5 Essential Tips for Mastering Auf Finance

In the world of finance, particularly in the realm of Auf Finance, managing your resources effectively is both an art and a science. Whether you're an individual trying to get a better grasp on your personal finances or a business owner looking to optimize your financial operations, mastering Auf Finance can provide you with a significant competitive edge. This post will walk you through five essential tips that can help you gain mastery over Auf Finance, ensuring you're not just keeping up with the financial world but are ahead of the curve.

1. Understand the Basics of Auf Finance

The first step towards mastering Auf Finance is to solidify your understanding of its fundamental principles:

- Financial Analysis: This involves analyzing financial statements to understand an organization’s performance, liquidity, solvency, and profitability.

- Budgeting: Creating and adhering to a budget helps in planning the financial course for both individuals and businesses.

- Investment: Knowing where to invest, understanding the risks, and predicting market trends are crucial.

- Cash Flow Management: Keeping track of the inflow and outflow of cash to ensure liquidity.

- Risk Management: Identifying, assessing, and controlling risks that arise from financial decisions.

💡 Note: Begin your journey with educational resources like books, online courses, or certified financial analyst programs to understand these basics thoroughly.

2. Implement Advanced Financial Tools and Software

Technology has revolutionized financial management:

- Accounting Software: Tools like QuickBooks or Xero automate financial reporting and bookkeeping.

- Investment Tracking: Platforms like Morningstar or Bloomberg Terminal provide real-time investment data and analysis.

- Robo-Advisors: For automated investment management with minimal human intervention.

- Financial Planning Software: Apps like Quicken or YNAB for personal finance tracking and planning.

- Data Analytics: Employ big data to forecast financial trends and make data-driven decisions.

By integrating these tools, you not only improve efficiency but also gain insights that would be difficult to achieve manually.

3. Cultivate a Network in Finance

Finance is as much about relationships as it is about numbers:

- Attend industry conferences and seminars.

- Join financial professional organizations or forums.

- Participate in or create investment clubs.

- Network with peers, mentors, and industry leaders to exchange knowledge and insights.

💡 Note: Your network can provide mentorship, job opportunities, and insights into emerging trends.

4. Regularly Assess and Rebalance Your Portfolio

Financial markets are dynamic, so should your investment strategy be:

- Periodic Review: At least quarterly, review your investment portfolio’s performance.

- Rebalancing: Adjust your investments to match your risk profile and financial goals.

- Risk Management: Diversify your investments to mitigate risks.

Here’s an example of how to structure a simple portfolio:

| Asset Class | Percentage Allocation |

|---|---|

| Equities | 40% |

| Bonds | 30% |

| Real Estate | 20% |

| Cash or Cash Equivalents | 10% |

💡 Note: Rebalancing doesn't mean selling all your assets; sometimes it can involve adjusting your new investments to correct the allocation.

5. Lifelong Learning and Adaptability

Finance is ever-evolving, and continuous learning is paramount:

- Stay updated with the latest financial regulations and economic policies.

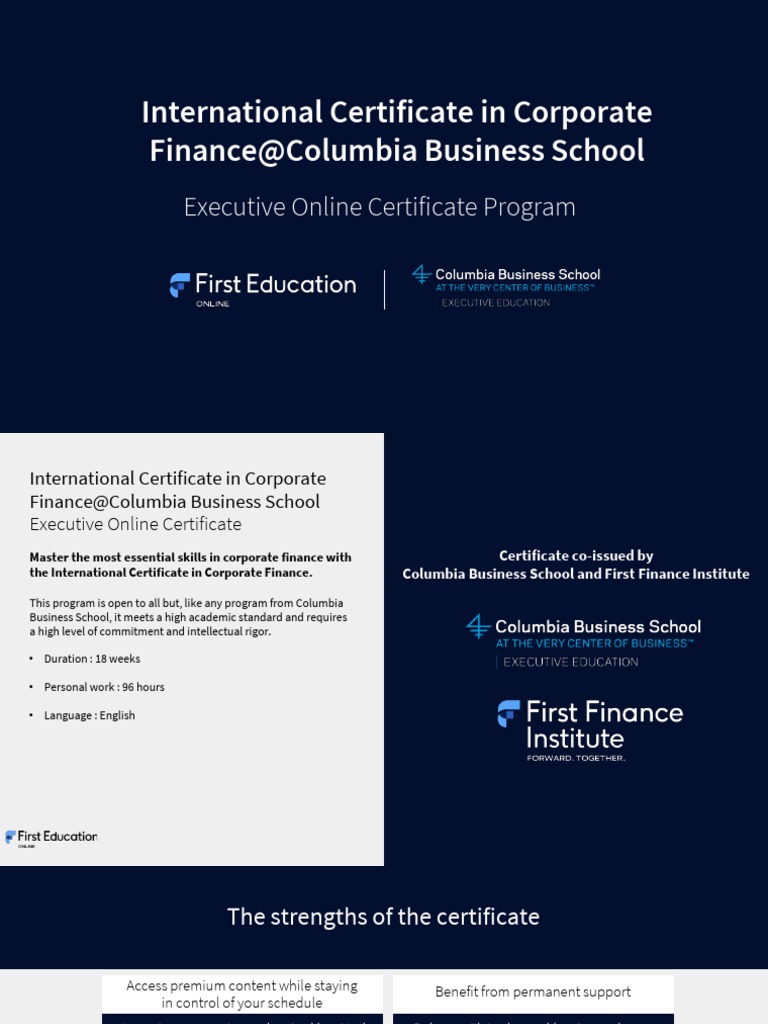

- Pursue advanced certifications like CFA or CPA.

- Learn from your financial decisions, both good and bad.

- Adapt your strategies to new financial products and technologies.

By committing to lifelong learning, you ensure your strategies remain relevant and effective.

By following these five tips, you're setting yourself up for success in the complex world of Auf Finance. The journey to mastery isn't linear; it's filled with challenges and opportunities for growth. Understanding the basics forms your foundation, leveraging technology gives you an edge, networking opens new doors, assessing your portfolio keeps you grounded, and continuous learning ensures you're always moving forward. Keep these principles in mind, stay disciplined in your approach, and you'll find that financial mastery isn't just within reach but can become a part of your everyday life.

What is Auf Finance?

+

Auf Finance refers to a specialized approach to financial management, often focusing on comprehensive analysis, strategy formulation, and adapting to modern financial tools and trends. It encompasses personal and business finance with an emphasis on forward-thinking and innovative financial planning.

Can beginners learn Auf Finance?

+

Absolutely. Beginners can start by understanding the basics of finance, using educational resources like courses and books. With dedication and practice, mastering Auf Finance is achievable for anyone willing to invest the time and effort.

Why is networking important in Auf Finance?

+

Networking in finance opens up avenues for knowledge exchange, mentorship, job opportunities, and staying updated with industry trends. It’s invaluable for insights, support, and professional growth.

How often should I review my financial portfolio?

+

At a minimum, a quarterly review is recommended. However, during volatile market conditions or significant life changes, more frequent assessments might be necessary.

What tools are essential for managing finances?

+

Key tools include accounting software, investment tracking platforms, robo-advisors, financial planning software, and data analytics tools. These help in efficient management, automation, and decision-making in finance.