Arnold Clark Finance: Your Easy Car Financing Guide

Financing a car purchase can be a complex process, yet it is a crucial step for many in fulfilling their dream of owning a vehicle. Through this detailed guide, we'll walk through the intricacies of Arnold Clark Finance, offering you the essential knowledge to navigate your car financing with confidence.

Why Choose Arnold Clark Finance?

Arnold Clark, renowned in the UK automotive industry, not only offers a wide range of vehicles but also provides comprehensive financing solutions. Here are key reasons why choosing Arnold Clark Finance could be beneficial for you:

- Flexibility: They offer tailored financial solutions to suit a variety of customer needs.

- Competitive Interest Rates: Arnold Clark Finance often provides rates that are competitive in the market.

- Streamlined Process: Their application and approval process is designed to be quick and efficient.

Understanding Your Financing Options

When considering car finance, you have several options to choose from. Here’s a breakdown of the main financing paths available:

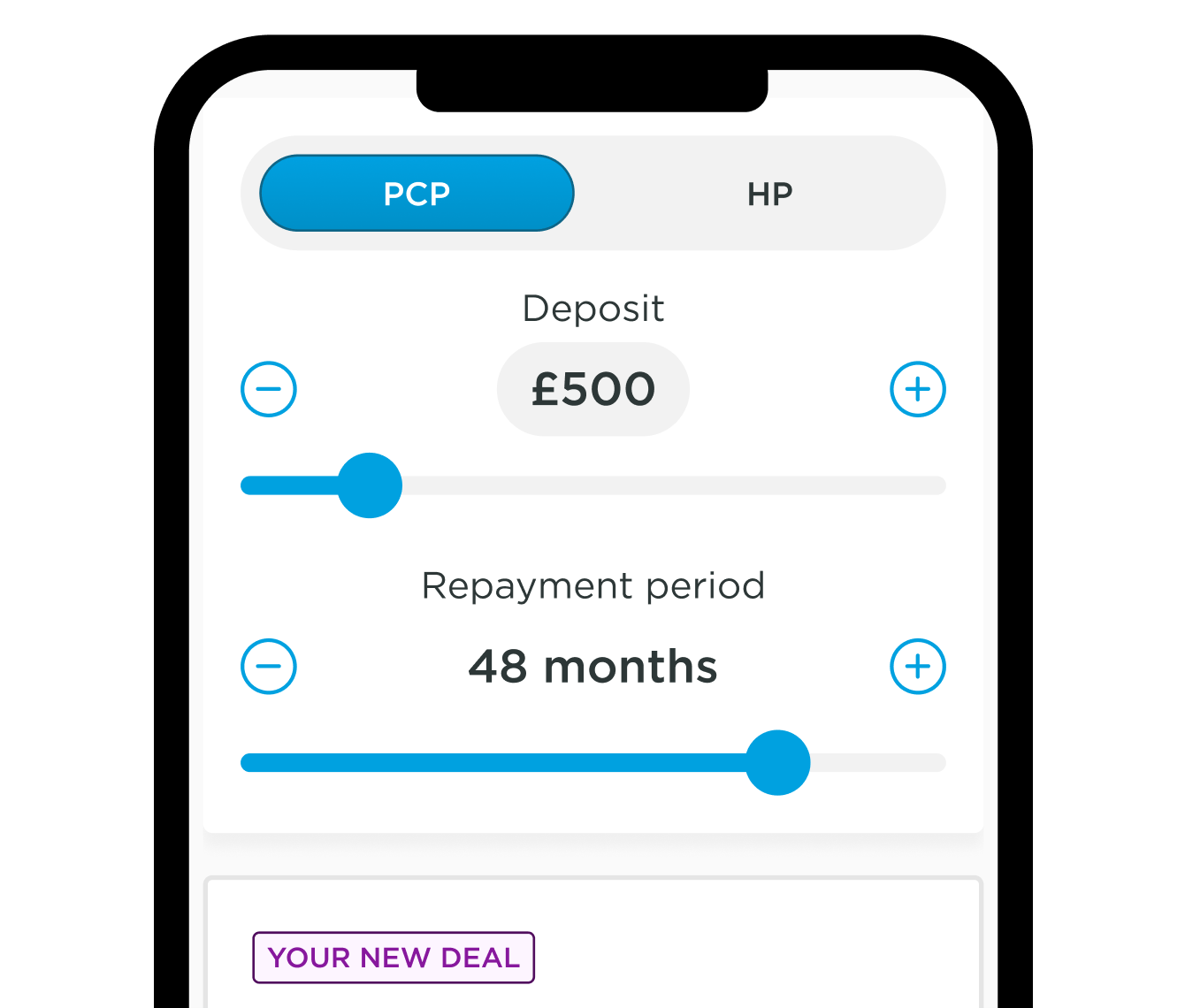

Hire Purchase (HP)

- What it is: A simple form of finance where you pay a deposit, drive the car, and make fixed monthly payments. Once all payments are made, you own the car.

- Advantages: Straightforward to understand, fixed payments make budgeting easier, and at the end of the term, the car is yours.

Personal Contract Purchase (PCP)

- What it is: Similar to HP but includes a final ‘balloon’ payment at the end of the term which can be paid, refinanced, or the car can be returned.

- Advantages: Lower monthly payments, flexibility at the end of the agreement, and the possibility to upgrade to a new car every few years.

✅ Note: PCP plans might involve mileage restrictions and the vehicle's future value can affect the balloon payment.

Car Loans and Leasing

- What it is: Loans can be secured or unsecured, while leasing involves long-term rental with potential ownership at the end.

- Advantages: Loans offer direct ownership, and leasing provides regular use of new cars without long-term commitment.

How to Apply for Arnold Clark Finance

Here’s the step-by-step process:

- Choose Your Vehicle: Find the car you wish to finance.

- Calculate Your Budget: Use tools available on the Arnold Clark website to estimate your finance affordability.

- Apply Online: Fill in the finance application form with your details.

