Bachelor Of Arts In Finance

Choosing to pursue a Bachelor of Arts (BA) in Finance can be a transformative decision for those interested in the financial sector. This degree not only equips students with the knowledge of financial principles, economics, and accounting but also fosters a broad range of skills including analytical thinking, strategic planning, and communication. Here’s an in-depth look at what you can expect from a BA in Finance program, why it might be the right path for you, and how to make the most of your educational journey.

What is a BA in Finance?

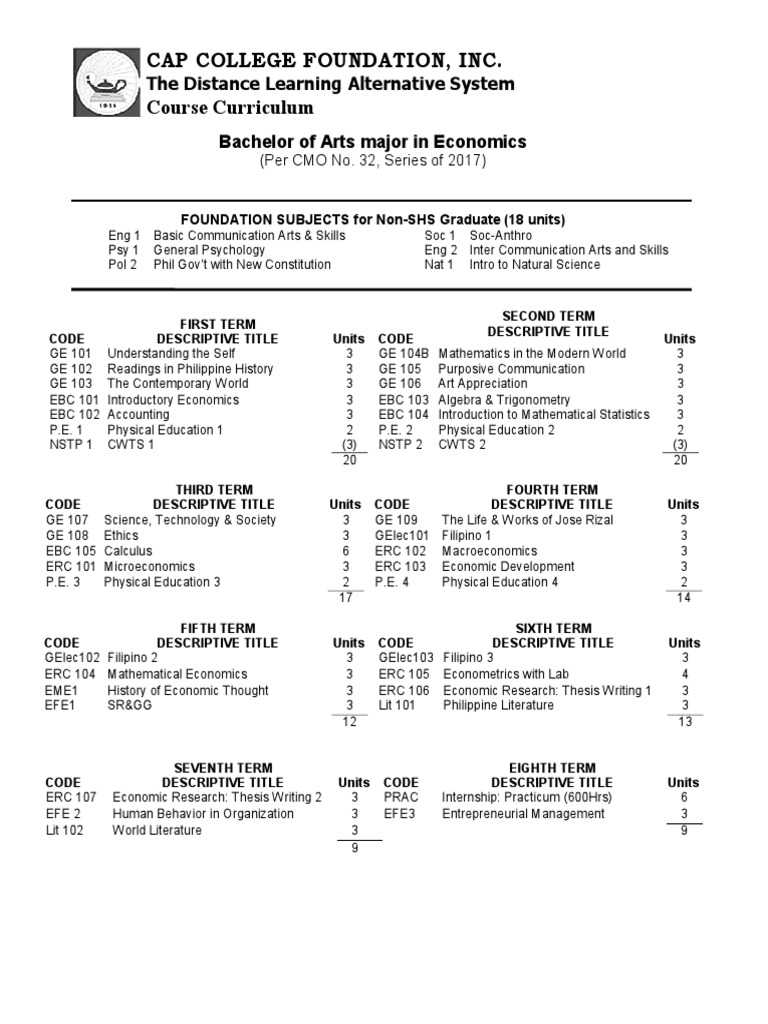

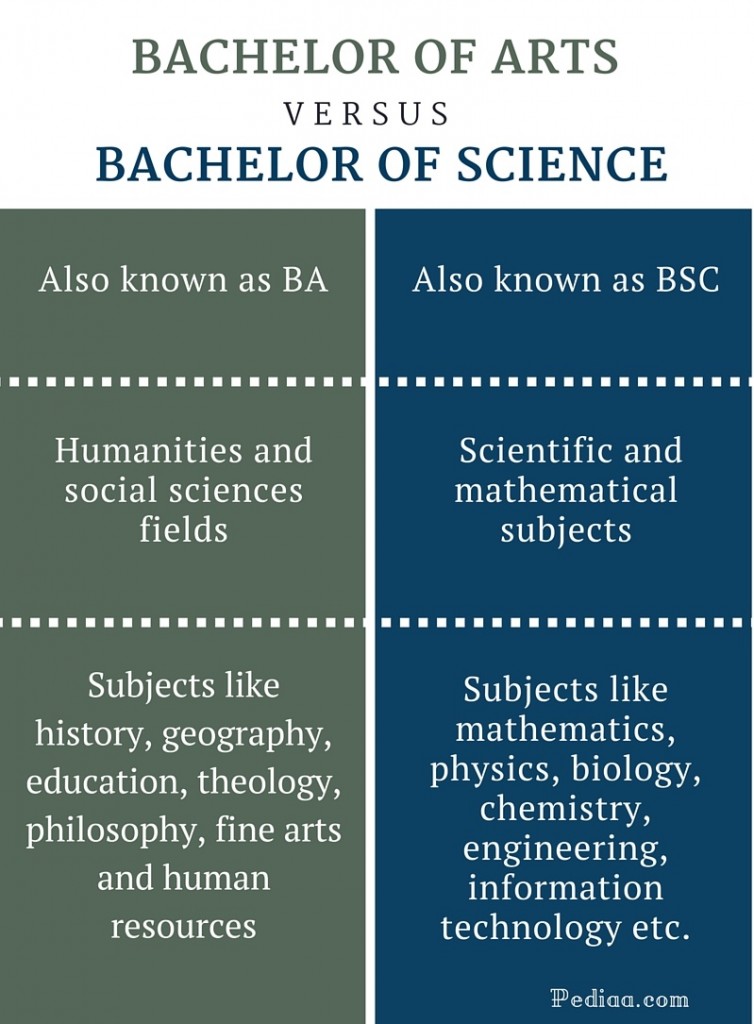

A Bachelor of Arts in Finance provides a comprehensive understanding of financial markets, institutions, and instruments. Unlike its counterpart, the Bachelor of Science (BS) in Finance, which might dive deeper into quantitative analysis, the BA focuses on a broader liberal arts education:

- Financial management

- Investment analysis

- Risk assessment and management

- Corporate finance

- International finance

Additionally, this degree incorporates courses in humanities, social sciences, and sometimes foreign languages, giving graduates a well-rounded skill set.

Why Choose a BA in Finance Over a BS?

Here are some reasons you might opt for a BA in Finance:

- Broader Education: The BA curriculum includes liberal arts courses, providing a richer educational experience that complements finance education with communication, critical thinking, and ethics.

- Employability: With a good balance of technical and interpersonal skills, BA graduates are versatile in their job prospects, suitable for roles in both finance and beyond.

- Interdisciplinary Approach: The integration of finance with other disciplines like psychology or sociology can help in understanding market behaviors, consumer decision-making, and economic policies.

