5 Essential Car Finance Guarantor Requirements You Need to Know

Choosing the right financing option for a new or used car is crucial. One of the avenues people often explore is securing a loan with a guarantor. Here's what you need to know about the requirements for a guarantor car finance:

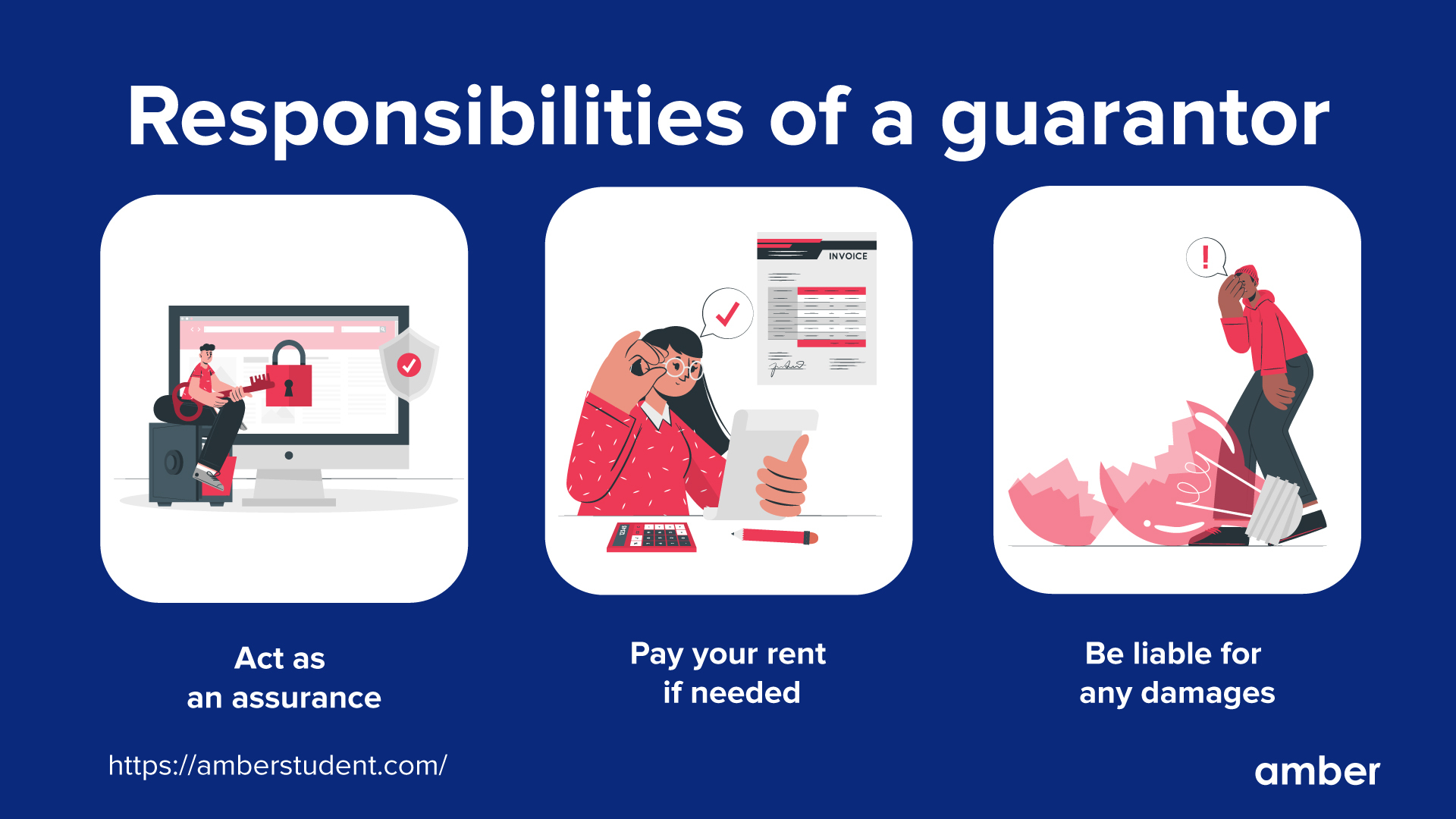

1. Understanding the Role of a Guarantor

A guarantor essentially agrees to repay the loan if the primary borrower defaults. Here’s what this role entails:

- Loan Commitment: The guarantor will be on the hook for the entire loan amount plus any interest and fees if the borrower can’t make payments.

- Credit Impact: Late or missed payments can negatively affect the guarantor’s credit score.

- Legal Responsibility: The guarantor has a legal obligation to step in, which can result in financial and legal repercussions if they fail to do so.

📝 Note: Ensure the guarantor fully understands these responsibilities before signing any agreement.

2. Creditworthiness of the Guarantor

The credit score and history of the guarantor is critical. Lenders look for:

- A good to excellent credit score, typically above 650 or equivalent depending on the country.

- A history of timely repayments of other credit products.

- No recent defaults or bankruptcies.

3. Income and Employment Stability

A guarantor should have:

- Stable employment with consistent income. This stability provides confidence to lenders that the guarantor can cover the loan if needed.

- Sufficient income, where their financial commitments (debt-to-income ratio) allow for the potential of taking on the car finance loan.

4. Assets and Net Worth

A guarantor should have:

- Enough assets or net worth to potentially cover the loan amount. This could be in the form of property, savings, or investments.

5. Relationship with the Borrower

The relationship between the borrower and guarantor can also play a role:

- Lenders prefer family members or close friends because there’s more trust involved.

- The relationship might influence the guarantor’s willingness to support the borrower in financial difficulties.

| Requirement | Description |

|---|---|

| Credit Score | Good to Excellent |

| Income Stability | Regular Employment |

| Net Worth | Sufficient Assets |

| Relationship | Close or Family |

📝 Note: The guarantor must be aware of the loan terms and how they might affect their financial health.

In summary, choosing a guarantor for your car finance is not a decision to take lightly. The guarantor's creditworthiness, financial stability, and relationship with the borrower are all crucial factors that lenders assess before approving a loan. Understanding the implications for both parties ensures that this arrangement is beneficial and secure for all involved.

What happens if I can’t make payments on my guarantor car loan?

+

If you can’t make payments, the lender will contact your guarantor to fulfill the repayment obligation as per the agreement.

Can anyone be a guarantor for car finance?

+

No, the guarantor must meet specific lender criteria regarding creditworthiness, financial stability, and sometimes their relationship with the borrower.

Does being a guarantor affect my credit rating?

+

Yes, if payments are missed or late, it can negatively impact the guarantor’s credit rating, just like it would for the primary borrower.

What should a guarantor consider before agreeing to the loan?

+

Consider the relationship with the borrower, your ability to repay the loan if necessary, and how this might affect your credit and finances.

Can a guarantor be removed from a car finance agreement?

+

Typically, a guarantor cannot be removed unless the loan is refinanced, paid off, or modified with the lender’s approval.