- Approval: If approved, you’ll receive finance terms and conditions for review.

- Finalize: Sign the agreement, pay any deposit, and proceed with the purchase.

Factors to Consider Before Finalizing Your Finance

Before committing to finance, consider the following:

- Total Cost: Look at the total amount payable, not just monthly payments.

- Interest Rates: Compare rates from various providers to ensure you’re getting a competitive deal.

- Length of Term: Longer terms might reduce monthly payments but increase total interest paid.

- Ownership: Determine if you want to own the car or prefer regular upgrades.

Summary

Arnold Clark Finance offers a tailored approach to car financing, ensuring that you have the information and options needed to make the best decision for your circumstances. By understanding the different financing schemes, the application process, and key considerations, you can embark on car ownership with full knowledge of what your finance entails.

What are the credit requirements for Arnold Clark Finance?

+

Arnold Clark Finance does not specify a fixed minimum credit score, but like many lenders, they consider your credit history, income, and affordability when assessing your application. Better credit scores generally result in more favorable terms.

Can I use Arnold Clark Finance if I have a poor credit history?

+

Yes, but with poor credit, you might face higher interest rates or different terms. Discuss your situation with an Arnold Clark Finance representative for personalized advice.

What happens if I miss a car finance payment?

+

Missing payments can result in late fees, a negative impact on your credit score, and in extreme cases, the vehicle could be repossessed. It’s important to contact your finance provider as soon as possible to discuss options if you’re facing payment issues.

How can I lower my monthly car finance payments?

+

Consider making a larger deposit, choosing a longer finance term, or exploring models with lower costs. Reviewing your budget to see if you can afford slightly higher monthly payments can also reduce the total amount of interest paid over time.

Is it possible to end my finance agreement early with Arnold Clark?

+

Yes, but there might be an early settlement fee and you would need to clear the outstanding balance. Always read the terms of your agreement to understand the implications of early termination.