Navigating the Pitfalls of Bad Car Finance Deals

Choosing the right car finance deal is critical for anyone looking to purchase a vehicle on credit. Unfortunately, navigating through the myriad of options can lead to mistakes that result in overpaying or entering into poor financial agreements. This guide aims to elucidate common pitfalls in car finance deals and provide tips on how to sidestep these traps.

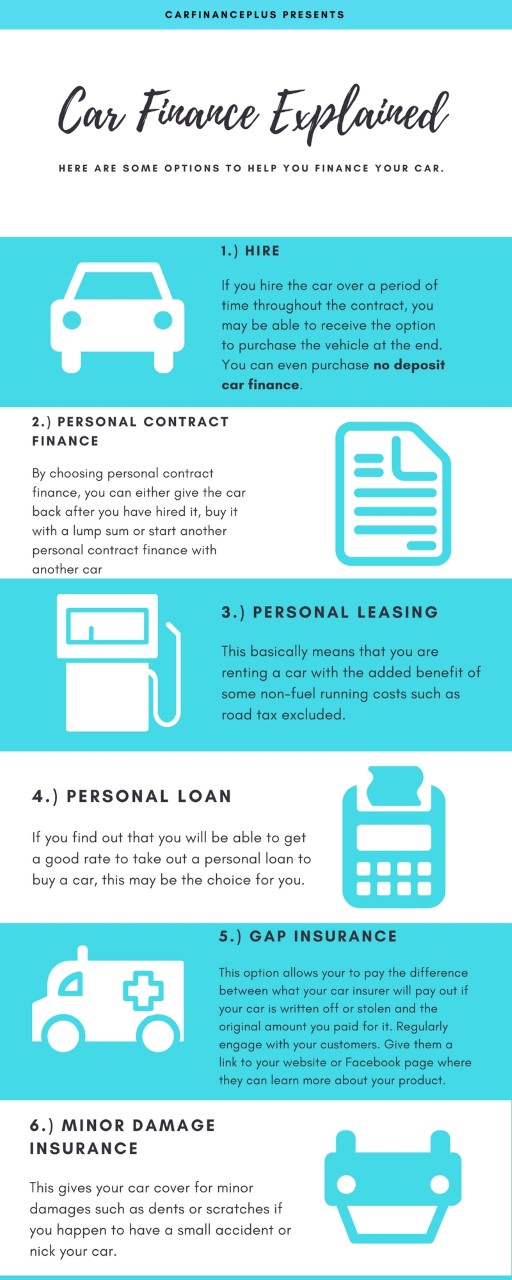

The Allure and Risks of Car Finance

Car finance schemes can make owning a car feasible even when cash is tight. However, the allure of owning a vehicle can sometimes cloud judgment, leading consumers to make costly mistakes:

- High Interest Rates: Some lenders offer lower interest rates as bait, but these can spike significantly if payments are missed.

- Hidden Fees: Finance deals might hide costs in fine print, such as administration fees, title transfer fees, or early termination charges.

- Negative Equity: Rolling over the balance of a previous car loan into a new one can lead to owing more than the vehicle is worth.

- Extended Terms: While lower monthly payments might seem attractive, extending the loan term means paying more in interest over time.

- Add-Ons: Lenders might push for unnecessary add-ons like extended warranties or gap insurance, inflating the loan amount.

Steps to Avoid Bad Car Finance Deals

Research and Compare

- Check the APR (Annual Percentage Rate) across various lenders to understand the true cost of borrowing.

- Compare lenders not just on rates but also on reputation, customer service, and terms of service.

💡 Note: Remember to account for all fees and the length of the loan when comparing. A lower rate might not be beneficial if the loan term is overly long.

Read the Fine Print

Pay close attention to:

- Any conditions attached to the interest rates.

- Default terms, especially how much interest or penalties accrue if payments are late or missed.

- Terms for early pay-offs.

💡 Note: Always have a legal or financial advisor review the contract if anything is unclear.

Calculate Total Cost

Use online tools or financial calculators to understand:

- The total amount payable over the life of the loan.

- The difference between various loan terms.

💡 Note: Longer loan terms might reduce monthly payments but increase total interest paid.