- Preparation for Diverse Careers: The skills gained can prepare you for careers in banking, investment, insurance, or even non-profit organizations.

Curriculum Overview

| Core Courses | Elective Courses |

|---|---|

|

|

Career Opportunities

Graduates of a BA in Finance have a plethora of career paths to explore:

- Financial Analysts: Providing insights and analysis on investment opportunities

- Investment Bankers: Advising on M&A, fundraising, and securities

- Personal Financial Advisors: Helping clients with personal finance strategies

- Risk Managers: Managing financial risks for organizations

- Compliance Officers: Ensuring financial practices meet regulatory standards

How to Stand Out

To differentiate yourself in the competitive finance job market:

- Internships: Gain practical experience through internships or co-op programs.

- Certifications: Consider obtaining certifications like the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP).

- Networking: Connect with industry professionals through finance clubs, career fairs, and networking events.

- Soft Skills: Work on developing leadership, communication, and ethical decision-making skills, which are highly valued in the finance sector.

💡 Note: While technical skills are important, many employers look for candidates who can also demonstrate strong interpersonal skills, as finance roles often require interaction with clients or team members.

Education Beyond the Classroom

Finance education extends beyond the lecture halls. Here are some ways to enhance your learning:

- Student Finance Organizations: Join groups where you can participate in case competitions, trading games, or investment clubs.

- Workshops and Seminars: Attend events to learn from industry experts and keep abreast of market trends.

- Global Study Programs: Study abroad to gain insights into international finance and broaden your cultural perspective.

- Capstone Projects: Engage in real-world financial projects for a practical understanding of how theoretical concepts apply.

