Financing a Car at 17: Is It Possible?

Buying your first car is an exhilarating milestone, especially when you're just 17 years old and the open road beckons. However, navigating the world of car financing at this age can be a bit tricky. This blog post will explore the possibilities, alternatives, and steps you can take if you're a teenager dreaming of owning your own car.

Understanding Car Financing

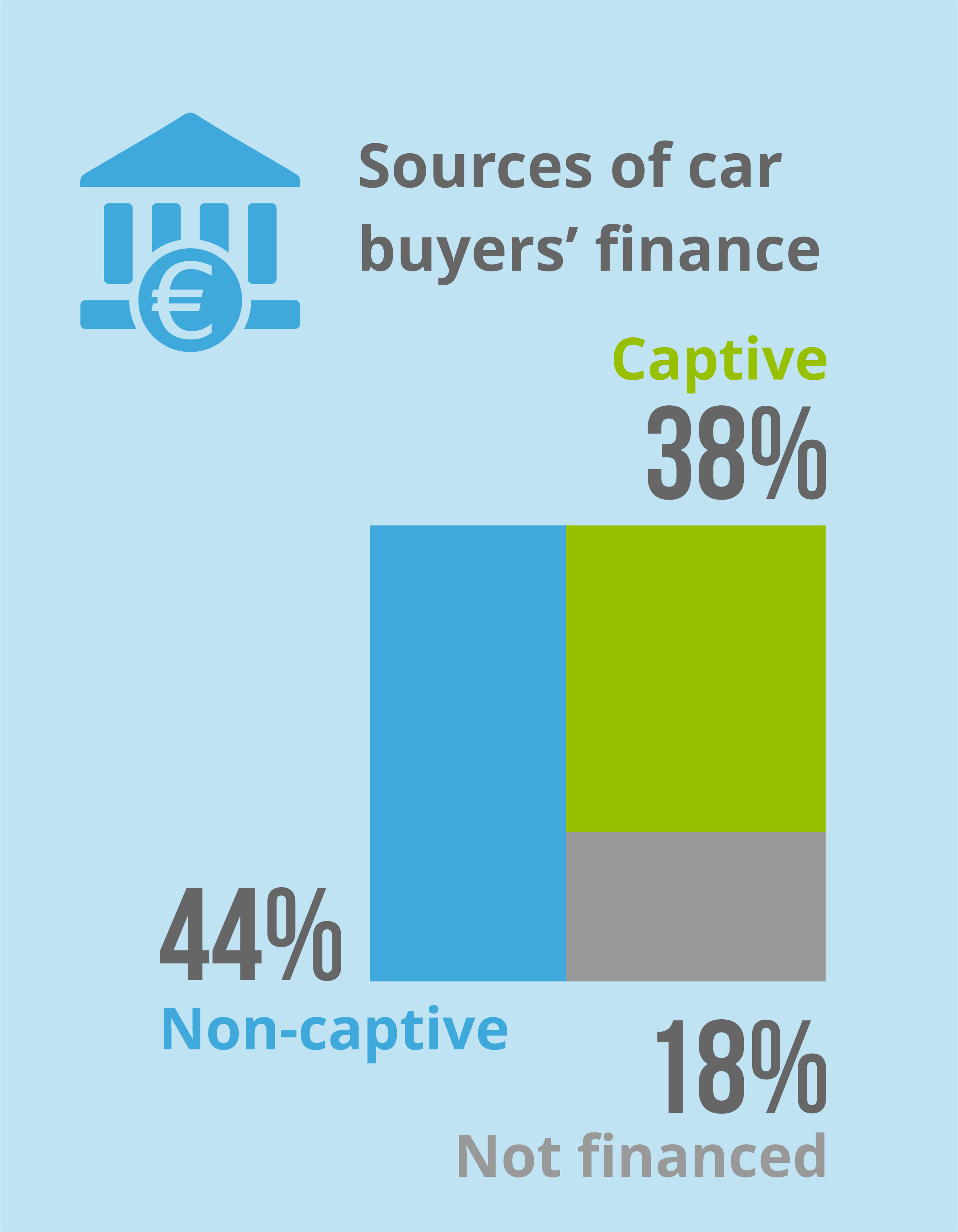

Car financing generally refers to various methods of paying for a vehicle over time rather than outright purchasing it. Here’s a brief overview:

- Car Loans: Borrow money to buy a car and pay it back with interest over time.