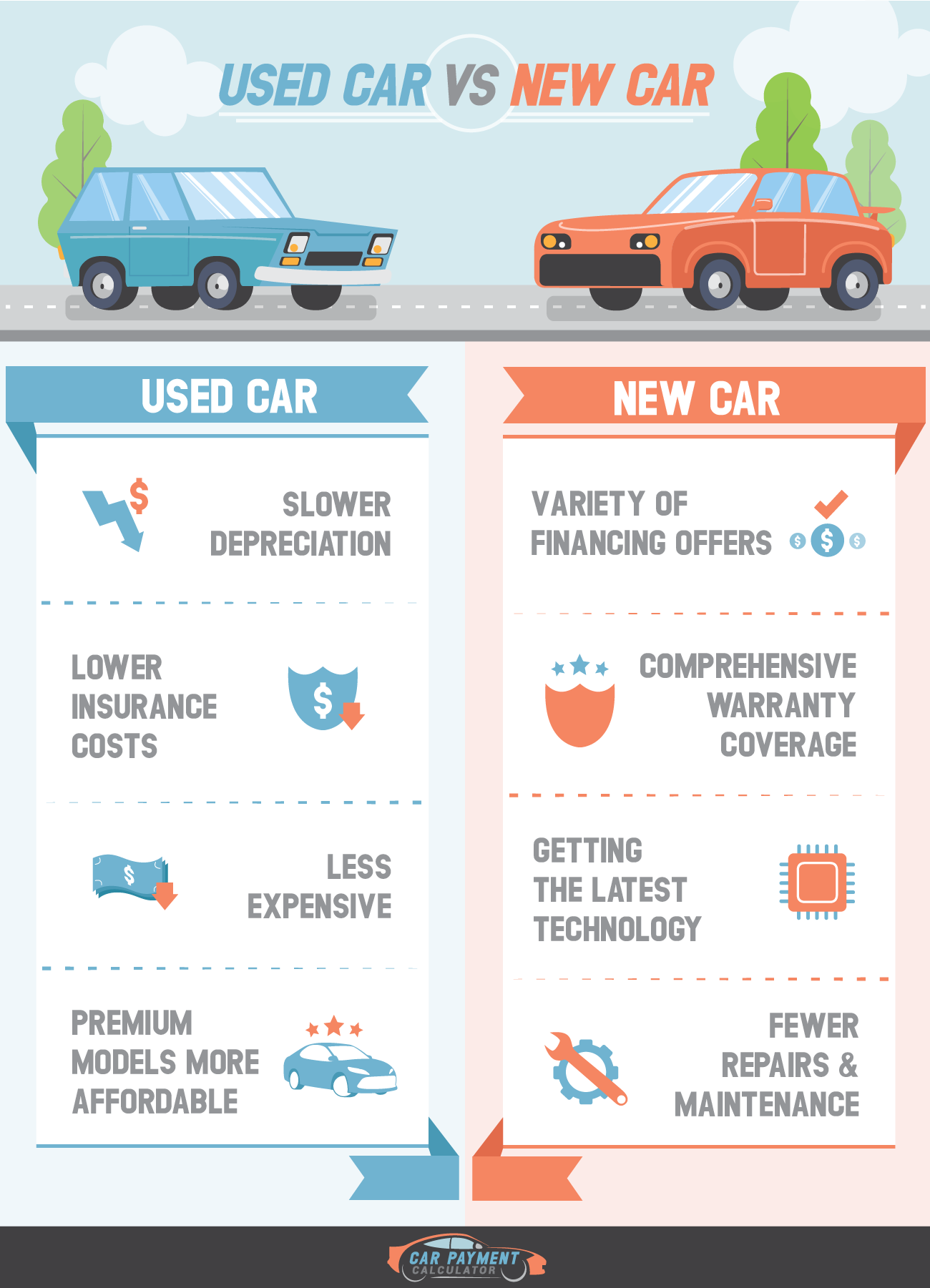

Negotiate the Deal

- Negotiate the price of the car first, then the finance terms.

- Ask for concessions like reduced interest rates or waived fees.

Avoid Unnecessary Extras

- Say no to add-ons like extended warranties unless they provide significant value.

- Review the benefits and costs of each add-on to ensure they are worth it.

Check Your Credit Report

Before applying for finance:

- Check your credit score to understand what rates you might qualify for.

- Fix any inaccuracies that could lower your score.

💡 Note: A higher credit score can lead to better finance terms, saving you money in the long run.

Recap of Navigating Car Finance Wisely

In summary, avoiding bad car finance deals requires diligence, research, and a clear understanding of finance terms. Comparing rates, reading fine print, negotiating, and resisting add-ons can save you significant money and heartache. By focusing on the total cost and not just monthly payments, you ensure that your car purchase is a financially sound decision.

How can I tell if a car finance deal is bad?

+

A deal might be bad if it involves a high APR, hidden fees, negative equity, overly long terms, or forced add-ons.

What should I do if I suspect I have a bad finance deal?

+

Review your contract, negotiate with your lender, or seek legal advice if necessary to see if terms can be improved or the contract can be refinanced.

Can I get out of a bad car finance deal?

+

Yes, through negotiation, refinancing, or sometimes by selling the car or returning it (if legally possible within the terms of your contract).

How do I know if add-ons are worth it?

+

Weigh the cost against the potential benefit. If the add-on’s value does not justify its cost or if it’s unlikely you’ll use it, it might not be worth it.

Why is understanding APR important?

+APR shows the total cost of borrowing, including interest and fees, giving a more comprehensive view than the interest rate alone.