5 Ways Bridge Financing Can Save Your Business

Bridge financing can be a powerful tool for businesses in various stages of development, offering a lifeline during times of financial transitions. Often misunderstood or underutilized, bridge financing isn't just about getting through the next month; it's about ensuring business continuity, seizing opportunities, and navigating through the unpredictable waters of commerce with confidence.

Understanding Bridge Financing

Bridge financing, or bridge loans, are short-term funding options designed to “bridge” a gap between financial events. Here are some key points:

- It’s a quick way to access capital, often within days rather than weeks or months.

- The terms are generally for a shorter duration, ranging from a few months to a few years.

- Interest rates are usually higher due to the short-term nature and risk involved.

- It’s typically used when conventional financing isn’t an option or when waiting for long-term funding would be detrimental.

1. Facilitating Growth or Expansion

When your business is ready to grow or expand but is cash-strapped, bridge financing can:

- Provide immediate funds for new projects or locations.

- Ensure you can take advantage of time-sensitive opportunities without delay.

- Enable you to cover startup costs until more permanent funding arrives.

Business owners often find themselves in a position where they must wait for long-term financing to be approved, which can take time. Bridge loans can fund expansion immediately, letting you act swiftly in a competitive market.

💡 Note: Ensure you have a solid business plan and cash flow projections to assure lenders of your ability to repay the bridge loan.

2. Managing Cash Flow Gaps

Operational hiccups, delayed payments, or seasonal fluctuations can lead to temporary cash flow gaps. Here’s how bridge financing can help:

- It provides the necessary liquidity to cover operational costs.

- Keeps your business solvent by ensuring you can meet payroll and supplier payments.

- Can offer a solution when waiting for receivables or when faced with unexpected expenses.

This type of financing can be particularly useful for businesses with predictable revenue cycles or those expecting a significant influx of cash soon.

3. Assisting in Mergers and Acquisitions

The process of merging with or acquiring another company can be complex:

- Bridge loans provide the funds to move forward with M&A activities without depleting your cash reserves.

- They can support due diligence, legal fees, and initial integration costs.

- It can help in closing the deal faster, giving you a competitive edge.

These transactions often require an injection of capital, and bridge financing can ensure the deal isn’t delayed due to funding issues.

4. Refinancing and Debt Restructuring

If your business is burdened by high-interest or unsustainable debt:

- Bridge financing can be used to pay off existing debts at a lower interest rate or to restructure your finances.

- It provides breathing room to negotiate better terms with lenders or to secure a more sustainable long-term financing solution.

This temporary financing can help avoid default or bankruptcy, giving businesses the time they need to stabilize their financial situation.

5. Funding Real Estate Development

Real estate projects often face delays or gaps in funding:

- Bridge loans can provide the initial capital to start or complete projects.

- They can serve as a down payment or as the funds needed to get to the next stage of development.

- This form of financing can help you avoid foreclosure or project cancellation when funding falls through.

In this highly competitive field, having immediate access to capital can mean the difference between a stalled project and a thriving development.

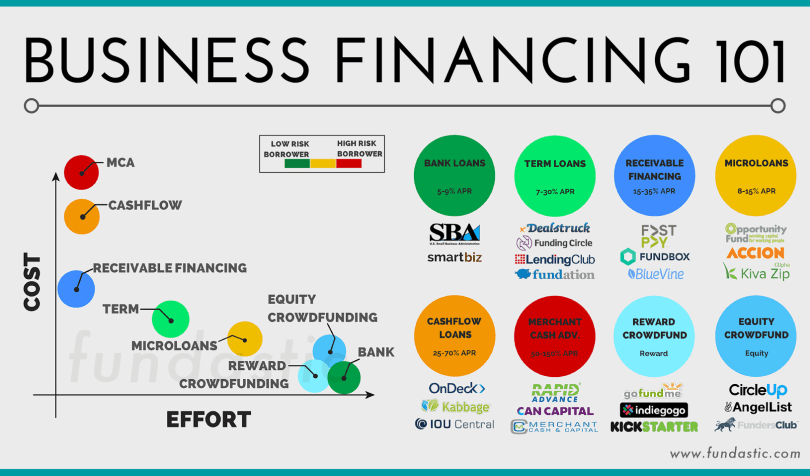

| Scenario | Benefit |

|---|---|

| Growth or Expansion | Immediate funds for new opportunities |

| Cash Flow Gaps | Liquidity to cover operational costs |

| Mergers & Acquisitions | Funding for transaction costs |

| Refinancing | Time to restructure debt |

| Real Estate Development | Capital for project continuation |

In summary, bridge financing offers businesses the flexibility to navigate through financial challenges and seize opportunities without delay. Whether you're looking to expand, cover a cash flow gap, manage an M&A deal, restructure debt, or fund real estate, bridge loans provide a strategic financial tool to ensure business growth and stability. Remember, although bridge loans come with higher interest rates and shorter repayment periods, their benefits can often outweigh the costs when used strategically.

What is bridge financing used for?

+

Bridge financing is commonly used to fund short-term needs, such as business growth, managing cash flow, executing mergers and acquisitions, restructuring debt, and facilitating real estate development.

How quickly can I get bridge financing?

+

Bridge loans can often be secured within days or a few weeks, making them faster to obtain than traditional financing options.

What are the cons of using bridge financing?

+

Bridge financing comes with higher interest rates, shorter repayment periods, and potential fees. There’s also the risk of not securing long-term financing to pay off the bridge loan, which could lead to financial strain.