Best Car Finance Options for Young Drivers

Choosing the right car finance option as a young driver can significantly impact both your financial health and your driving experience. Whether you're a recent graduate stepping into the world of work or a young professional, understanding your options is crucial. This article dives deep into various car finance options, focusing on what young drivers should consider before making a decision.

Why Car Finance Matters to Young Drivers

For young drivers, owning a car means independence, the ability to travel freely, and often, a necessary tool for work or study. Here’s why the choice of finance is pivotal:

- Credit Score Impact: Managing your car finance can help build your credit score or, if mismanaged, severely harm it.

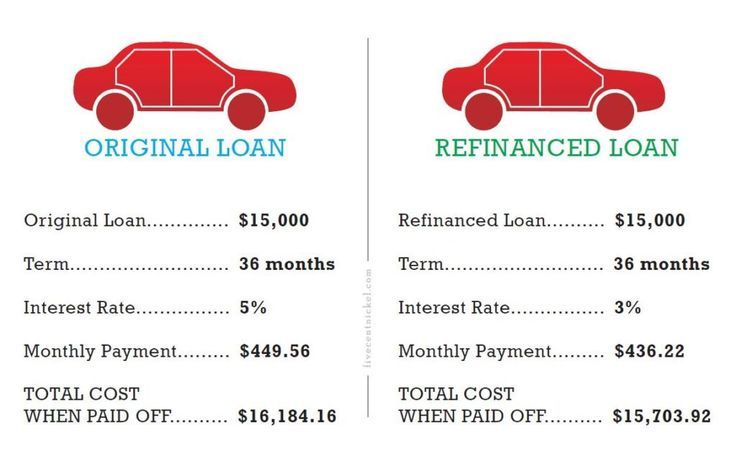

- Cost of Borrowing: Interest rates can greatly affect the overall cost of your vehicle.

- Flexibility: Different finance options offer varying degrees of flexibility in terms of ownership, mileage limits, and monthly payments.

Types of Car Finance for Young Drivers

Here are the primary car finance options available:

Personal Contract Purchase (PCP)

PCP is one of the most popular finance options for young drivers due to its low initial deposit and flexible monthly payments:

- You pay a deposit, followed by monthly installments for a fixed term.

- At the end, you have three choices: return the car, part-exchange it, or pay a final balloon payment to own it.

- Pro: Lower monthly payments compared to traditional loans.

- Con: You don’t own the car until you pay the balloon payment.

Hire Purchase (HP)

HP finance allows you to:

- Pay a deposit and then own the car once all monthly payments are made.

- Pro: You own the car at the end of the term, helping build equity.

- Con: Higher monthly payments compared to PCP.

Personal Loans

With a personal loan, you can:

- Borrow a fixed amount to buy a car outright.

- Pro: Ownership from the start and the flexibility to choose your car.

- Con: Requires a good credit score to secure a favorable interest rate.

Leasing or Personal Contract Hire (PCH)

This option is like long-term renting:

- Pay a deposit and then fixed monthly rentals to use the car.

- Pro: You never own the car but drive the latest models with maintenance often included.

- Con: Mileage restrictions and no equity building.

Subsidized Schemes or Manufacturer Finance

Some car makers offer:

- Special finance rates or incentives for young drivers.

- Pro: Can provide better rates than standard finance due to manufacturer backing.

- Con: Limited to specific makes or models.

| Finance Type | Ownership | Flexibility | Monthly Cost |

|---|---|---|---|

| PCP | Option to Buy | High | Lower |

| HP | Yes | Medium | Higher |

| Personal Loans | Immediate | Highest | Depends on loan terms |

| Leasing/PCH | No | Medium | Low |

💡 Note: Always compare the total cost of borrowing for each option, including interest rates, fees, and potential final payments or balloon payments.

Understanding these finance options allows young drivers to make an informed decision that aligns with their financial situation, lifestyle needs, and long-term goals. The key is to assess how much car you can truly afford, taking into account all costs beyond just the monthly payment - like insurance, maintenance, fuel, and unexpected repairs.

Here are some steps to consider when choosing your finance:

- Assess your budget including all car-related costs.

- Calculate your maximum affordable monthly payment.

- Check your credit score; it influences your finance rates.

- Compare multiple finance offers from different providers.

- Understand the terms, especially regarding mileage, ownership, and penalties for early repayment.

- Consider the make and model of the car you want and whether it affects your finance choices.

⚠️ Note: Remember, car finance agreements can have significant penalties for early termination or excessive mileage. Always read the fine print.

As we wrap up this guide, it's worth reflecting on the key takeaways. Car finance options for young drivers range from outright ownership through personal loans to more flexible arrangements like PCP or leasing. Each option has its pros and cons, tailored to different financial situations, lifestyle preferences, and long-term plans. By understanding these options, young drivers can make choices that not only meet their current needs but also support their financial future. Whether you're looking for the lowest monthly cost, the opportunity to own a car, or just the latest model to drive, there's a finance solution out there for you.

What if I can’t afford the balloon payment at the end of a PCP?

+

You can either hand the car back to the finance company, part-exchange it for another car, or potentially extend the agreement with an increased deposit to cover the final payment. Each option impacts your credit score differently.

Can I finance a used car?

+

Yes, many finance options are available for used cars, especially PCP, HP, and personal loans. Just ensure the car meets the finance provider’s criteria regarding age, mileage, and condition.

How does my credit score affect my car finance options?

+

A good credit score can secure better interest rates, lower deposits, and more flexible terms. Poor credit scores might still get you finance, but with higher rates, stricter terms, and potentially needing a guarantor.