- Leasing: Rent the car for a period of time with the option to buy at the end of the term.

- Dealer Financing: Car dealerships often offer financing directly.

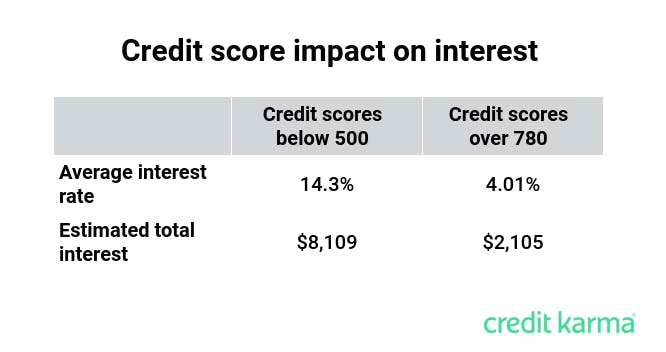

💡 Note: Understanding the terms, including interest rates, credit scores, and down payment requirements, is crucial before entering any financing agreement.

Legal and Age Restrictions

In most places, you must be 18 to legally sign a loan or lease agreement. However:

- In some states, you can sign a contract at 17 if you’re an emancipated minor or have legal parental consent.

- Financial institutions might have their own age-related policies.

Alternatives for 17-Year-Olds

If you can’t secure car financing in your own name, consider these alternatives:

- Co-Signer: Find a parent or guardian with good credit to co-sign the loan.

- Parental Purchase: A parent can buy the car in their name, and you can take over payments.

- Save for a Used Car: Save enough money to buy a reliable used car outright.

Building Credit at 17

Even if you can’t finance a car directly, starting to build your credit at a young age can help in future car purchases:

- Get a credit card in your name with a low limit or as an authorized user on your parent’s card.

- Open a secured credit card or consider a student credit card.

- Ensure you make payments on time to establish a positive credit history.

Steps to Financing a Car

If you’re looking to finance a car with or without a co-signer, here are the steps:

- Assess your finances: Understand your income, savings, and potential monthly payments.

- Get a co-signer: If necessary, find someone with a good credit score to back your loan.

- Research lenders: Look for lenders offering loans or leases to younger borrowers.

- Compare rates: Get quotes from multiple lenders to find the best rate and terms.

- Pre-approval: Apply for pre-approval to know how much you can borrow.

- Choose your car: Select a vehicle that fits within your financial parameters.

- Finalize the deal: Review the loan contract carefully, ensuring all terms are understood.

- Make timely payments: Keep your credit healthy by paying on time.

💡 Note: Always review the fine print in loan or lease agreements. Ask questions if anything is unclear.

Considerations for Car Ownership

Car ownership at 17 comes with additional responsibilities:

- Insurance: Expect higher premiums due to your age and inexperience.

- Maintenance: Regular maintenance is crucial, especially for used cars.

- Learning to Drive: Safe driving practices are essential to prevent accidents and maintain your driving record.

While it might seem like a hurdle to finance a car at 17, it's not impossible. With a solid understanding of your options, preparing ahead of time, or working with a co-signer, you can navigate the car finance world effectively. Remember, patience and planning can pay off as you strive for car ownership at a young age. Building credit now will also benefit your financial future, making it easier to secure financing later in life. By approaching the process thoughtfully, you're setting the stage for responsible vehicle ownership and financial literacy.

Can I finance a car if I’m under 18?

+

Yes, with some caveats. Typically, you need to be 18 to sign a contract, but you might be able to get financing with a co-signer or if you’re an emancipated minor.

How can I improve my chances of getting a car loan at 17?

+

Find a co-signer with good credit, save for a significant down payment, and start building your credit history by using credit cards responsibly or as an authorized user on a parent’s card.

What should I do if I can’t get car financing at 17?

+

Consider waiting until you turn 18 or look into alternative methods like a parental purchase or saving for a used car. Meanwhile, continue to build your credit.

What are the insurance implications for a 17-year-old car owner?

+

Insurance for a 17-year-old can be significantly higher due to inexperience and statistical risk. Shopping around for quotes, considering discounts for safe driving or good grades, and adding a mature driver to the policy can help manage costs.