5 Proven Tips for Approved Car Finance

Understand Your Credit Score

Before you apply for car finance, it’s crucial to understand your credit score. This three-digit number plays a pivotal role in the approval process for your loan. Here’s how:

- Higher scores indicate a lower risk to lenders, potentially leading to better interest rates.

- A score below 600 might limit your options and result in higher interest rates due to perceived higher risk.

You can access your credit score from credit bureaus like Equifax, Experian, or TransUnion. Checking this beforehand helps you:

- Identify errors or discrepancies which you can dispute to improve your score.

- Assess your standing and plan accordingly if your score needs improvement.

Know Your Budget

Understanding your financial capacity is key to obtaining car finance:

- Calculate your monthly income after taxes.

- List out all your monthly expenses including rent, utilities, groceries, and other payments.

- Determine how much you can comfortably allocate to a car payment without stretching your finances thin.

This exercise ensures you're not biting off more than you can chew, reducing the risk of loan rejection due to an unaffordable payment plan.

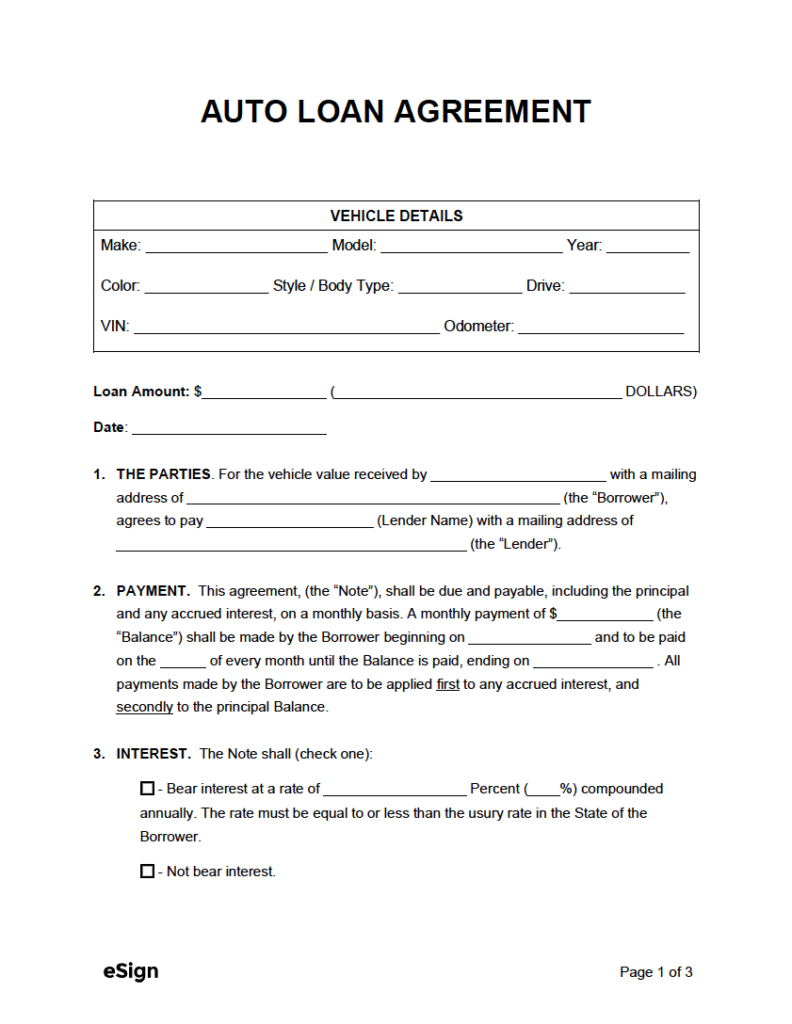

Shop for the Best Deal

| Lender | Interest Rate | Loan Term | APR |

|---|---|---|---|

| Bank A | 3.25% | 48 months | 3.8% |

| Credit Union B | 2.99% | 60 months | 3.4% |

| Dealer C | 5.45% | 36 months | 6.2% |

🚘 Note: The above table displays the hypothetical offers from different lenders for a clearer understanding. Always verify rates at the time of application.

Don't just go with the first lender you come across:

- Obtain pre-approvals from multiple lenders.

- Compare interest rates, loan terms, and the Annual Percentage Rate (APR) to get the best deal.

Gather Necessary Documents

When applying for car finance, preparation is key:

- Proof of income - Pay stubs, W-2 forms, or tax returns.

- Proof of identity - Driver's license or passport.

- Proof of residence - Utility bills or rental agreements.

Having these documents ready streamlines the application process, increasing your chances of approval.

Consider a Co-signer

If your credit isn’t stellar, or if you’re a first-time buyer, consider a co-signer:

- They can boost your chances of approval with their good credit history.

- However, both of you are responsible for the loan. Understand the implications for both parties.

Having a co-signer can significantly improve your chances of getting approved, especially if you're navigating poor credit or low income.

⚠️ Note: Ensure you communicate with your co-signer about the risks and responsibilities involved.

Understanding these five tips can pave the way for securing car finance that aligns with your financial health and vehicle needs. Remember to assess your credit, set a realistic budget, compare offers, prepare your paperwork, and consider a co-signer if necessary. This approach not only increases the probability of approval but also ensures you get a deal that’s financially sustainable.

In closing, finding the right car finance deal involves careful planning, research, and understanding your financial situation. By following these steps, you can negotiate from a position of strength, ensuring that the loan you take is manageable and benefits both you and the lender.

How often should I check my credit score?

+

It’s a good idea to check your credit score every 3 to 6 months to ensure there are no discrepancies or sudden changes.

What is the difference between APR and interest rate?

+

The interest rate is the cost you pay for borrowing money. The APR includes the interest rate plus other charges like lender fees, making it a more comprehensive rate to compare loan costs.

Can I negotiate interest rates with lenders?

+

Yes, especially if you have a good credit score, multiple pre-approvals, or a strong financial profile, you might negotiate for lower rates or better terms.