Technology in Finance

The integration of technology in finance, or Fintech, is revolutionizing the industry:

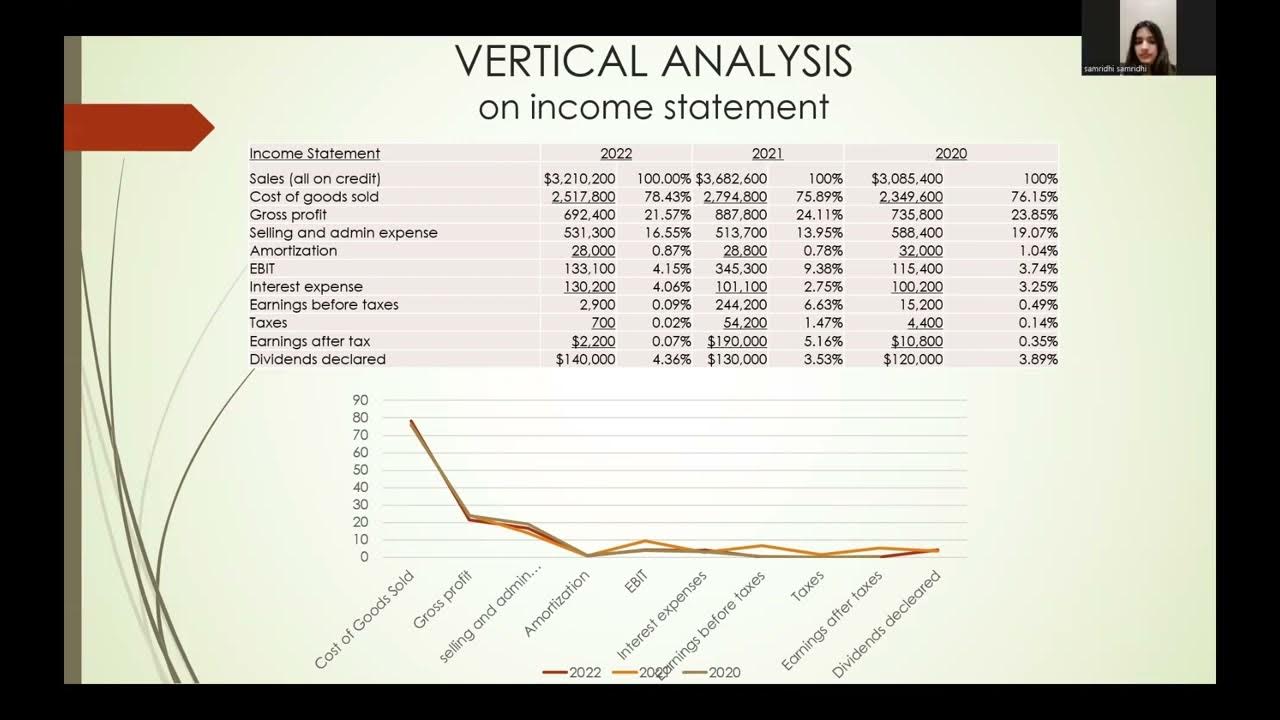

- Big Data and Analytics: Use of sophisticated models for risk assessment and market prediction.

- Blockchain and Cryptocurrencies: Understanding how these technologies disrupt traditional financial models.

- Robo-Advisors: Automated investment advice services that require a blend of tech-savvy and financial knowledge.

Understanding and leveraging these technologies can give you a competitive edge in the finance job market.

The journey through a Bachelor of Arts in Finance program is both challenging and rewarding, providing students with a holistic education that spans the theoretical to the practical. As you navigate through your studies, remember that your ability to communicate, think critically, and understand human behavior will be as valuable as your financial acumen. The finance sector's evolution with technology, coupled with a need for ethical and socially responsible finance, makes this an exciting time to enter the field. Balancing technical proficiency with interpersonal skills will prepare you for a dynamic and potentially impactful career, where you can contribute significantly to both personal and corporate financial decision-making.

What is the difference between a BA and BS in Finance?

+

A BA in Finance tends to include a liberal arts education, with courses in humanities and social sciences alongside finance, fostering broader skills in communication, ethics, and critical thinking. A BS in Finance focuses more on quantitative methods, statistics, and technical skills related directly to finance and business.

How can I prepare for a finance career before enrolling in a BA program?

+

Prioritize math and economics classes in high school. Also, consider:

- Participating in finance-related clubs or investment simulations.

- Seeking internships at financial institutions.

- Reading financial news and analysis to stay informed.

Is a BA in Finance worth it without an MBA?

+

Yes, a BA in Finance can be valuable on its own. Many finance roles do not require an MBA. However, an MBA can provide:

- Advanced knowledge

- Broader networking opportunities

- Potential for higher earnings and leadership roles