly payments until the car is fully paid for, at which point you own it outright.

Can I finance a used car?

+

Yes, many finance options are available for used cars, including PCP, HP, and personal loans. However, terms and interest rates might differ from new car financing.

How does my credit score affect car finance?

+

A good credit score can help secure lower interest rates and better terms. If your credit isn’t ideal, some lenders in Luton offer finance for those with poor credit, though at higher rates.